13 Best CRMs for Banking Industry You Can Trust in 2026

Do your customers know when your bank system is undergoing maintenance?

Or do they need to wait longer, leading to a negative experience with your brand, and ultimately causing them to give up on your services?

Imagine a scenario to relate: Your friends gather to chill in KFC at your birthday party invitation. For them, you place orders of delicious burgers, chicken nuggets, soft drinks, and more. And when you head over to make an online payment, it repetitively shows errors.

Isn’t this enough to ruin your celebration mood?

It will undoubtedly cause you frustration, and in the worst-case scenario, if you're unable to pay at the moment due to having only an online wallet and no cash, it may cause your reputation to be at stake.

I'm sure that as a banking service, you don't want to provide this kind of experience to your customers. You can smartly avoid the mishap by informing them beforehand with quick, updated messages. While automating the task, consider integrating an AI-powered CRM like Zixflow for your bank.

With the help of AI-powered CRMs, you can now level up your game to provide your customers with an authentic experience like never before. This decision will be a win-win for you, allowing you to hold your current customers and win back lost clients. This is not it. There are several other benefits offered by CRMs in the banking sector.

So, just sit on the chair, grab your coffee, and relax your mood because you’re on the way to unfolding the list of best CRMs for the banking industry that you can trust now and beyond.

Why should you choose CRMs for the banking industry?

“CRM is your GPS to a better route on your Business Development journey.” – Bobby Darnell.

Analytics and reports provide you with a mirror reflection of the benefits of integrating a CRM system into your business.

Data says that 47% of professionals using CRMs are experiencing success in customer satisfaction, along with 39% seeing improvements in upselling and cross-selling, and 45% experiencing success rates in generating revenue. Furthermore, 55% of CRM buyers have reported significant ROI enhancements in six months or less.

Now, tell me, as a business-savvy individual, who wouldn't want that? Probably, you want to achieve the same.

Well then, have a quick glance at why you should integrate an AI-powered CRM into your banking system:

✅If you want to go beyond newspaper and billboard advertising while leveraging multiple channels for efficient marketing and standing where your customers are.

✅If you desire to identify and crack the sales deal before anyone else does and secure those high-stakes accounts where business banks lend out 15% more money than customers do.

✅If you want to identify gaps between your teams' performance and customer satisfaction and enhance productivity while delivering digital-first engagement to earn customers' loyalty.

✅If you want to turn your probability of selling additional services or products under your mutual belt and convert 5% to 20% hot leads along with triggering buyer persona of 60% to 70% of existing ones.

How to choose the best CRM for the banking industry that you can trust?

🎯Set a fixed intent of your bank’s unique requirements while incorporating CRM into your existing system.

🎯Ensure the capability of third-party integrations for multi-channel usefulness, and capacity to generate flawless analytical reports in evolving market trends.

🎯Ensure usability and adaptability of user-friendly CRM that aligns with the effectiveness of optimizing sales engagement queue and workflow, and that must be easy to navigate without extensive training requirements.

🎯Consider your total cost-effective budget that includes ownership, licensing, integration, customization, and maintenance costs.

🎯Ensure your chosen CRM is efficient in handling the security of sensitive information and completely complies with current privacy regulation standards.

🎯Last but not the least, ensure their reputation in the current competitive environment with the help of either G2 or Capterra.

The ultimate list of 13 best CRMs for banking & how they benefit?

Zixflow

Zixflow, one of the best AI-wizard CRMs for the banking industry, has all the essential ingredients in a single powerful stack. From nurturing healthy bonds with your customers and maintaining privacy to sending them different types of emails for sales engagement at the right time and tracking all activities - It has all for you.

Key benefits

Capture highly potential leads with captivating forms

Do you want to get instant engagement with your hot leads?

Yes, of course. Aha! There you’re with Zixflow. But how

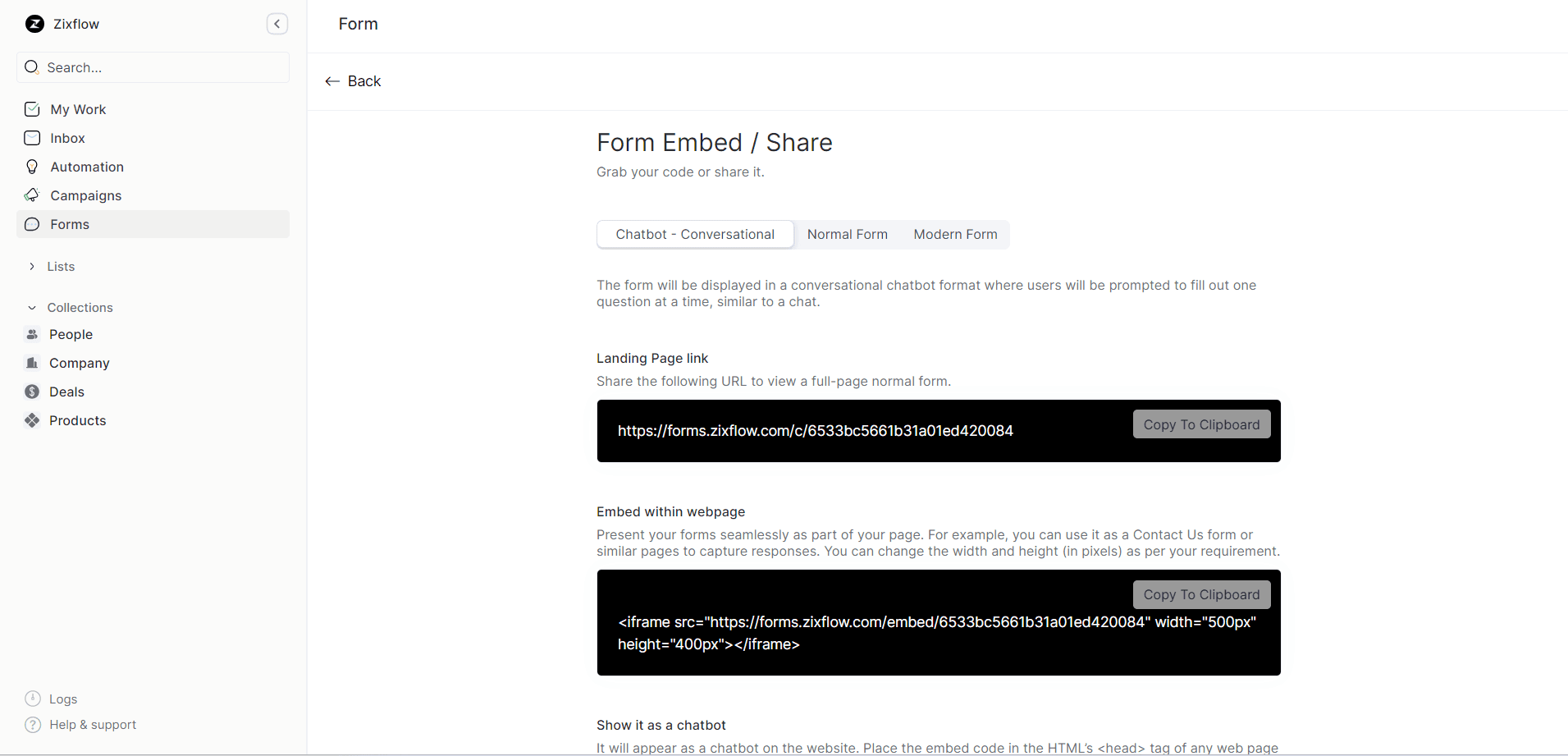

With Zixflow’s eye-catching form builder feature, you can not only capture leads and count on qualified hot leads but also showcase your interest by asking interesting questions. Well, you can utilize these forms in different ways, such as a landing page, an embed form in your website, or a modern form to place your question and customize it according to your needs and preferences. This is why it is also a renowned alternative to Typeform.

This approach is important for your banking services, especially when it comes to showcasing your concern for your customers’ financial circumstances and approaching them to build an emotional engagement.

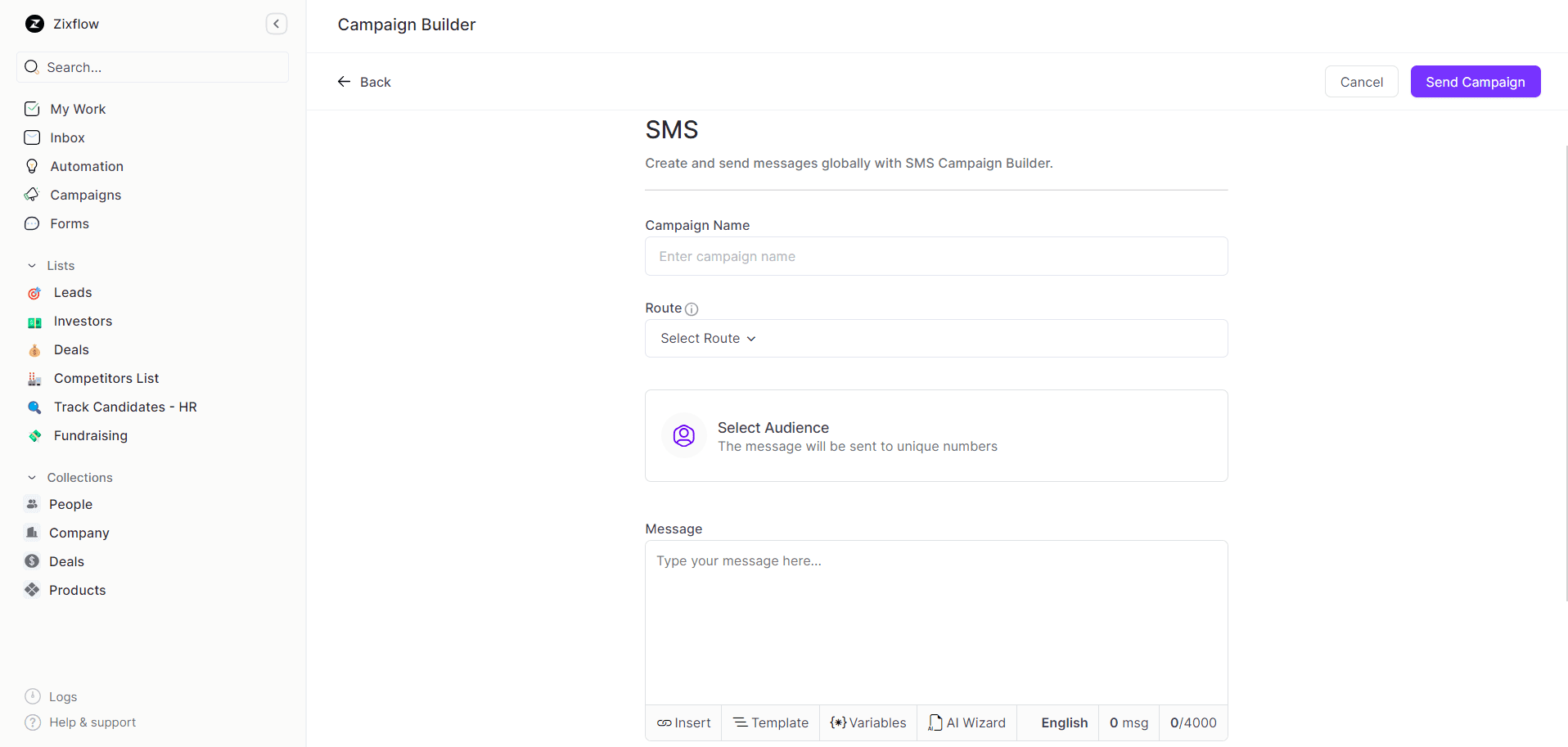

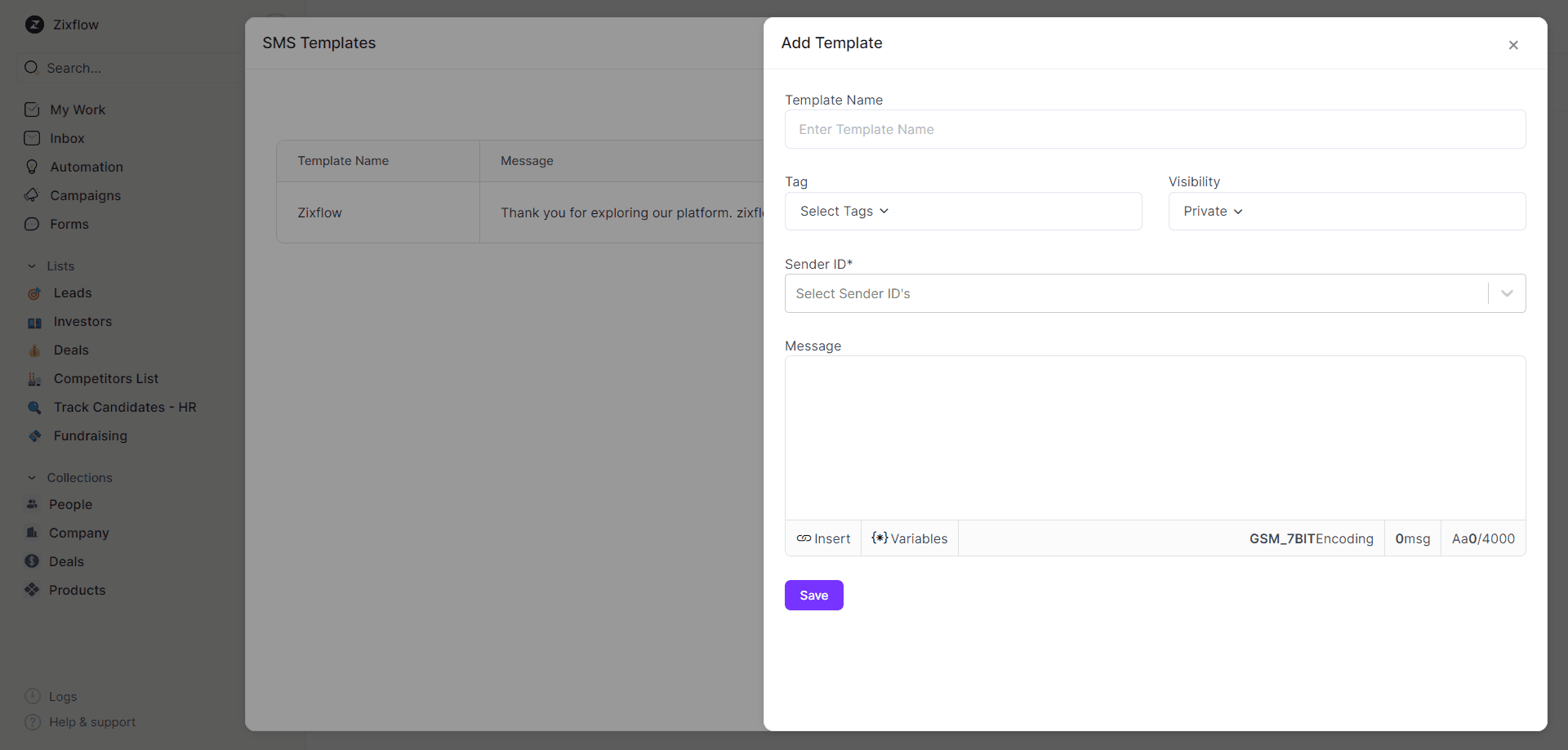

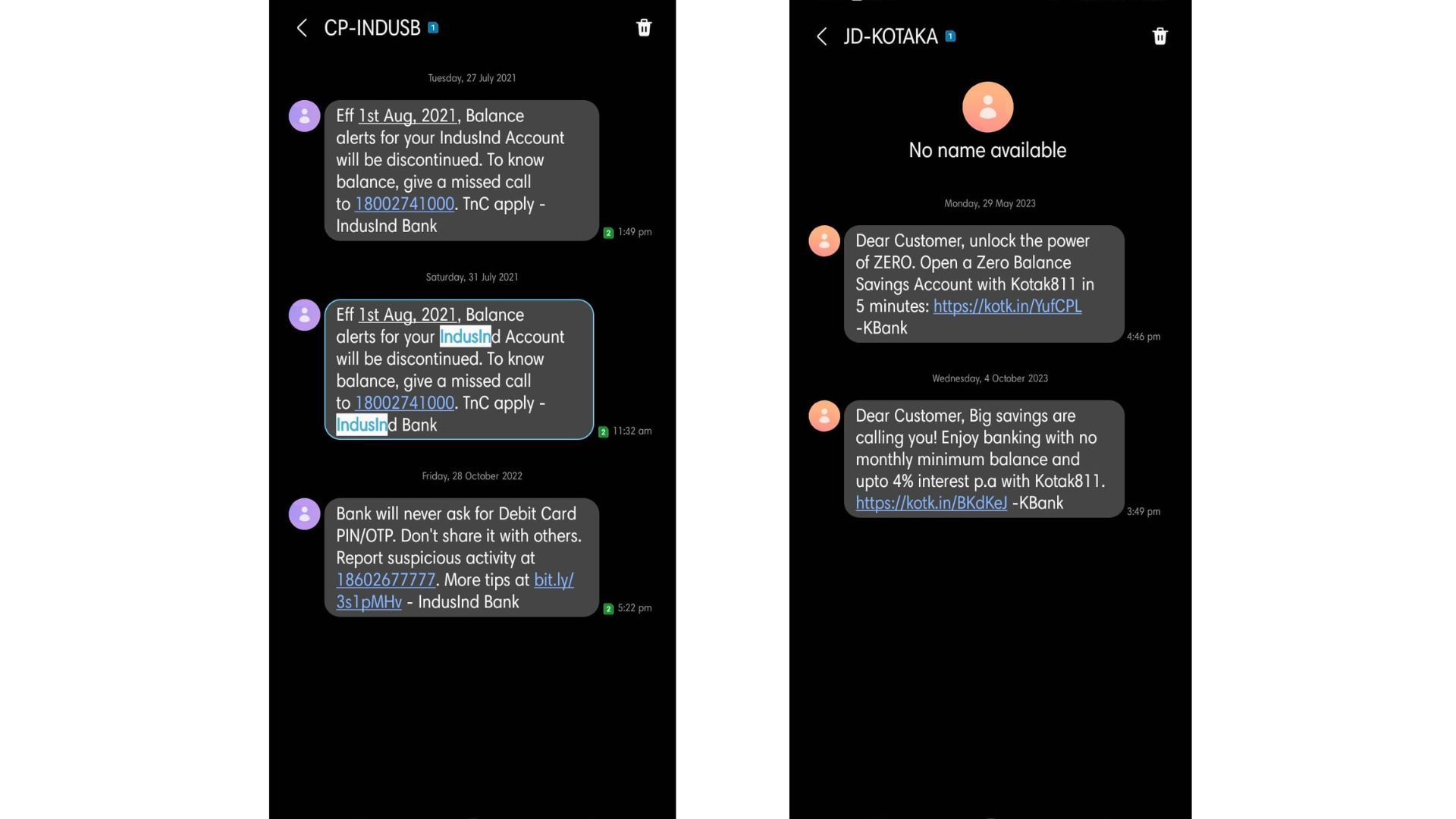

Send immediate crucial info with SMS campaign builder

Do you agree that staying vigilant is a smarter choice, especially when it comes to your hard-earned money?

Today, fraud hackers are more active than ever, willing to go to any extent for scams, and banking sectors have to take responsibility for it.

But now Zixflow SMS campaign builder embraces a two-way SMS interaction or directly reaches out to your clients to create blockage in suspicious engagements.

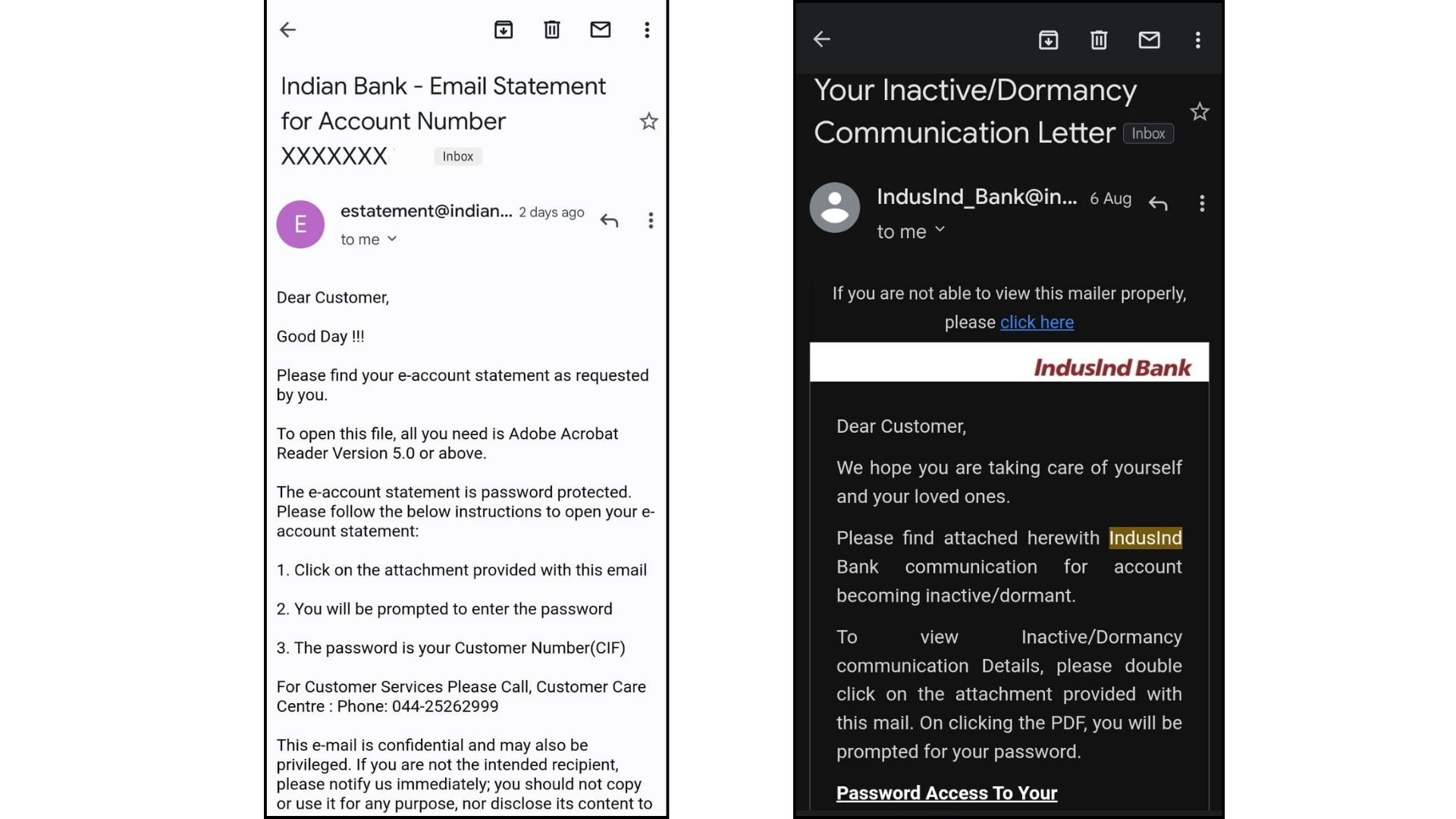

Moreover, it allows you to quickly send important info about banking maintenance, payment transactions, authenticate access of banking log-in ID with OTP, etc. to avoid fraudulent activities and ensure safety over regret.

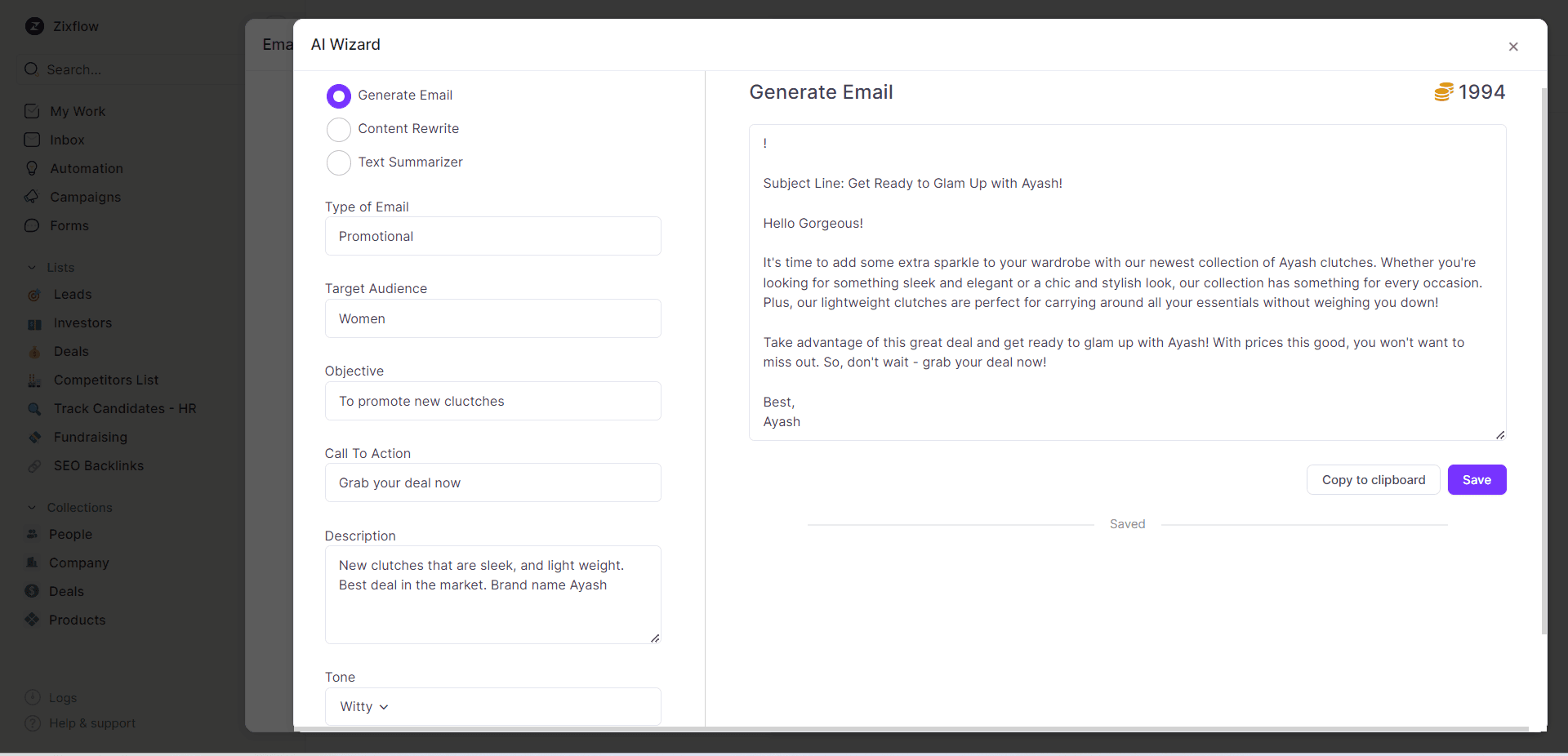

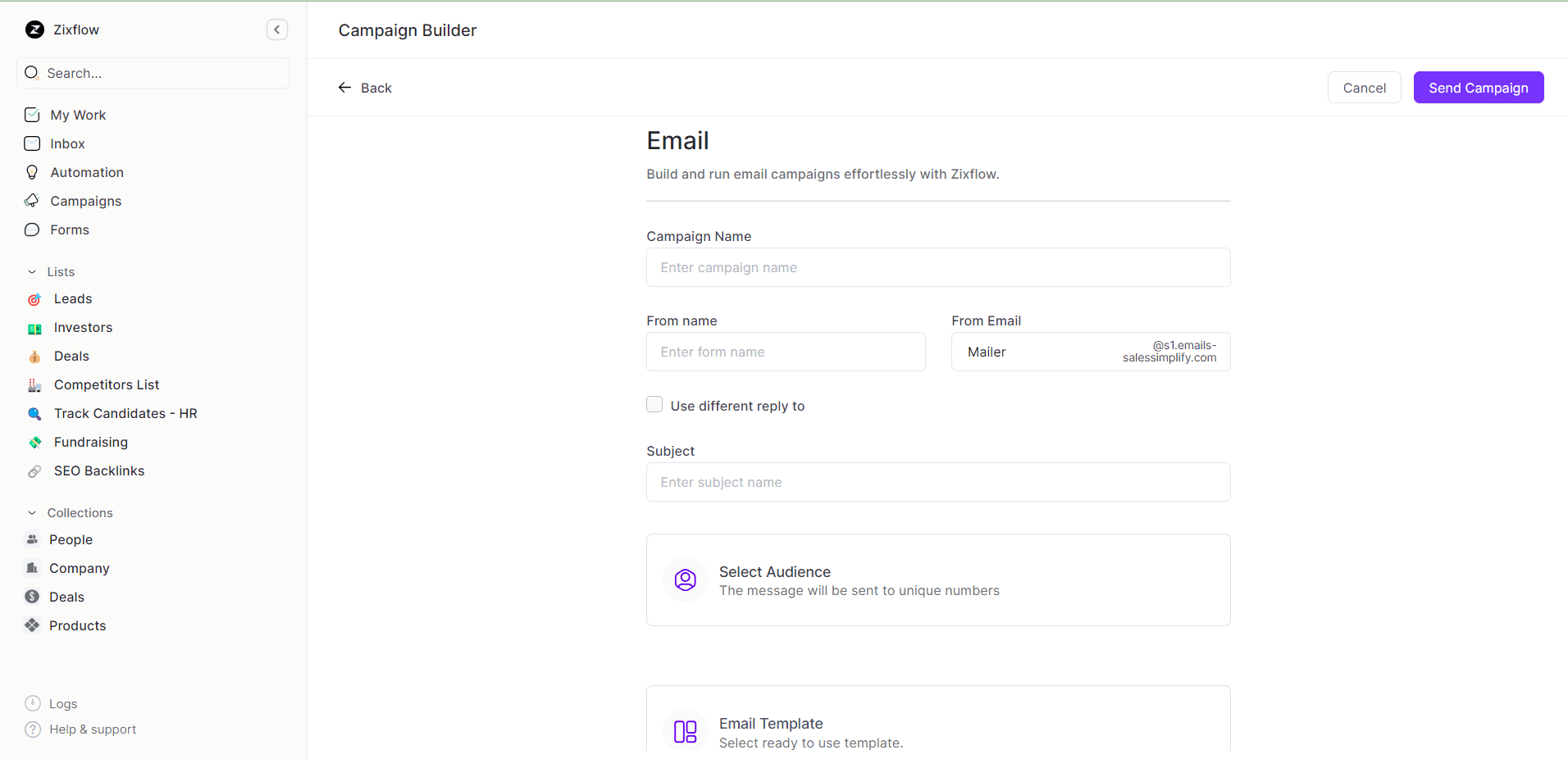

Set email campaigns while following up banking partners

It’s your time to reach out to a wider audience of your baking clients with a single click. But how? Leverage the Zixflow email campaign builder.

No matter if you're a pro or not at crafting a catchy email message. With this tool, you can write personalized email content with AI writers, utilize customized email templates, and make email messages more conversational. But that’s not all.

Now, you can access the AI wizard for writing emails as you want, send them in automated mode, and conquer your outreach follow-up efforts with a sigh of relief. This becomes very crucial when you also want to achieve targets of a 78% customer retention rate on financial services.

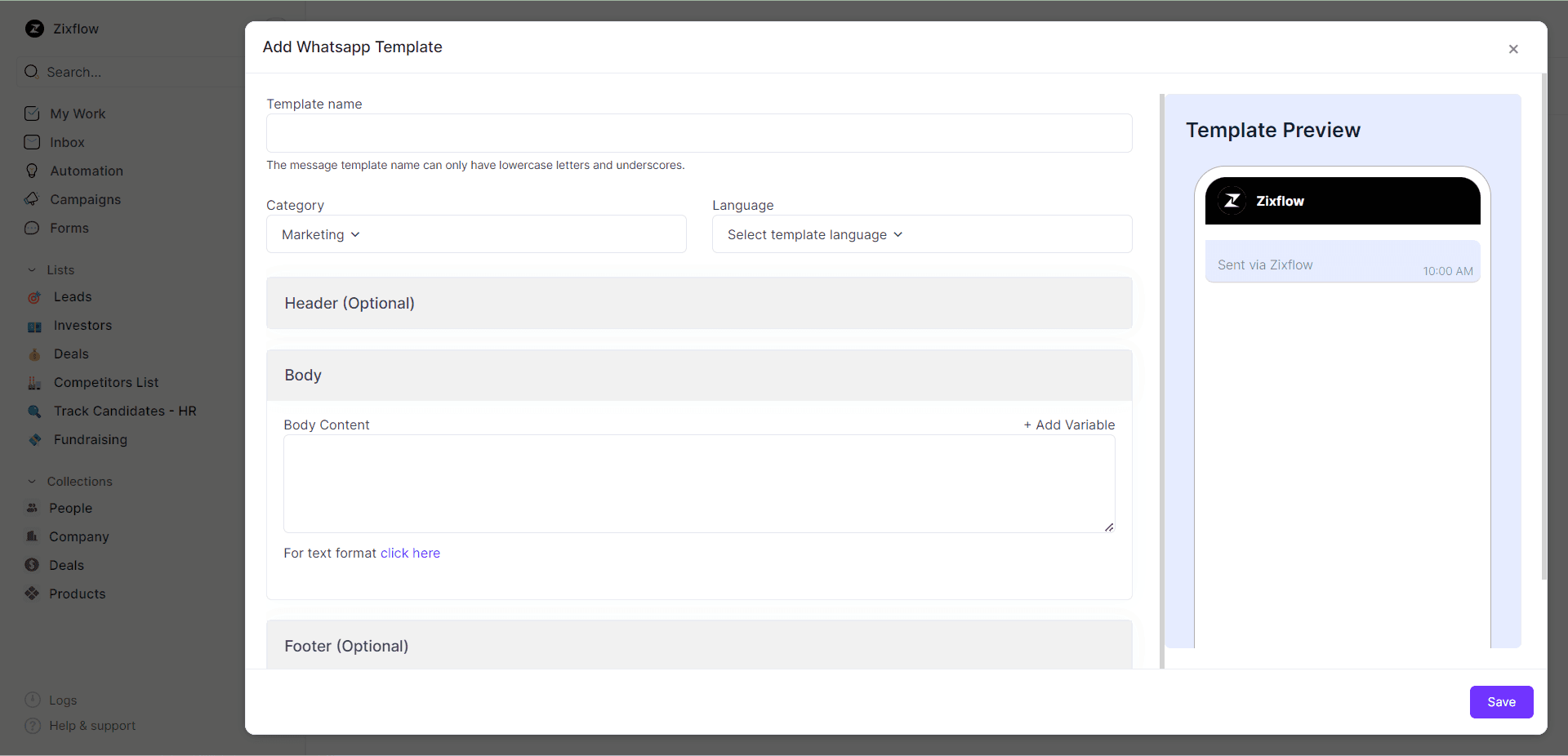

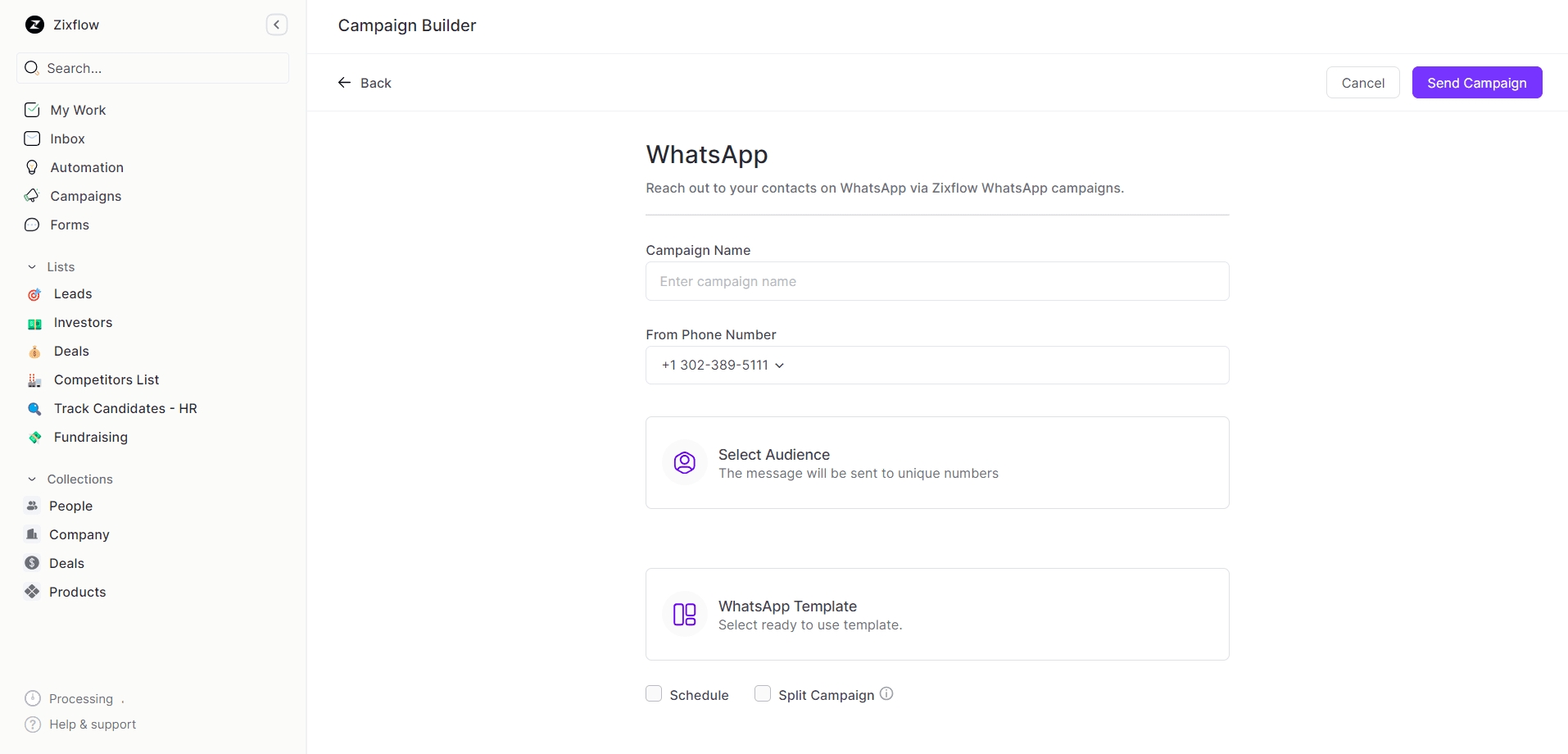

Send marketing messages with WhatsApp integration

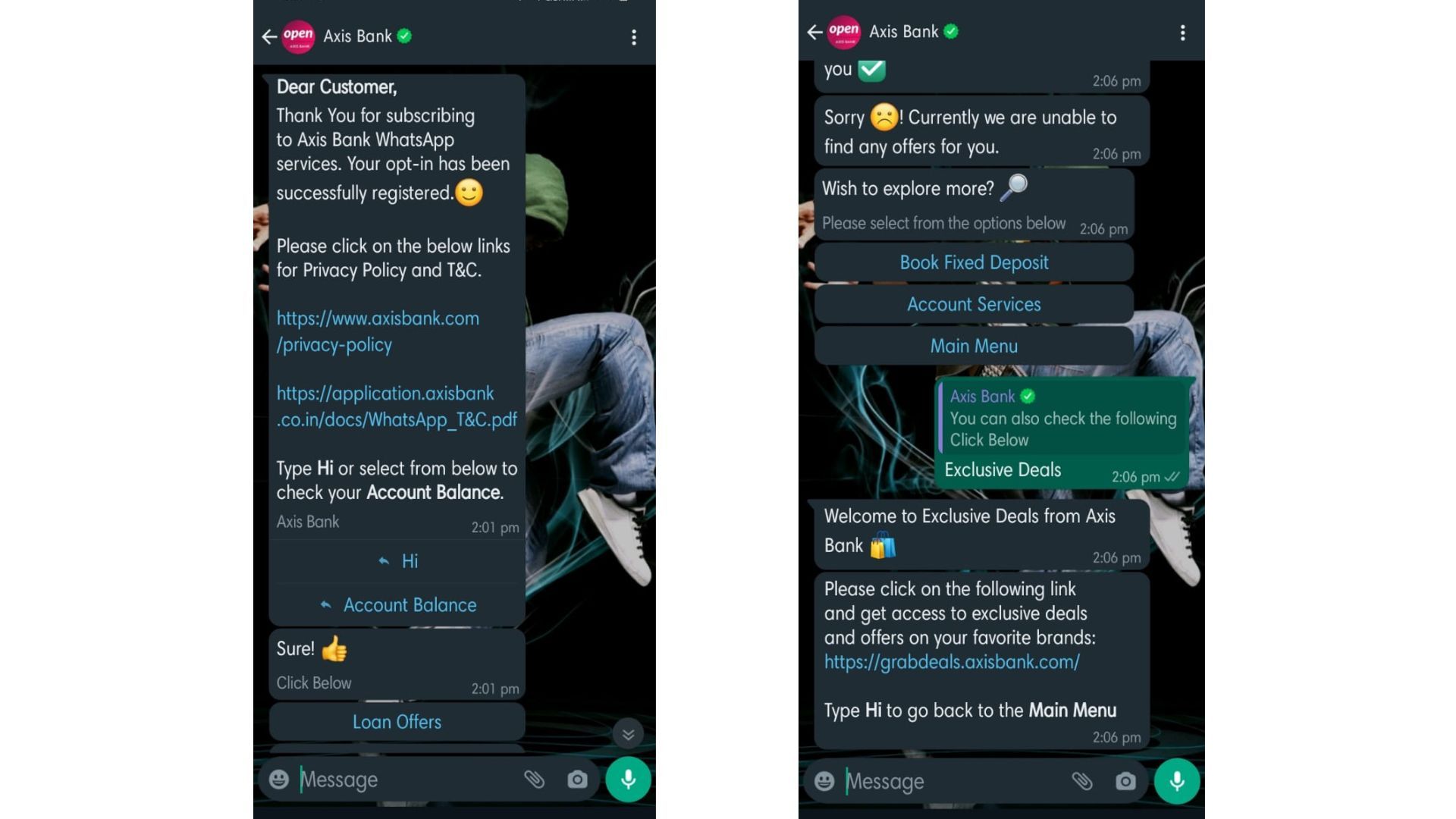

Have you received WhatsApp messages from banks with discounts on loans or launching new programs?

Surely it’s a yes. Well, now you can do the same with your banking services by integrating WhatsApp with CRM software like Zixflow and using its WhatsApp campaign builder.

Now, approach your customers with alluring WhatsApp advertising messages while welcoming them and offering them catchy discounts on loans, interest in savings, and more. Reach out to your broad audience in the blink of an eye while utilizing WhatsApp broadcast messaging services provided by WhatsApp Cloud API.

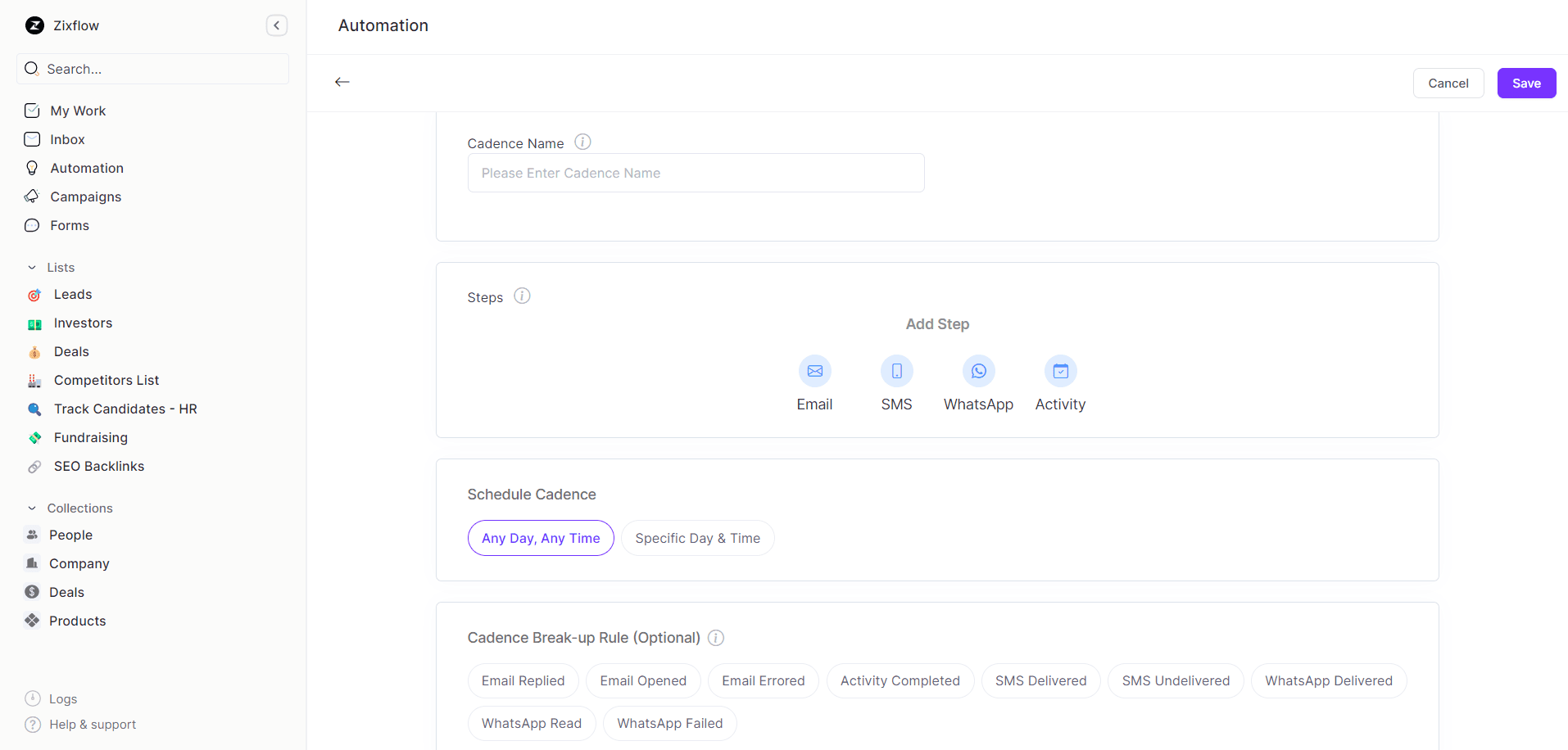

Automate sales cadence

Sales cadence is the outreach sequence for following up with each of your potential leads and prospective clients at regular intervals.

It requires well-structured scheduling over a fixed period of time and a range of multi-channel sales engagement - email, phone calls, SMS, and social media. It helps eventually gain the clients’ trust and trigger proactive communications to strengthen your bond.

Zixflow provides you with the tool to automate and schedule sales cadences for putting your efforts in the right direction. With Zixflow, you can either create a new cadence or copy the same cadence style from the previous one. Also, to sort things more fat, you can start with its pre-built templates.

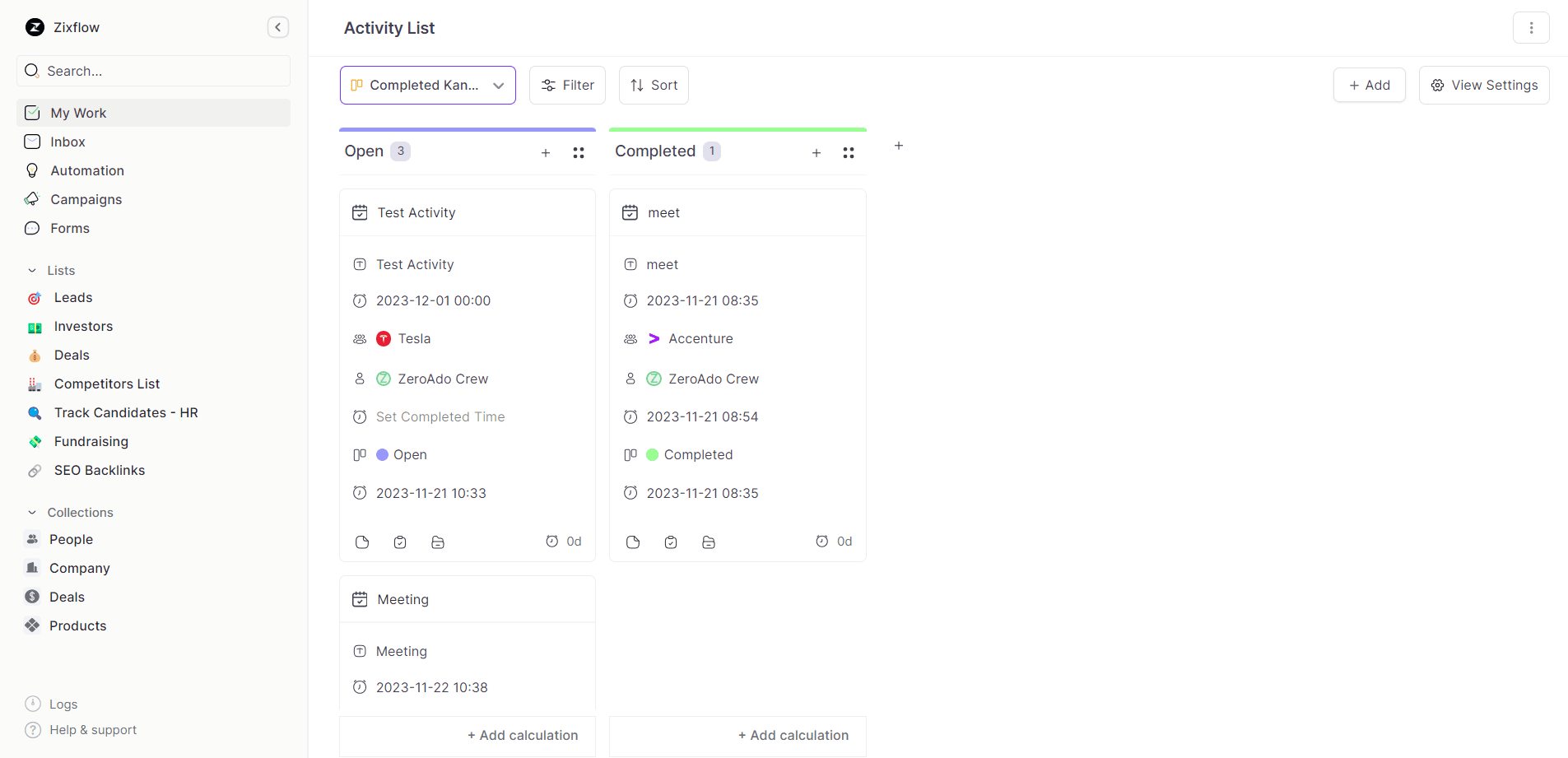

Automate workflow & track all activities

Do you want to know whether all your target work schedules are complete?

If so, then get rid of headaches with Zixflow.

With Zixflow, you can now schedule all your tasks in a single dashboard. Be it setting daily targets, following up with your banking customers, or sharply noticing your teams’ activities, you can automate it all in one go. You just need to set individual work titles for your better understanding and set triggers along with action points.

And, if your concern is to assess your banking teams’ productivity to know whether they are applying their efforts in the right place or need your guidance, you can utilize Zixflow to track it at your fingertips.

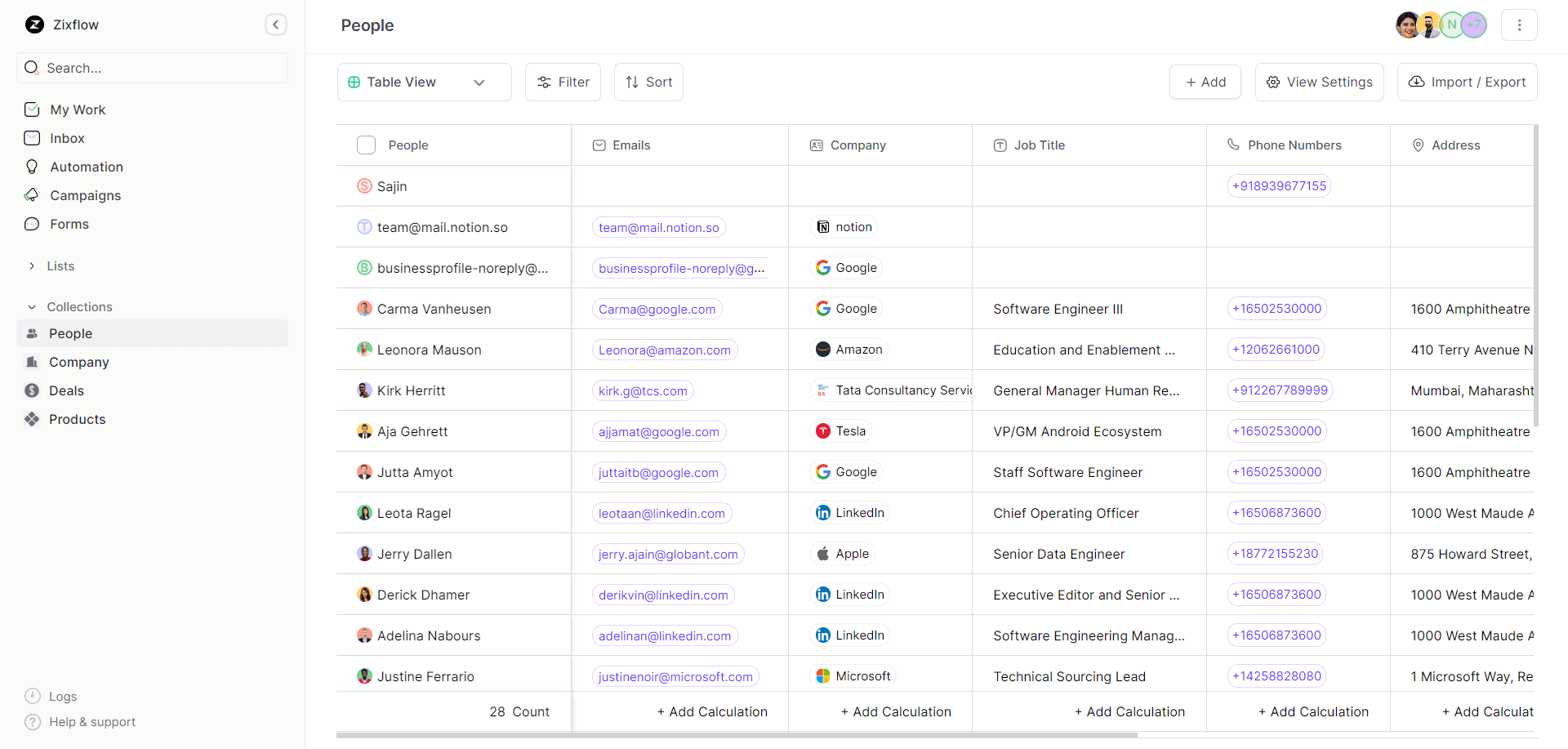

Seamlessly manage customer data in one go

Whether you’re an SMB, a fintech bank, or a multinational one, mindfully organizing your customers' data is not easy at all. Because your wide array of customer data includes individual names, physical addresses, email addresses, phone numbers, WhatsApp contacts, and so on.

To prevent messing up your customer data and jeopardizing the outcome of marketing and sales campaigns, you need to place a cherry on the cake with one of the best CRMs for banking, and that is Zixflow. With this tool, you can filter and sort out the long list of customers in just a few clicks and put your focus on whom you actually need.

USPs of Zixflow

-

All-in-one stack with the most advanced AI security.

-

Activity tracking while utilizing a list of different table styles and sorting the list by using filters.

-

Automate marketing and sales campaigns for multi-channel engagement while utilizing WhatsApp campaign builder, email campaign builder, or SMS campaign builder.

-

Capture potential leads and drive them into the sales pipeline by using captivating forms that can be customized based on your industrial needs.

-

Write personalized and to-the-point email content without any expertise while utilizing a built-in AI writer.

-

Workflow automation by setting triggers, emphasizing work conditions, and adding actions.

-

Utilize eye-appealing pre-built templates or simply customize them for different campaigns to grab your customers’ attention.

Pricing module

You can explore Zixflow’s top-notch automated service with a 7-day free trial and make the most of the pay-as-you-use campaign wallet structure.

- Marketing: Starting at $0 for email and SMS. And $39/month (billed annually) for WhatsApp.

- XCRM: Starting at $59 for 3 users per month, billed annually.

- One (XCRM + Marketing): The initial cost is $79/month, which comes with 3 users.

Salesforce

Generating worthwhile leads and nurturing them is not a cakewalk at all, but the Salesforce cloud-based management system makes this work a hassle-free task for the banking industry. Salesforce, one of the best CRM softwares, provides multiple integrations in one place for marketing, enhancing sales process, and forecasting rooms for future opportunities. You can check our compiled list of top CRM alternatives to Salesforce and compare their features with Salesforce for making an informed choice.

Key benefits

-

You can manage your leads in one stack with Salesforce’s holistic approach.

-

You can provide exclusive customer experience through mobile devices anytime and anywhere.

-

You can eliminate manual tasks and increase productivity at individual and team levels together.

USPs of Salesforce

-

Email integration.

-

File synchronization and sharing.

-

Sales forecasting with analytics and reports.

-

Sales performance management.

Pricing module

Salesforce offers four subscriptions: Starter, Professional, Enterprise, and Unlimited.

- Starter - $25 per user/month.

- Professional - $80 per user/month.

- Enterprise - 165 per user/month.

- Unlimited - $330 per user/month.

Rating & reviews by G2

⭐⭐⭐⭐.3

4.3 out of 5 (18,351 reviews).

Hubspot

Hubspot is your next best option when choosing a top-notch CRM solution for your banking services in the competitive market. You can seamlessly incorporate the CRM with other tools such as Gmail, and Microsoft Dynamics to enhance productivity. Well, Hubspot is especially used for drip campaigns to enhance sales engagement over a long period and also boost your customers’ experience all the way.

“Customer experience isn’t an expense. Managing customer experience bolsters your brand” - Stan Phelps.

Suppose, you’re in a rush to have an immediate follow-up with your customers, you can use its AI email writer to save your time. You can allow your customers to book a meeting where you both can conveniently discuss overdue amounts, discounts on loan interest, higher returns on Fixed Deposits, or any other profitable deals.

Key benefits

-

You can distribute and analyze quality content with Hubspot's on-the-go optimization tools and increase traffic to your website with SEO optimization.

-

Easily schedule and manage your meetings with leads and prospects to address their pain points.

-

With Hubspot sales hub track your team performance with real-time insights into sales activity.

-

You can easily manage your multiple social media accounts for marketing and set email-campaign for a wider outreach.

USPs of Hubspot

-

Automated CRM database.

-

A/B testing.

-

Lead management.

-

Email marketing.

Pricing module

Hubspot offers two subscriptions along with a 1-day Free trial: Professional, and Enterprise.

- Professional - $1600/month.

- Enterprise - $5000/month.

Rating & reviews by G2

⭐⭐⭐⭐.4

4.4 out of 5 (10493 reviews).

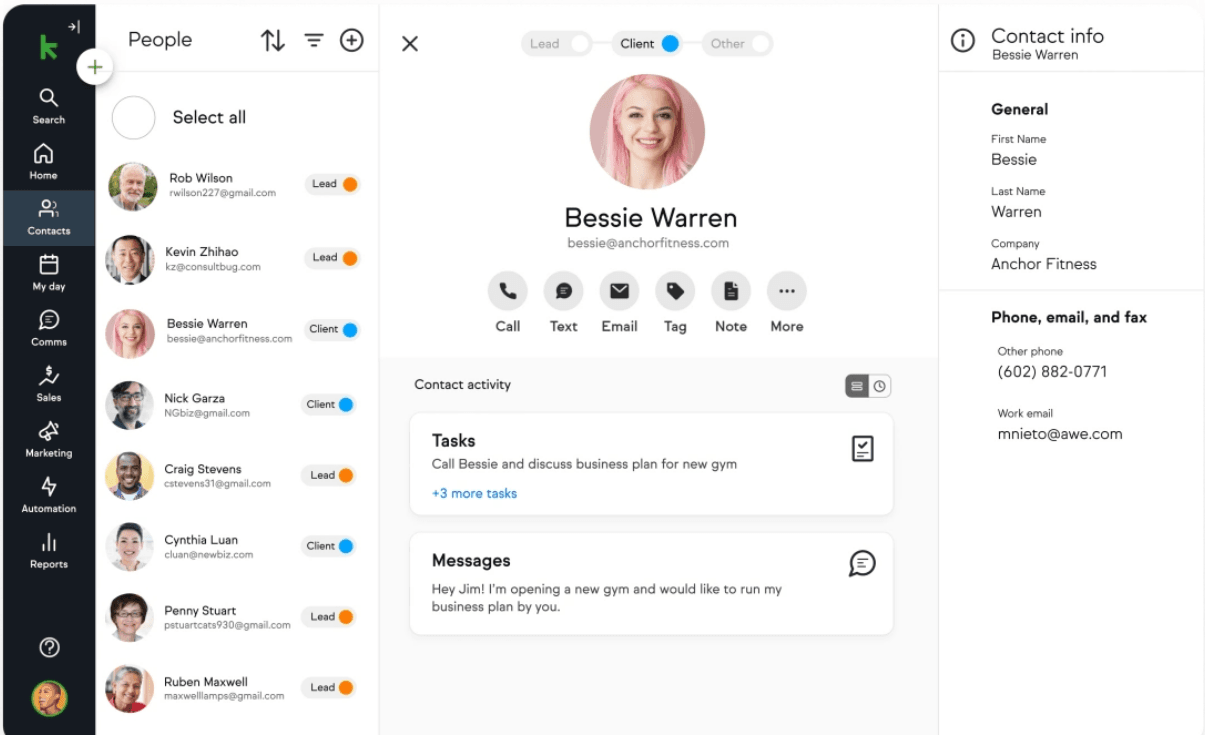

Keap

To break the ice between you and your different types of leads in sales, presenting a quick and problem-solving response at the right time is needed. And by incorporating Keap you do the same in the banking industry.

This platform helps you to organize contacts, monitor data, and capture leads while connecting them with undivided attention. It is one of the leading sales pipeline management tools that helps you track and manage leads as they move through the sales funnel. Also, Keap enables integration with other tools such as Gmail, Paypal, Quickbooks to ease your banking tasks. Keap is often compared with HubSpot as a CRM software. That’s why we have drawn an elaborate comparison between Keap vs HubSpot so you can make an informed choice.

Key benefits

-

Allow your teams to set up an appointment with your prospects using Keap’s advanced calendar feature.

-

Generate invoices, track EMI bills, and incorporate multiple payment gateways with Keap to deliver hassle-free day-to-day tasks.

-

With access from mobile device applications as well, enhance the productivity of your banking agents.

-

In fact, you can send the quickest OTP notification through offline text to protect your consumer from fraud cases.

USPs of Keap

-

Lead management.

-

Email marketing.

-

Marketing and Sales automation.

-

Report analysis and management.

-

Appointment scheduling.

Pricing module

Keap offers four subscriptions: Free, Pro, Max, and Max Classic.

- It offers a 14 Day free trial.

- Pro - $159/month, billed annually or $199/month, billed monthly.

- Max - $229/month, billed annually or $289/month, billed monthly.

- To access features with the Max Classic plan, you need to contact the team.

Rating & reviews by G2

⭐⭐⭐⭐.2

4.2 out of 5 (1460 reviews).

ActiveCampaign

ActiveCampaign is your next CRM, especially for retail banking. If you’re looking to create a mass email marketing campaign to build strong relationships for selling, then your go-to tool is this. From following up with your clients, if needed, to sending them your alluring discounts on loans or higher interest rates, you can do this all by accessing ActiveCampaigns' captivating email templates.

Key benefits

-

You can merge this tool with others for autoresponders, goal tracking, and marketing tasks and eliminate obstacles on the way to up-selling or cross-selling.

-

You can flawlessly segregate and churn your customers based on their demographics, purchasing powers, etc to modify strategy and enhance conversion rates.

-

Send your customers any crucial notifications with the help of SMS, email, or in-app messaging to keep them informed and alert.

USPs of Active Campaign

-

Customer experience solutions.

-

Third-party application integrations.

-

Lead scoring and lead management.

-

Email-marketing.

Pricing module

Active Campaign offers five subscriptions: Free, Lite, Plus, Professional, and Enterprise.

- Lite - $29/month/1 user, billed annually.

- Plus - $49/month/3 users, billed annually.

- Professional - $149/month/5 users, billed annually.

- For an Enterprise plan, you need to consult and customize your plan.

Rating & reviews by G2

⭐⭐⭐⭐.5

4.5 out of 5 (1651 reviews).

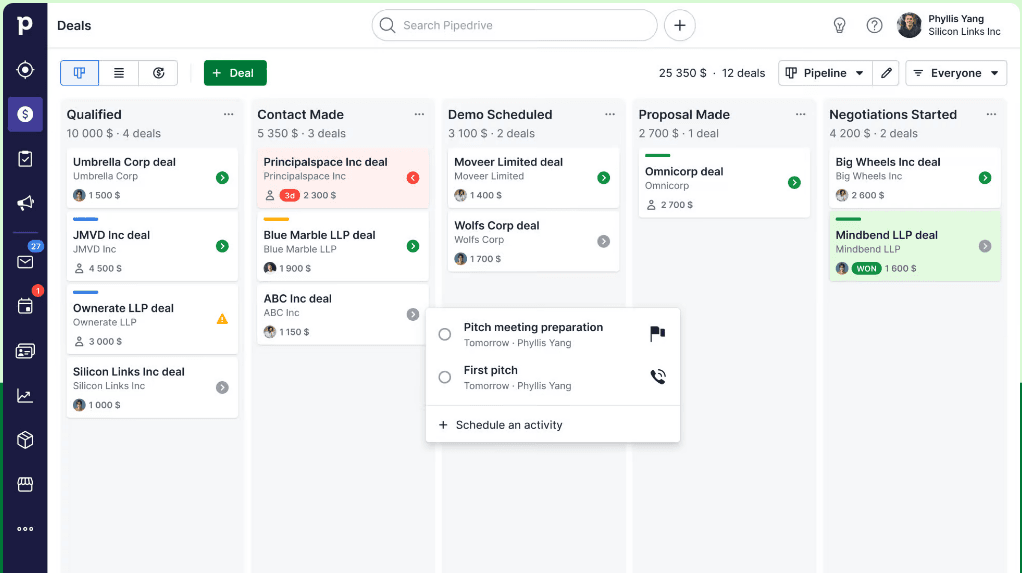

Pipedrive

To design a better sales structure, optimizing each stage of a sales pipeline is as crucial as creating a lasting impact on your client’s mind. By integrating Pipedrive CRM for banking services, you can stay one step ahead in the sales game and focus on other aspects as well including appointment scheduling, email processing, immediate notifications sharing, and so on.

Before you choose Pipedrive, you can check out the comparison between Keap vs Pipedrive software.

Key benefits

-

You can enhance your efficiency drastically while automating your workflows by eliminating repetitive banking administration tasks.

-

You can synchronize communication with emails and track customer responses in one single dashboard. Also, you can send confidential messages of your customers’ transaction activities on their bank accounts via emails.

-

To enhance customer satisfaction with quicker live chat response, utilize Pipedrive’s built-in chatbot and guide your clients in every possible way. By doing this, you can protect your customers from any misleading information.

-

With Pipedrive, you can gain an extra edge over your customers' data protection, so that your banking business never gets compromised.

USPs of Pipedrive

-

Email builder, segmentation, and email campaigns.

-

Lead management.

-

Sales automation.

-

Access to detailed analytics and reports.

Pricing module

Pipedrive offers five subscriptions: Essential, Advanced, Professional, Power, and Enterprise.

- Essential - $9.90/month/1 user, billed annually.

- Advanced - $19.90/month/1 user, billed annually.

- Professional - $39.90/month/1 user, billed annually.

- Power - $49.90/month/1 user, billed annually.

- Enterprise - $59.90/month/1 user, billed annually.

Rating & reviews by G2

⭐⭐⭐⭐.2

4.2 out of 5 (1696 reviews).

Creatio

Creatio is your best comprehensive CRM software that is aligned with banking industry standards. It is best known for being one of the top CRM for investment banking. With Creatio make your journey in omnichannel presence and coordinate your customers with every touchpoint. Furthermore, Creatio can help you outperform in better responding while you target and trigger sales psychology with ease to make a final decision.

Key benefits

-

You can get flexibility in this software customization to cater to your banking business needs.

-

Its user-friendly interface makes training easier for your employees from various departments and reduces the hurdles.

-

With Creatio, maintain strong security with two-factor authentication in your customer database and make customer journeys fearless while boosting your authenticity.

USPs of Creatio

-

End-to-end encryption and codeless management.

-

Campaigns and event management.

-

Integrated AI-powered automation.

Pricing module

Creatio offers three subscriptions: Growth, Enterprise, and Unlimited.

- Growth - $25/month/1 user.

- Enterprise - $55/month/1 user.

- Unlimited - $85/month/1 user.

Rating & reviews by G2

⭐⭐⭐⭐.6

4.6 out of 5 (240 reviews).

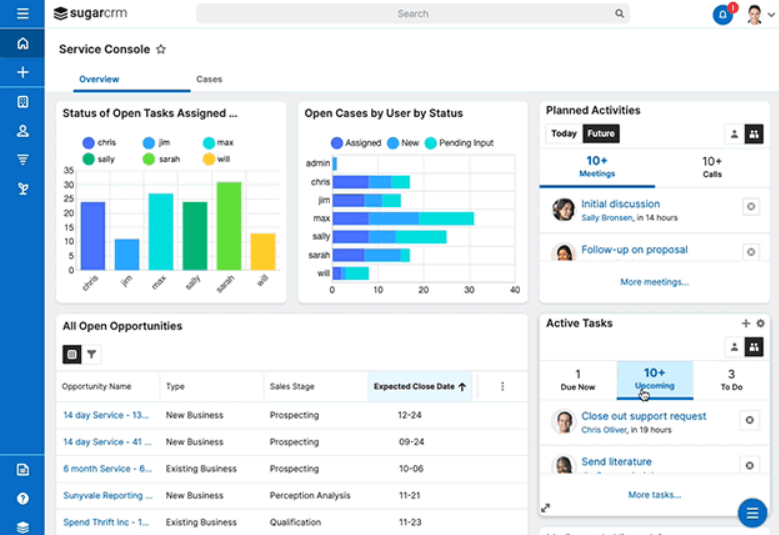

SugarCRM

Building rapport for enhancing sales can’t be overlooked while enhancing the experience of your prospective clients because your prospects don't want to be regarded as a number on a list.

And there, SugarCRM comes in with a solution to strengthen your bonds with your banking partners while helping you in understanding their different backgrounds. With SugarCRM, you can effortlessly handle your customers’ needs and preferences to drive them solely with your organization.

Key benefits

-

SugarCRM empowers your banking employees to focus more on developing creative solutions while putting an end to manual tasks.

-

To stay in compliance without any confusion or questions, SugarCRM's solutions are designed to provide reporting and audit functions to assist bankers in meeting regulatory requirements.

-

With the help of real-time data, you can understand your customers for further communication and identify cross-sell opportunities to generate revenue.

USPs of SugarCRM

-

Next-gen sales automation.

-

Customer service management.

-

Usage of generative AI.

Pricing module

SugarCRM offers five subscriptions: Sell, Sell Premiere, Enterprise, and Serve.

- Sell - $49/month, billed annually.

- Sell Premiere - $135/month, billed annually.

- Enterprise - $85/month, billed annually.

- Serve - $80/month, billed annually.

Rating & reviews by G2

⭐⭐⭐.8

3.8 out of 5 (693 reviews).

EngageBay

With Engagebay, apply your customer-centric selling approach in banking environments and turn your target audience into your future customrs. Your banking services can taste benefits with Engagebay in terms of advanced automation, marketing and sales productivity, and customer support tools. If you’re an Attio user and are looking to switch, then EngageBay is a top-rated alternative to Attio.

Key benefits

-

It gathers every single customer data from across multiple channels such as calls, emails, social media, etc. to help you customize solutions that align with your clients' preferences.

-

You can improve your bottom line of sales funnels with Engagebay while you scrutinize clients’ data to make a well-crafted report on that and set modified strategies.

-

From the first touch of customer interactions to follow-up and retaining lost clients, you can easily store, update, and retrieve everything in one single dashboard.

USPs of EngageBay

-

Email sequencing and email marketing.

-

Automated appointment scheduling.

-

Live chat with AI bot.

-

Single dashboard for management, marketing, and sales tasks.

Pricing module

EngageBay offers four subscriptions: Free, Basic, Growth, and Pro.

- Basic - $12.74 per user/month.

- Growth - $42.49 per user/month.

- Pro - $84.99 per user/month.

Rating & reviews by G2

⭐⭐⭐⭐.6

4.6 out of 5 (211 reviews).

Microsoft Dynamics 365

Microsoft Dynamics 365, a cloud-based CRM software, offers banks a range of features including customer service, sales, and marketing. Microsoft Dynamics 365 allows you to communicate with your prospect proactively while smartly overcoming objections in sales, and completing final agreements more quickly. It is also a renowned CRM alternative to Folk.

“Preparation will prevent you from becoming lost in a negotiation with not knowing what action to take next.” - Tom Hopkins.

Key benefits

-

With the help of data encryption and control features of this CRM, you can now provide your customers with best-in-class security and make your brand’s presence more authentic.

-

This tool enables you to organize valuable customer information and further helps you to find and contact potential leads to enhance your sales opportunity.

-

This tool provides real-time analytics and reporting based on the changing market trends, the performance of your sales cadences, and other marketing and sales activities.

USPs of Microsoft Dynamics 365

-

ERP solutions.

-

Advanced analytics.

-

Flexible customizations.

-

Seamless integration with other products of Microsoft.

Pricing module

It has three subscriptions along with a Free trial: Dynamic 365, Customer Engagement, and Unified Operation.

- Dynamic 365 - $210 per user/month.

- Customer Engagement - $115 per user/month.

- Unified Operation - $190 per user/month.

Rating & reviews by G2

⭐⭐⭐.8

3.8 out of 5 (1577 reviews).

Oracle Netsuite

Whether you're a small or large bank, in both cases, your chosen AI-driven CRM can be Oracle Netsuite for using customer engagement to skyrocket sales and drive revenues. From ERP (Enterprise Resource Planning) to ABM (Account Based Marketing), you can access any solutions in this cloud-based platform. Oracle Netsuite is known for being one of the powerful CRM software for insurance companies.

Key benefits

-

To reduce your sales cycle length and plan your financial budget for a long-term goal, Netsuite provides you with real-time figures for your current organization’s financial performance.

-

With its contact management, sales pipeline tracking, and workflow automation, you manage all the tasks like a pro.

-

Utilize its in-built capabilities to efficiently manage global currency, tax, and reporting requirements.

USPs of Oracle Netsuite

-

ERP solutions.

-

Workflow automation.

-

Real-time performance tracking and reporting.

-

Accounting and financial management.

Pricing module

You need to consult to get a feature-rich cloud-based ERP solution before purchasing.

Rating & reviews by G2

⭐⭐⭐⭐

4 out of 5 (2855 reviews).

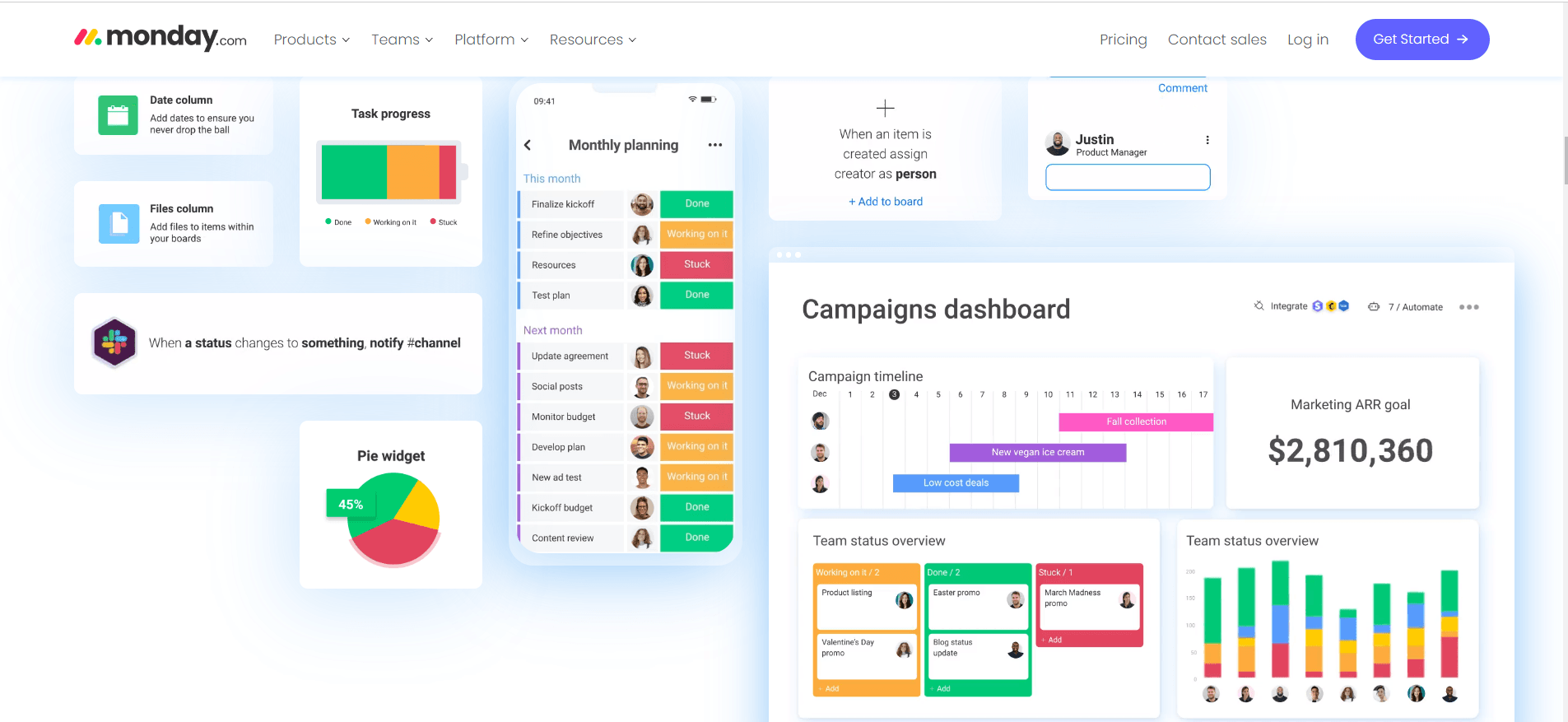

Monday.com

Follow-up with potential leads in your banking business is essential but it's actually a time-consuming process. But here Monday.com comes into play while allowing you to schedule your follow-up emails at the right time. This ensures your well-crafted sales cadence is functioning with all its potential. We recommend exploring CRM alternatives to Monday for making a detailed comparison and reaching a sound decision.

Key benefits

-

Effortlessly create, customize, and send emails and set email reminders to confirm approvals while staying in your target audiences’ minds.

-

Utilize Monday.com’s custom dashboard and edit column to organize your customers’ affordability, proposed products, and more.

-

Gain visibility throughout the sales cycle from the first touchpoint to sign off the deal with your consumer and alter strategies with valuable insights.

USPs of Monday.com

-

Email marketing.

-

Smoothly sales pipeline tracking.

-

Sales forecasting.

-

No-code automation.

Pricing module

It provides you with four subscriptions along with a Free trial: Pro, Max, and Max Classic.

- Pro - $159/month, billed annually or $199/month, billed monthly.

- Max - $229/month, billed annually or $289/month, billed monthly.

- To access features with the Max Classic plan, you need to contact the team.

Rating & reviews by G2

⭐⭐⭐⭐.7

4.7 out of 5 (9552 reviews).

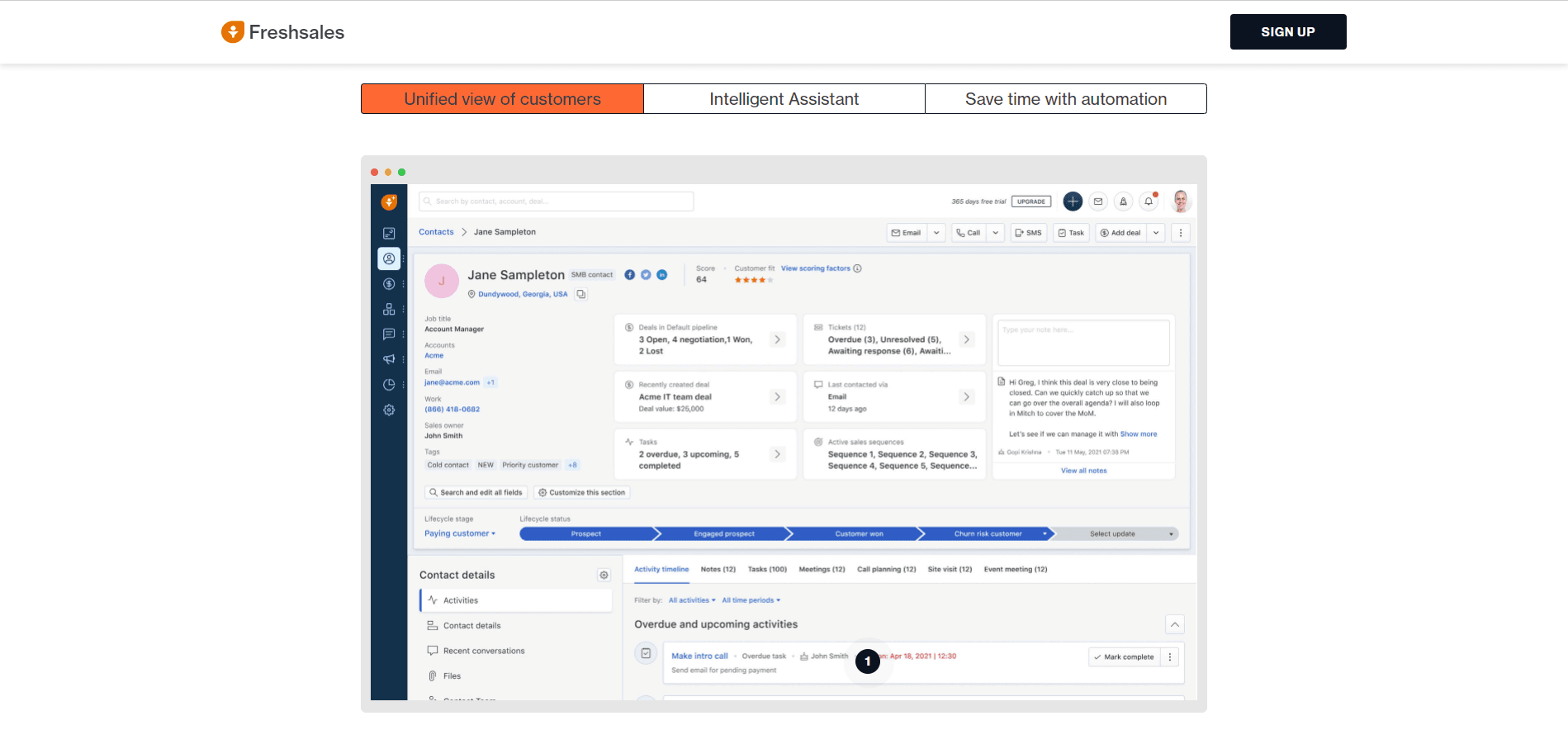

Freshsales

The user-friendly CRM for banking, Freshsales, offers you extensive integration with multiple third-party applications along with access to different plugins. It helps you to rock your deals from engaging with your consumers in pre-sales to post-purchase scenarios. If you’re inclining towards hubspot then you should check out comparison between Hubspot crm and Freshsales crm in order to make an informed choice.

Key benefits

-

Utilize AI-powered chatbots to create an instant live chat with your customers while asking them interesting sales-qualifying questions and responding to them promptly.

-

Automatically sync your customers' data with this CRM and segment them based on your selection.

-

Track the intent of your new visitors or existing satisfied customers, predict lead scoring, and set campaigns in automation with eye-catching pop-ups to promote your exclusive deals.

USPs of Freshsales

-

Multi-currency transactions management.

-

Seamless third-party app integration.

-

Live chat with an AI-powered bot.

-

Sales pipeline management.

-

Track activities and report analysis.

Pricing module

It offers four subscriptions: Free, Growth, Pro, and Enterprise.

- You can enjoy a 21 day free trial with Freshsales.

- Growth - $9/user/month, billed annually.

- Pro - $39/user/month, billed annually.

- Enterprise - $59/user/month, billed annually.

Rating & reviews by G2

⭐⭐⭐⭐.5

4.5 out of 5 (1108 reviews).

Streamline your banking tasks through automation with Zixflow CRM

Whether you’re a public sector bank, private sector bank, or retail bank business, CRMs are no longer limited to a specific area; rather they are a necessity for entities irrespective of size, share in the market, and number of its existing clients. Banking is a highly regulated sector, so you must also conduct CRM audits regularly to ensure compliance.

Already you've gained knowledge of how these CRMs can smoothly amplify your banking activities be it managing administrative tasks, engaging your leads, impressing your prospects, retargeting and retaining your customers, or maintaining highly secured data privacy.

Now, it's your time to rock on & create buzz while unfolding a new chapter of success in the banking industry. If you don't want to freak out after missing a premium experience on the way, go and grab the opportunity to access Zixflow now!