11 Best & Trusted CRMs for Investment Banking in 2026

Ever been here? A Monday morning rush that is fully packed with work, a lot of deals ahead that need to be closed, and continuous meetings with clients. And the need to make new successful investments ahead of the week, which your client must be satisfied with.

The sphere of investment banking is a place where chaos can be the norm and with the right tools like a trusted customer relationship management by your side, you can manage this chaos effectively. We can't stress enough on the importance of using CRM in the banking sector.

Let me tell you about 11 amazing CRM tools that can help you solve the problems that you might face in investment banking.

Problems faced in investment banking and the solutions CRMs offer

Every field of work has its problems, right? Well, investment banking is no different.

There may be problems on the higher side with investment banking such as juggling between tasks, managing intricate financial transactions, finding ways to overcome sales objections, and dealing with your clients' evolving needs all while keeping a watchful eye on the market trends.

I understand these problems might sometimes be overwhelming but there are always solutions to them in the form of workflow automation or CRM software.

Here are some of the common problems you might face in investment banking along with the solutions which a CRM can offer.

Client data management

Problem

In investment banking, you might often struggle with effectively managing and accessing customer data like transaction history, risk tolerance, investment portfolios, and more. This can lead you to failure with deals due to your inability to access data or loss of reputation due to those failed investments that did not meet your client's requirements.

Solution

With an effective CRM in place, you can automate the data entry process, saving you some valuable time. Also, you can segment clients based on your requirements and personalize solutions that are tailored to those specific clients. Along with this, you can make informed investment decisions thanks to the easy accessibility to data like customer profiles, risk tolerance, investment preferences, and financial history which are available with the CRM.

Regulatory Compliance

Problem

The investment banking sector is bombarded with rules and regulations and these keep changing and evolving with time. As the policies take place to protect client data and other sensitive information, banks need to be strictly adhered to the regulatory compliances which can make you always feel anxious about messing things up. This can affect your efficient performance and sometimes even hinder your workflow.

Solution

Most CRM software are extremely customizable which means they can be designed in a way that adheres to all the changing regulations. CRMs ensure that the data stored regarding client interactions and transactions remain compliant ensuring adherence to data protection regulations. Moreover, CRM audits on a regular basis helps you stay compliant with regulations.

Deal tracking and management

Problem

In the world of investment banking, one is often under high pressure and it is understandable that you might lose track of a deal's progress, forget to enter client data, or follow up on a client. All this can seriously affect your deal closures and business growth as a whole.

Solution

CRM systems automatically enter your client data whenever a lead is qualified while eliminating the need for you to manually enter all the data. A CRM then helps track these leads throughout the sales pipeline stages to crack the deals.

Well, you need to know that an efficient CRM like Zixflow can automate your sales flow from the start by automating the lead generation process, following them up, turning them into paying customers, helping you close those deals, and retaining them as well.

Cybersecurity

Problems

You might be aware that most investment banking companies are subject to cyber attacks by hackers and thus cyber security is becoming of utmost importance for you, right?

Solution

Modern CRMs are very advanced and highly secured. They are equipped with top-notch security measures to protect your client’s sensitive data and transaction details from data breaches and theft while giving peace of mind to you and your clients. Integrating SIEM tools (Security Information and Event Management tools) further enhances this security by providing real-time monitoring and automated incident response across all CRM activities.

Performance analytics

Problem

You might be an amazing investment banker, but if you don’t have the necessary data and reports to back up your investments, your reputation is not going to be highly valued.

You as an investment banker might often come short when it comes to detailed reports to show your successful investment ventures in front of your existing clients and future prospects. This issue is common and understandable as these data can be hard to maintain, find, and analyze.

Solution

CRM systems provide you with extensive and comprehensive data as it tracks and maintains all data related to customers, deals, and investments. With these reports, you can make informed decisions for the future and adjust strategies accordingly. You can seal more deals with these reports by showing your success.

Communication with clients

Problem

Communication is key in any business relationship. However, in investment banking when you target effective communication with your clients, you might often struggle to inform them about new opportunities, send them reminders, or follow them up to share the planned investment ideas.

Solution

CRM can help you extensively in communication with your clients through meetings while allowing you to access automated meeting schedulers. It can add value to these communications by sending personalized email messages tailored to your audience's needs. Well, the process is smoothly done as CRM helps you to customize solutions based on the existing customer data. Here the purpose is to inform them about new investment opportunities or follow up with them about deal status.

Client retention and satisfaction

Problem

An unsatisfied client is a sign of a failed relationship with the customers. You might be facing this problem, as it is quite common for clients to be disappointed with the investment banking sector due to their requirements not being met.

Solution

CRM is all about satisfying your customers. It uses your customer data to segment clients' demography and personalize experiences so that each one can feel noticed and valued. This increases trust and trust is very important in the investment banking sector.

CRM personalized interactions with your clients through automated emails or helps to create the perfect investment based on their preferences and financial history, this increase in customer satisfaction would mean higher customer retention.

11 best and trusted CRMs for investment banking to solve your problems

Zixflow

Zixflow CRM is an extremely versatile and customizable tool making it one of the best choices for the investment banking industry. Zixflow CRM is highly capable of solving all your common problems and concerns of investment banking that I mentioned earlier.

It does so with its amazing features and tools that are highly customizable and purpose-built for investment banking. Let me share with you some amazing features of Zixflow CRM that give you 360-degree support from generating leads to closing the investment deal.

Key features

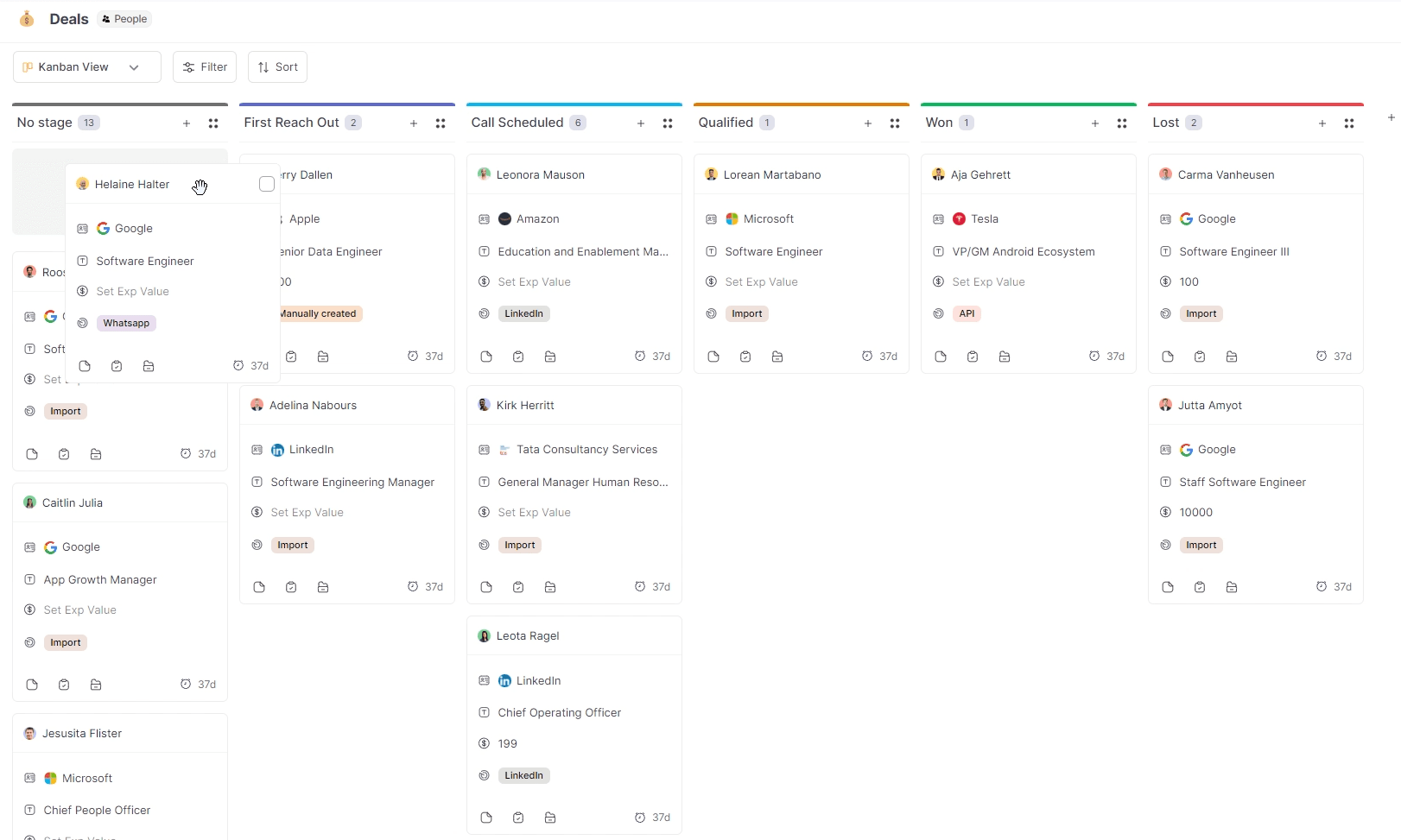

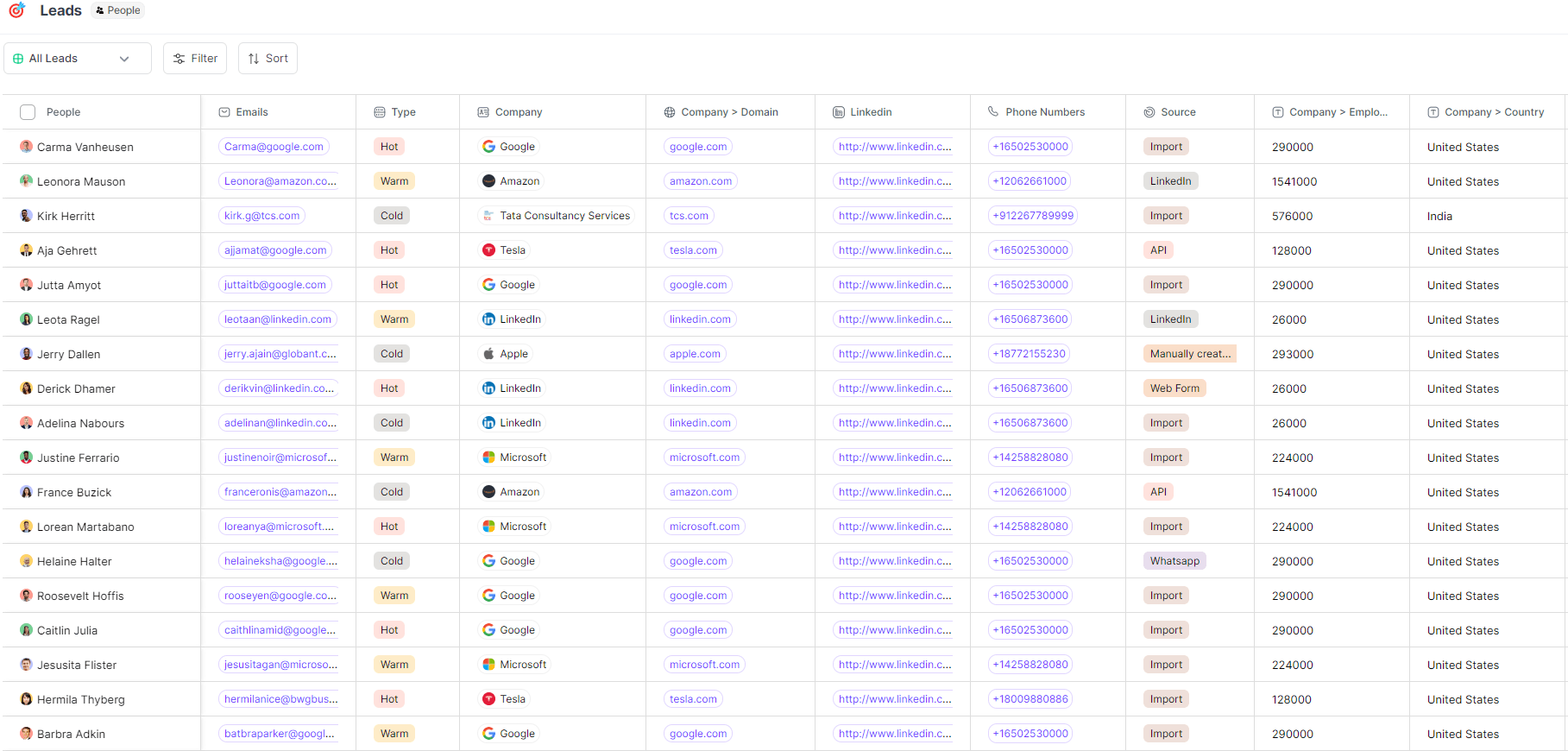

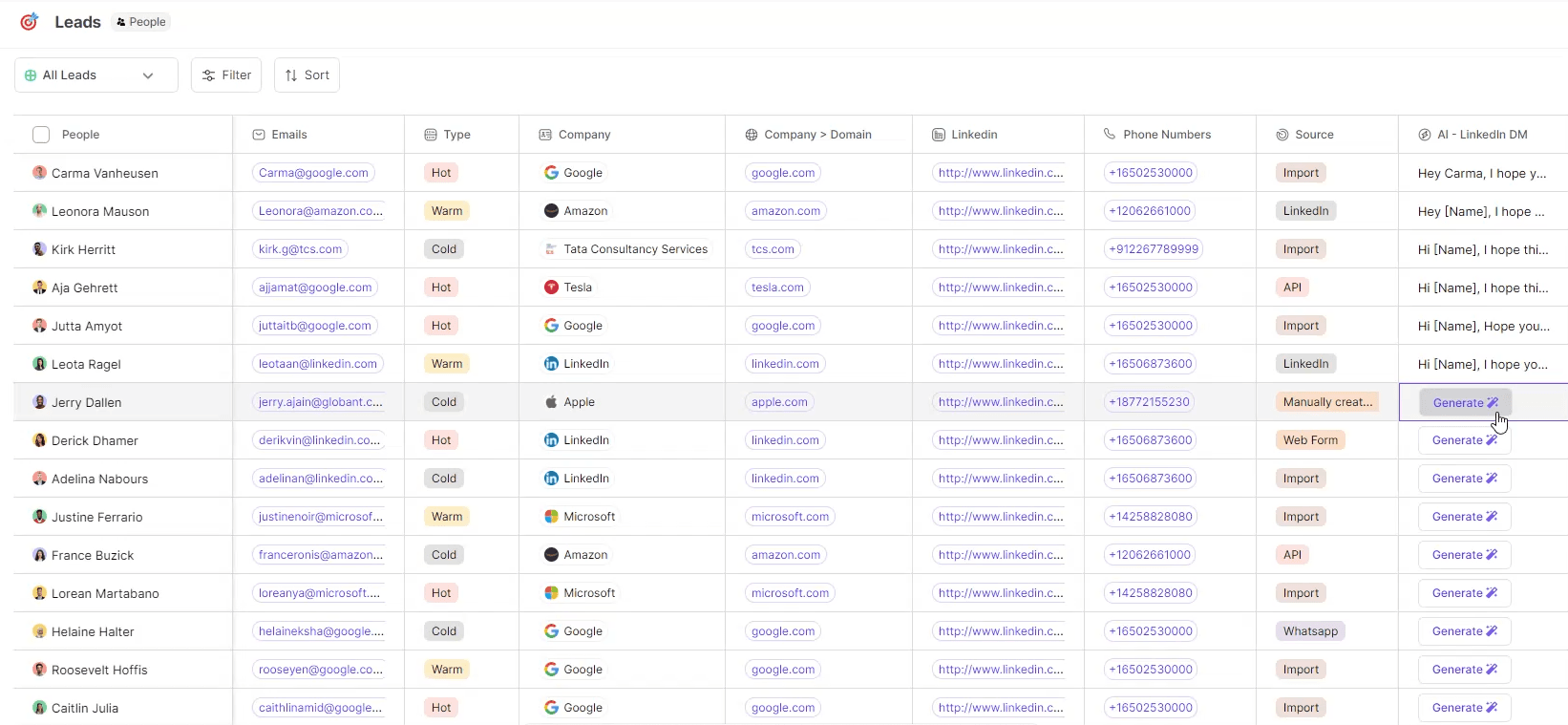

Custom lists to track leads, deals, and projects

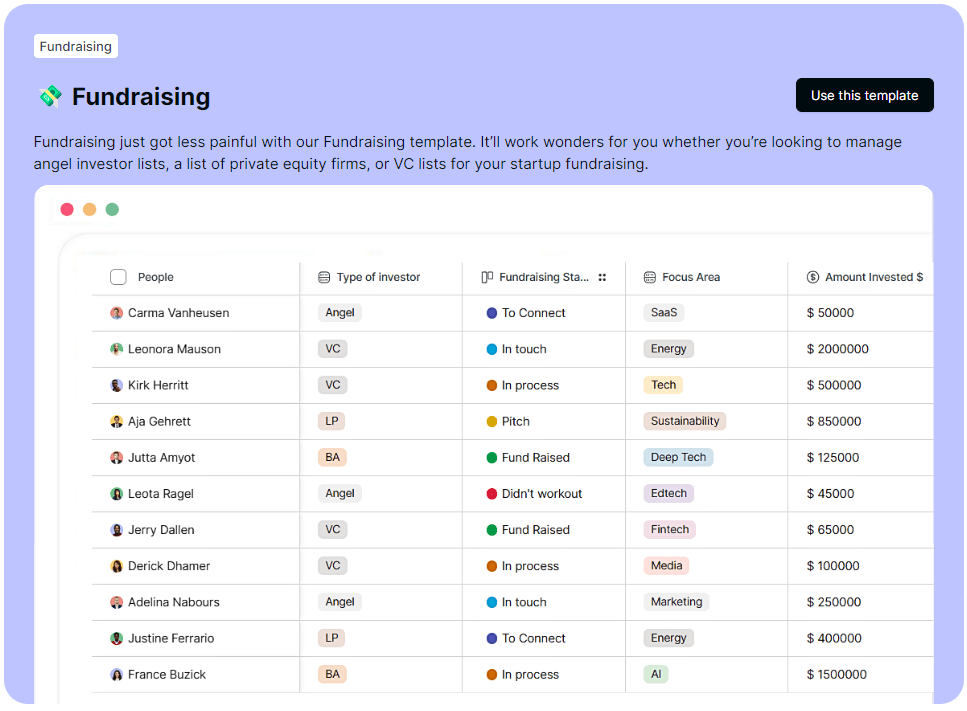

Zixflow has customizable templates that are purpose-built CRM for investment banking. The fundraising template that Zixflow offers is a highly customizable template made specifically for investment banking.

You can easily change what you see with custom fields like Investor name, type, amount invested, preferred industry, invested industry, and many more.

You can also create a list that does exactly what you want from scratch using the build-your-own section on templates.

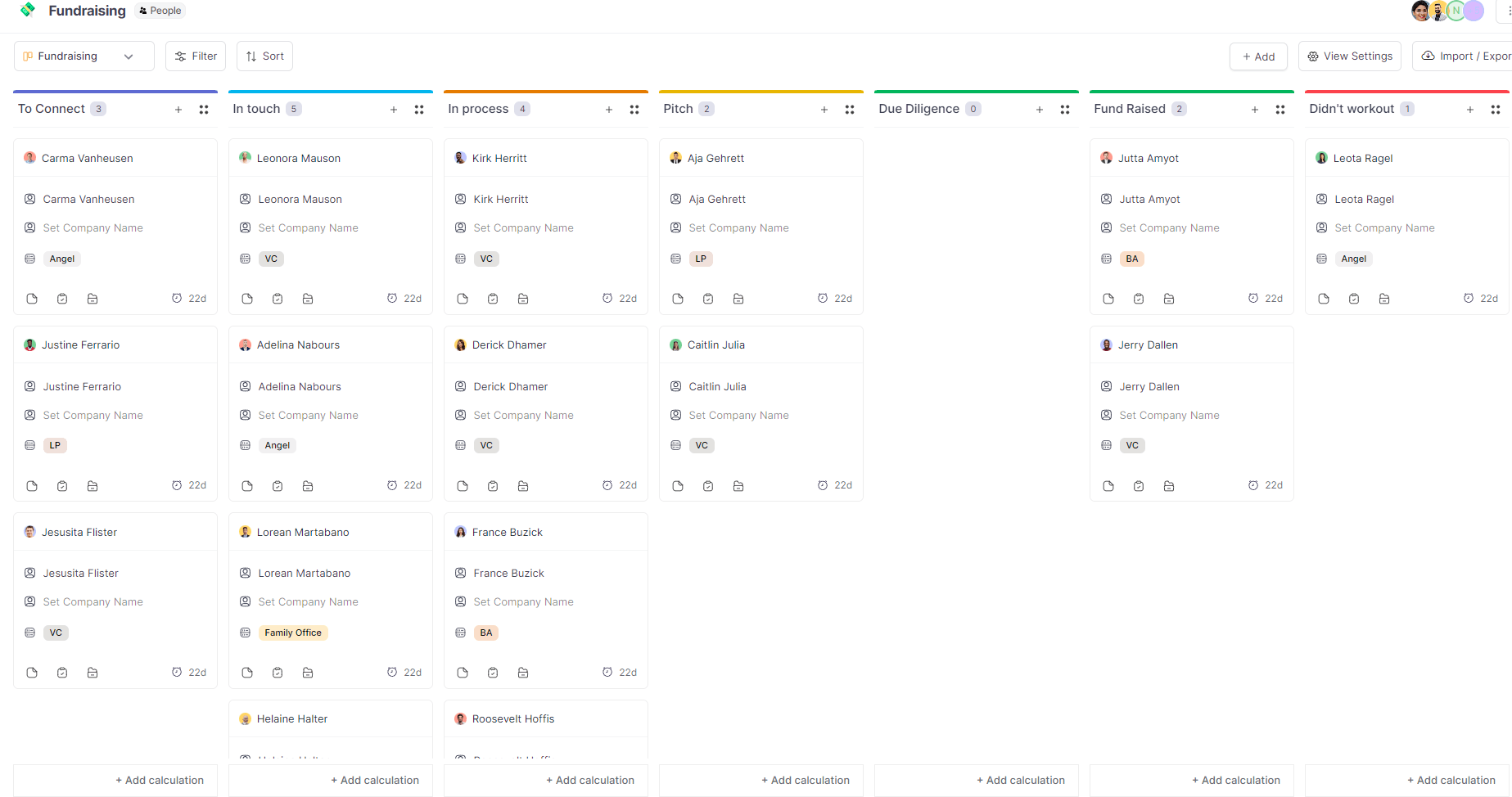

Easy to use drag-and-drop pipeline

With just a click you can change your view from a table showing all investment details to a visual deal pipeline. This eliminates the time and energy spent on creating pipelines for each list and manual data entry.

Zixflow’s easy-to-use drag-and-drop visual pipeline helps to track and manage deals and progress with ease. You can always be informed and stay on top of everything going on in your organization with Zixflow CRM's custom lists and pipelines.

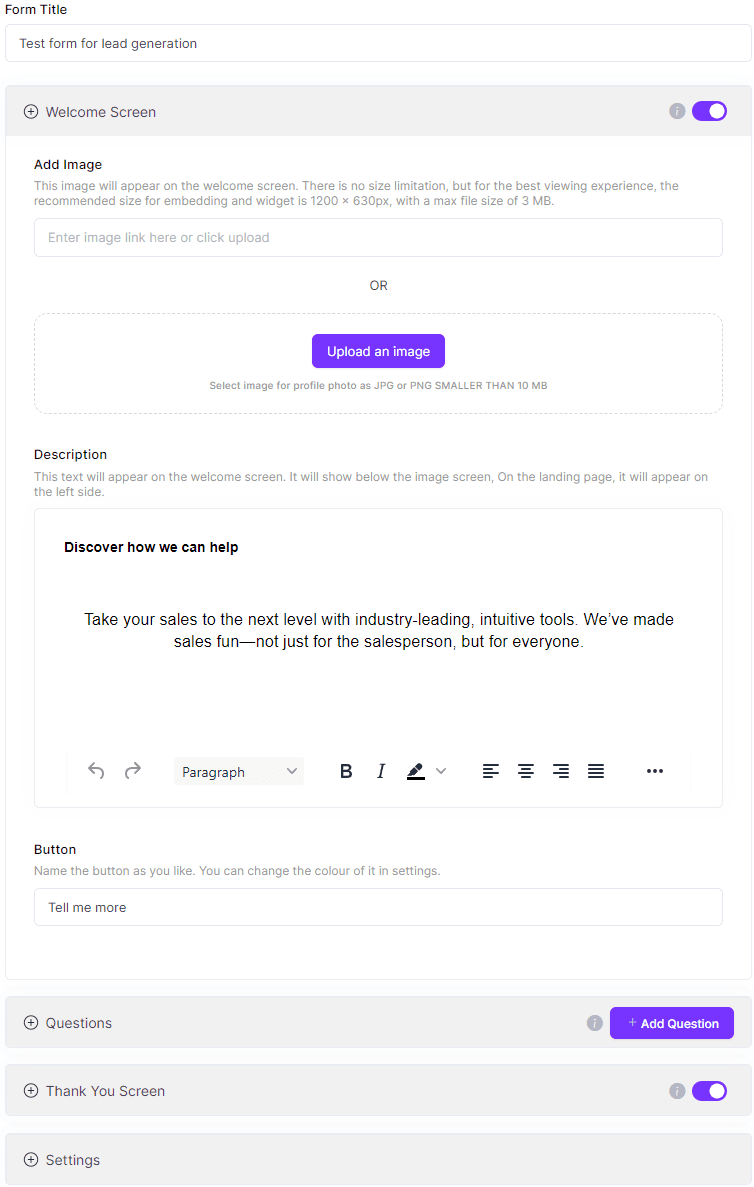

Automated lead generation

Zixflow helps you automate your lead-generation process with ease. You can use Zixflow’s virtual form builder to build forms. These forms can easily be integrated into your website to automate your lead generation process and generate high-quality leads that fit your lead qualification checklist.

Easy management of leads and client data

Zixflow automatically enters your leads generated from forms to a list you choose. This eliminates the time spent on manual data entry. Automatically entering leads means you can quickly engage with leads when it is hot, increasing your chance of conversion.

Zixflow’s customizable lists help you securely store, manage, and track all your leads and client information in one place. A customizable list means you see things the way you choose to see them. Helping you always be informed and stay on top of everything that’s going on.

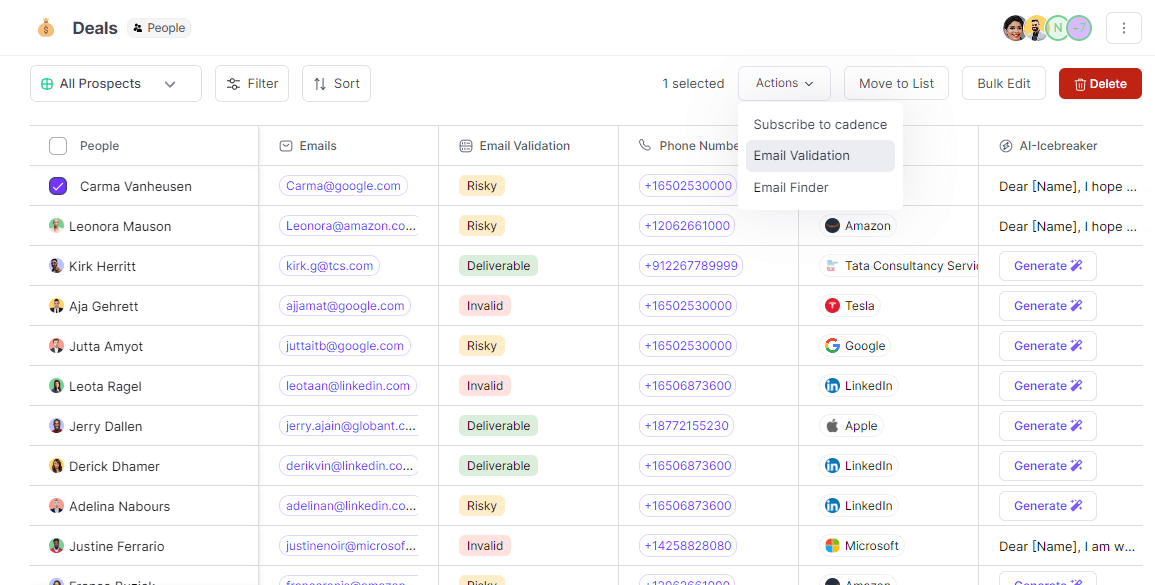

Email validity check

Zixflow helps you check the validity of your lead with just a simple click. The email validity checker feature is accessible from the list you create itself which means you can check the email validity of a large number of clients in a single go saving you plenty of time to focus on your core works.

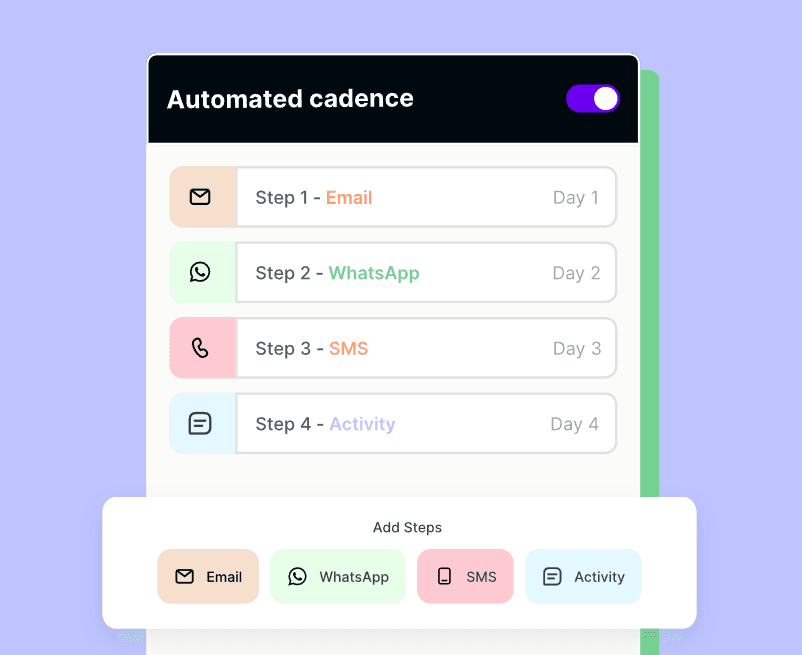

Enhanced engagement with clients

Sales engagement for the investment sector is vital to enhance customer satisfaction. Zixflow helps stay connected with your customers and enhances customer engagement with multi-channel campaigns and easy contact features. The multi-channel campaign feature lets you create personalized outreach campaigns to engage with your prospects.

Zixflow always aims to make your life easier, so they have easy contact options to contact and communicate with your clients in the platform they prefer and use.

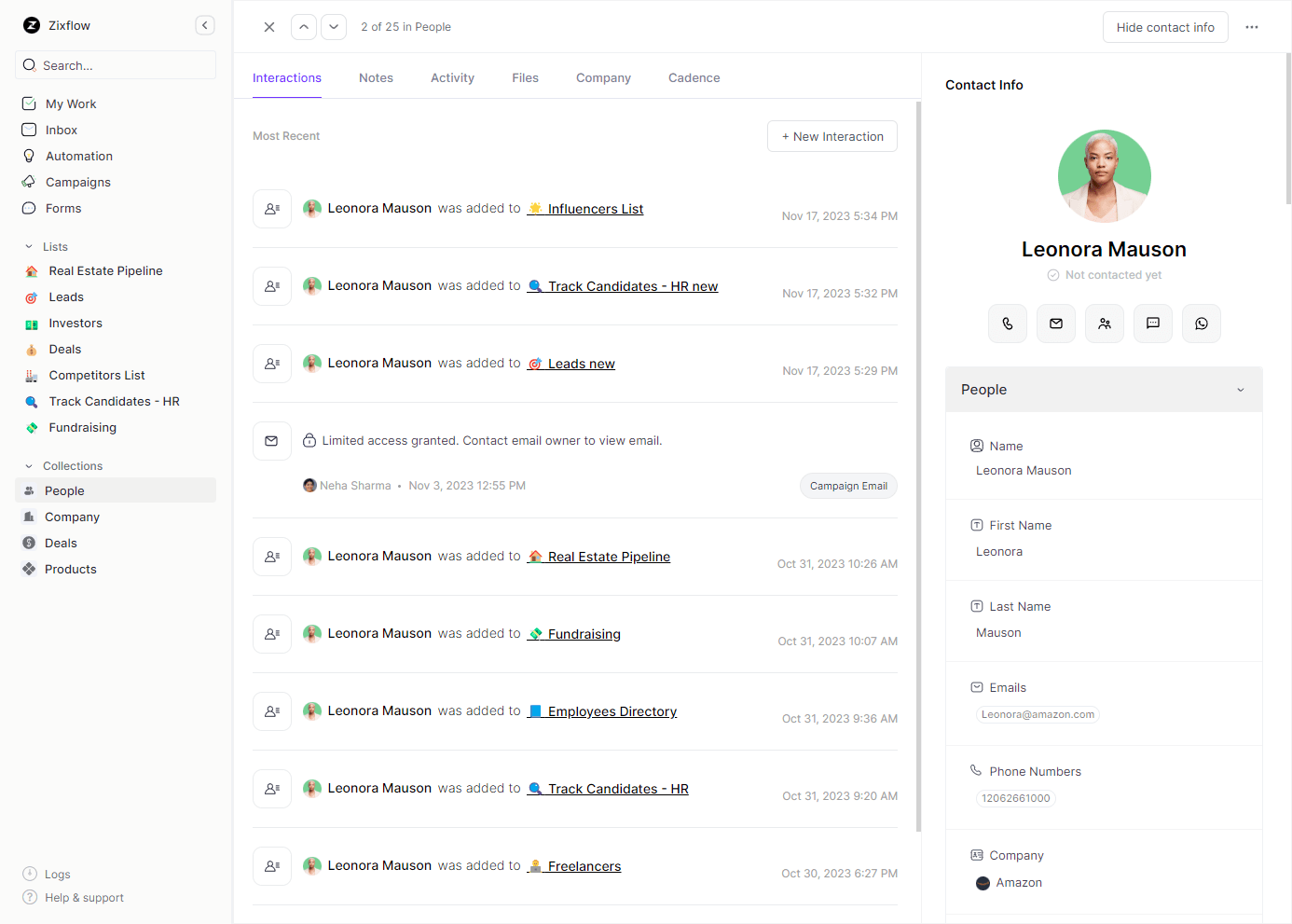

One-click 360-degree customer view

As an investment banker, it is important for you to have a complete understanding of your customers. Zixflow gives a holistic view of your customers with a simple click on the contact. It shows all the necessary information like contact details, past interactions, client files, and more.

Zixflow has a notes section which along with the other information gives you a 360-degree view of your customers. With this, you can know your client’s risk tolerance, financial history, investment preference and history, financial capabilities, and other information to make personalized investments on their behalf.

This also helps you deliver a personalized customer experience which is vital to enhance customer satisfaction.

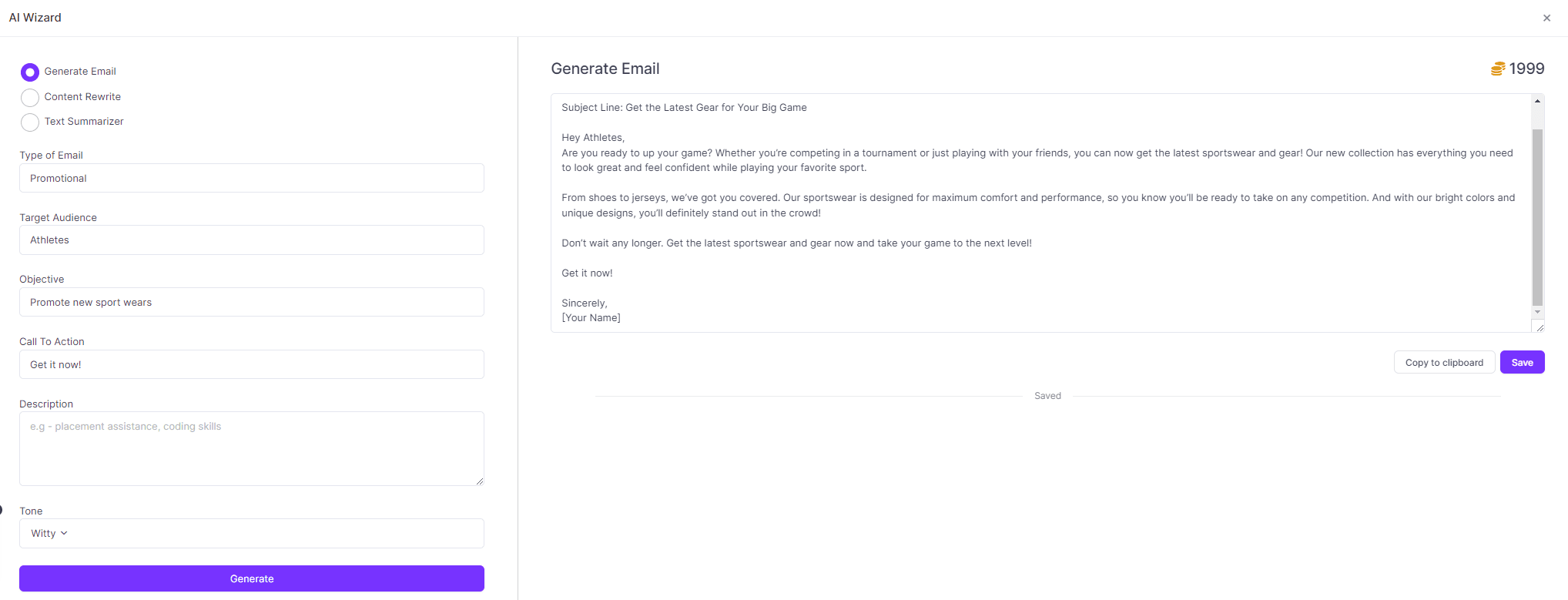

AI-powered icebreakers and emails

Zixflow’s AI can create personalized icebreaking messages that can help you create a great first impression with your clients which is important to build trust.

Zixflow makes it easy to create icebreakers, you can simply add an icebreaker section to your list. From the list now you can create personalized messages with just a click.

Zixflow’s AI wizard can also help you write personalized and engaging emails with ease. You just need to fill out the necessary fields like the type of email, target audience, objective, call to action, description, and tone. This eliminates the time spent on writing emails.

One-stop dashboard

While most CRMs require that you move between different sections and tabs, Zixflow provides a one-stop dashboard from which you can access everything you need. This helps you streamline your workflow and increase efficiency in your organization.

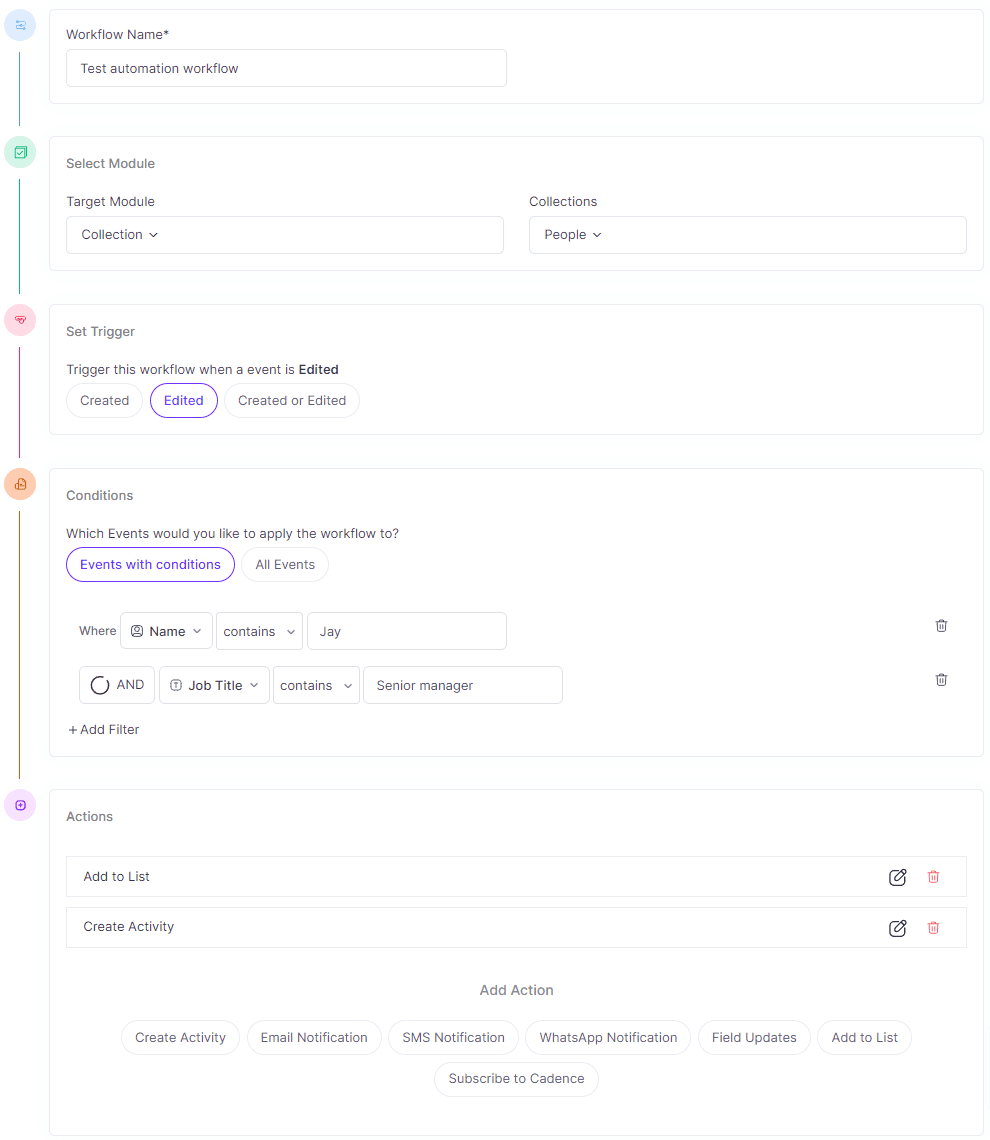

Workflow automation

Zixflow’s workflow automation helps you streamline your workflow. It has customizable workflow templates that require no coding knowledge to set up which means it is beginner-friendly.

You can use the IFTTT triggers (If This Then That) to completely automate your workflow. For example, if one of your clients doesn’t open your email you can set that as a trigger to perform the action of sending a follow-up email.

This would extensively save you time managing things and help you focus more on your core work.

Advanced security

As an investment banker, you deal with sensitive documents and client information. Zixflow’s security helps you safeguard this information and data from potential data security breaches.

Zixflow CRM's top-notch security gives you peace of mind by securing all your data with robust data security, end-to-end encryption, and password-less authentication.

Pricing

Zixflow offers multiple pricing plans based on how you want to use the platform. For instance, if you want to use the solution as a marketing stack, you can get started with the platform for free to run email and SMS campaigns. If you wish to run initiatives on WhatsApp, then you will have to get the Started plan costing just $39/month and includes 3 users.

Similarly, for XCRM usage, the starting plan is $59/month (billed annually) and comes with 3 users. Additionally, if you want to use the platform for both the CRM and marketing solution, Zixflow offers One, a mix of XCRM and marketing. Zixflow One ranges from $79 per month (billed annually) to $299/month (billed annually). All these plans come with 3 users, and you can add more users based on your needs.

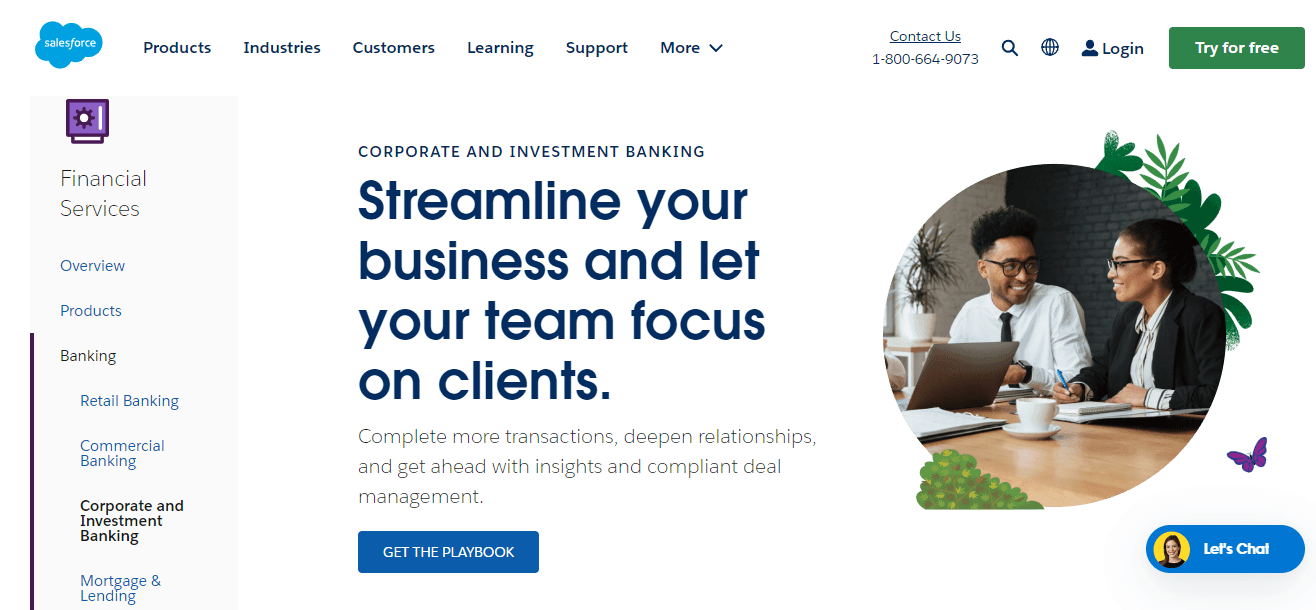

Salesforce

Salesforce offers a purpose-built CRM solution specific to the investment banking sector that enables you to better understand your clients and their needs. So that you can offer customized investment solutions for them. Salesforce elevates your team's performance by optimizing the deal pipelines and giving them actionable insight at the right time with its comprehensive analytics tool. Let’s explore the features that make it one of the best CRM tools for accountants working in investment banking.

Key features

Financial services cloud

The financial services cloud feature helps you deliver similar customer experiences across all channels and geographies while helping you keep the best customer experience consistent.

Analytics for informed decisions

The comprehensive analytics feature of Salesforce gives your team a clear overview of things, helping them find answers to any of their data queries. The in-depth analytics help you make informed data-driven decisions.

Einstein relationship insights

If you find analyzing the data in the analytics dashboard hard and time-consuming, Salesforce has you covered with its AI-powered assistant called Einstein to analyze the data to discover relationship opportunities and provide insights to help close deals faster.

Compliant data sharing

Salesforce helps your team stay connected through effective collaboration. It also remains compliant with the existing data-sharing regulations and shares data only with authorized team members to protect sensitive information.

Pipeline management

Salesforce has an easy-to-use pipeline management tool that helps you stay on top and deliver consistent performance. Its pipeline management helps you manage tasks assigned to your team, and see the progress. Therefore, you can further boost sales productivity by implementing sales process automation to save time and resources.

Customer rating on G2

⭐⭐⭐⭐.3

4.3 out of 5 (18,351 reviews).

Pricing

Salesforce CRM offers four pricing plans.

- Starter - enterprise edition for $250 /user/month.

- Starter - unlimited edition for $425 /user/month.

- Growth - enterprise edition for $325 /user/month.

- Growth- unlimited edition for $500 /user/month.

Microsoft Dynamics 365

Microsoft Dynamics 365 is a great tool if you are already using its products like Word, Excel, and PowerPoint. As it easily integrates with external tools, it provides you with an easy-to-adapt and useful environment.

In investment banking, Dynamics 365 specifically helps you maintain and elevate your customer satisfaction through its comprehensive 360-degree view of clients to better understand them and tailor investments according to them.

Key features

369-degree view of client

Dynamics 365 gives you a 360-degree view of your clients like their interests, preferences in investment opportunities, previous transactions, communication history, and so on. This provides you with all in one place that you can access all the information to make the right investment on your customers’ behalf.

Investor information and interest tracking

Always be informed about all your client actions by tracking and keeping a record of emails, phone calls, and meetings with Dynamics 365. Track their interest easily and categorize them by sectors, companies, funds, and more.

Fund management

Manage your client funds effectively in one place with Dynamics 365 while defining funds and segregating them accordingly. Track the investments, the returns on them that are made through these funds, and other activities that are done for appreciation.

Deal management

Set up an easy-to-understand pipeline that is customized for your needs while tracking and managing the sales cycle for each client. So that you can easily see the deal progress, optimize the process when necessary, and excel in impressing your sales prospect.

Regulatory compliance

This tool makes sure that no rule is violated to comply with the existing industry regulations for maintaining data privacy and security.

Customer rating on G2

⭐⭐⭐.8

3.8 out of 5 ( 558 reviews).

Pricing

Microsoft Dynamics 365 offers 2 pricing plans for its finance CRM.

- First Dynamics 365 app for $180/user/month.

- Subsequent qualifying1 Dynamics 365 app for $30/user/month.

4Degrees

4 Degrees is a CRM software specifically designed for investment banking to organize and streamline your banking tasks. It is an all-in-one solution to protect your million-dollar transactions. The tool integrates with numerous modern-day software like Outlook, Pitchbook, LinkedIn, Mailchimp, and 1000+ tools via Zapier and API, and even with other CRMs like Salesforce and Hubspot that you might already be using.

Key features

Send captivating emails

Engage with wealth management teams, private equity firms, and any business by sending customized emails to provide information about news and funding events.

Strength scoring algorithm

Use the strength scoring algorithms so that your team can leverage the benefits of finding hot leads, interacting with prospective clients, and ensuring a higher possibility of scoring the best deals.

Fully customizable pipeline

Leverage the fully customizable pipeline to deal with multiple clients effectively and manage your workflow. You can further improve your sales flow by implementing the best practices to manage the sales pipeline like regular updates and close monitoring deals.

Track all the deals and progress made by deals to gain valuable insight that can help you alter your strategies in the future.

Data management and segmentation

Enter the generated leads automatically into the sales pipeline and segment them based on your existing criteria for each type of client to find the right investment opportunity for those groups. You can make the early stage of this process by automatically generating leads through a lead generation tool.

Automated reminders

Constant reminders are key in the investment banking sector so that you don’t need to lose touch with your clients or sponsors. Thereafter, you can maintain a healthy relationship & stay on your client's mind by using the automated reminders feature of 4 Degrees.

Customer rating on G2

⭐⭐⭐⭐.5

4.5 out of 5 (4 reviews).

Pricing

4 Degrees offers custom pricing based on your needs.

DealCloud

DealCloud offers a comprehensive CRM solution that is made for investment banking institutions. It is a perfect choice for you especially if you are looking to nurture and maintain meaningful customer relationships by leveraging client data and insights. So that you can close deals faster by managing the deal pipeline effectively while leveraging the benefits of customer engagement to increase sales.

Key features

Customizable pipelines

DealCloud helps you streamline your workflow by providing you with a customizable pipeline that you can use to manage and track your deals, clients, and sales progress.

Automatic contact management

DealCloud manages your contacts effectively by segmenting them and constantly updating the contact information after any change is made to their profile or any change is made in their investments.

Enhanced reporting

DealCloud has a comprehensive reporting page that compiles all the data collected through the pipeline, deal transactions, client interaction, and investments that you can use to optimize your deal flow or customize the pipeline to alter the deal cycle.

Easy integration

DealCloud easily integrates with Microsoft 365 to make adaptability easier.

Customer rating on G2

⭐⭐⭐⭐.6

4.6 out of 5 (8 reviews).

Pricing

DealCloud offers custom pricing based on your requirements.

Creatio

Creatio offers highly customizable no-code CRM software that can easily adapt to the investment banking sector and help you manage your customer relationships. Monitoring your internal and external operations to collect data for managing deals and client investments is made easier with Creatio. With Creatio no matter how your business works you can bend it to your needs to improve your customer experience.

Key features

Effective cross-team collaboration

With Creatio collaboration between the different departments of your organization like marketing, sales, and service is made easier which makes them work as one cohesive unit that drives success.

Creating and managing campaigns

With Creatio you can create multichannel marketing campaigns to boost your reach and automate lead generation. You can further optimize your campaigns with the data collected through CRM.

Pipeline management and analysis

It helps you analyze your pipeline stage by stage to find areas that can be optimized to boost productivity.

Personalization

Enhance your customer experience by personalizing the experience for the segmented audience. By customizing strategies based on the available data, you can boost customer experience and maintain rapport to increase sales.

Customer rating on G2

⭐⭐⭐⭐.6

4.6 out of 5 (240 reviews).

Pricing

Creatio offers 3 pricing plans.

- Growth for $25/user/month.

- Enterprise for $55/user/month.

- Unlimited for $85/user/month.

Oracle NetSuite CRM

This is a perfect match if you are looking for a CRM solution for the banking industry that is easy to install and has a user-friendly interface. Also, this CRM is straightforward and easily integrates with many tools. Overall it's a perfect fit for your investment banking company that is looking to elevate and maintain its customer relationships. Other than investment banks, it is also regarded as one of the best insurance CRM solutions in the market.

Key features

360-degree customer view

Oracle gives you a complete 360-degree view of your customers across all channels like their interested sectors, investment preferences, financial history, risk tolerance, and investment history. The purpose is to help you make better decisions that resonate with your customers.

Target segments

Build data-rich customer profiles based on your customers’ behavior and interactions that you have with them. Thereafter, segment your broad audience to provide a personalized experience and find the best investment opportunities for them.

Easy collaboration

Collaborate easily across your internal teams to maintain transparency while providing them with the current stand of your business that you need to work on.

Analytics and reporting

Gain valuable information through the analytics dashboard that you can use to make informed decisions regarding customer investment opportunities and alter strategies to stay updated with sales engagement trends.

Customer rating on G2

⭐⭐⭐⭐

4.0 out of 5 (2,855 reviews).

Pricing

Oracle Netsuite offers a custom pricing plan based on your needs.

Engagebay

Engagebay is an all-in-one CRM platform that lets you automate your marketing campaigns, optimize your workflow with a customizable pipeline, and report on deals. Its highly customizable deal management ability along with its inbuilt email template for lead generation make this a perfect choice for your investment banking endeavors. EngageBay is considered to be one of the best CRM alternatives to Attio. It is also known to be one of the best alternatives to Zoho software.

Key features

Workflow automation

Engagebay helps you automate your workflow and boost productivity by managing several tasks in a single stack, be it segmenting leads, interacting with them, or making a prompt follow-up.

360-degree customer view and management

Gain a holistic view of your customers to build a complete customer profile for them with relevant information like contact, demographics, financial history, investment preferences, and risk tolerance.

Email integration

Make the tedious process of switching between email inboxes a thing of the past by using Engagebay’s email integration. Now, you can send emails in bulk, promote your latest deals for investment, and manage your follow-ups while doing this all by maintaining a healthy customer relationship.

Deal management

Create and manage deals easily with a customizable visual sales pipeline while building a well-crafted sales engagement model. Use its free AI automation feature to close deals faster than ever while staying informed about all deals, and their progress that is present on your sales funnel.

Data security

With EngageBay, remain compliant with all the data regulations related to protecting your customers' sensitive data and building a shield against cyber security threats.

Appointment scheduling software

You can eliminate the possibility of being late for meetings with your customers by utilizing Engagebay's automated meeting scheduler. Also, you can send gentle reminders to your customers that you guys have never missed the purpose of fruitful communication.

Customer rating on G2

⭐⭐⭐⭐.6

4.6 out of 5 (212 reviews).

Pricing

EngagBay offers 4 different pricing plans for its CRM and sales bay.

- Free.

- Basic for $11.04/user/month.

- Growth for $42.49/user/month.

- Pro for $67.99/user/month.

CRMNEXT

CRMNEXT is a popular choice among investment bankers and credit unions. Thanks to its advanced ability to automate your workflow, manage your leads and deals, and maintain relationships with effective interactions.

It also has an in-depth analytics page that gives all the information you need to optimize. So that you can maintain workflow and change investment approaches for a customer based on the available data.

Features

AI day planner

Personalize the tasks assigned to your team based on customer interactions, customer profiles, and financial transactions with CRMNEXT AI/ML to boost the conversion rate and increase productivity.

Work prioritization

Use the AI/ML models of CRMNEXT to analyze and categorize the tasks assigned to your team based on urgency, importance, and relevancy. Also, you can measure progress to find the gaps in your teams’ productivity.

Customer 360

You can get a complete customer profile with all the necessary information like the transaction, purchasing pattern, income analysis, and investment on deals, to measure customer experience accordingly and increase customer satisfaction.

Conversion strikers

Now, you can utilize the AI-driven conversation striker card with CRMNEXT to get real-time insight into the conversion of your MQL into SQL. Also, you can get a visualized pattern for the converted profitable deals that you earn by winning sales engagement processes.

Playbooks

Use the collected data over time to easily create a customized playbook with all the common factors responsible for your business success. Your team can use this later for reference like what investments need to be made in different situations or what to say to a potential customer to win over a deal and deliver consistent performance to boost your revenue.

Target Assistance

With CRMNEXT, you can create tasks with predefined targets and quotas and track them to see progress in real-time to adjust the workflow or pace if needed to meet those targets.

Micro segmented campaigns

Define your target audience, craft personalized messages, or use a template to create and execute coordinated multichannel campaigns like WhatsApp marketing, Facebook marketing, google ads, and more.

Pricing

CRMNEXT offers a custom pricing plan based on your requirements.

LeadSquared

LeadSquared is an all-in-one CRM for investment banking that you can rely on. It helps you in every aspect like lead generation, automatic data entry of all clients, and investment-related information. Also, it helps you in tracking your leads’ activity across websites, messages, and emails to give an in-depth understanding of your customers.

Key features

Website and email tracking

Find and track the activities of your clients and prospective customers on platforms like your website, and emails, to keep your sharp eye on their intent. Further, to nail your sales engagement strategies, tailor your approach towards them or act quickly in converting the leads.

News alerts

Use LeadSquared’s advanced news alerts to be on top of all news related to your customers so that you can act upon it quickly and build meaningful relationships with them. For example, when you find out one of your customers won an award for filmmaking, quickly congratulate them to nurture the relationship.

Location intelligence

Track your teams' location in real-time to give them alerts through the mobile app about nearby prospective customers. So that your expert sales reps can quickly connect through in-person meetings with them and talk about the next big investment opportunity that is best for them.

360-degree customer view

Get a complete understanding of who your customers are based on their demographic, investment history, financial history, past financial transactions, investment preferences, and more.

Efficient data reports

No approach is perfect, so optimize your workflow, deal cycle, and more with the comprehensive data you gain through the analytics dashboard.

Customer rating on G2

⭐⭐⭐⭐.6

4.6 out of 5 (213 reviews).

Pricing

LeadSquared offers 3 pricing plans.

- Lite for ₹1250/user/month.

- Pro for ₹2500/user/month.

- Super for ₹5000/user/month.

Navatar

![]()

Navtar’s investment banking CRM is a perfect fit if you are looking for a CRM, where you can seamlessly put your intelligence for sales engagement. It helps you in every stage of the deal cycle from marketing to lead generation to closing the deal, and finally retaining those people as well. It does all this while building customer relationships, developing your business, and complying with banking industry regulations.

Key features

Relationship management

Navtar manages your customer relationships by helping you define relationships that are natural to your existing deal process. Further, it helps you maintain those relationships by providing a personalized experience to your customers that makes them feel noticed, and valued. Well, all these are vital for you to build the essential trust required in investment banking.

Business management

Create an effective outreach program easily by automating your marketing efforts to capture and nurture your relationship with prospective clients to win mandates.

Managing mandates

Track your interactions with customers, their buyer history from previous deals, and their investment portfolio to collect data to drive effective mandate execution essential to finding success in investments.

Client coverage

Have a complete understanding of your clients through Navatar to make better investment decisions on their beliefs and to give effective compelling pitches tailored to them that are highly likely to get a ‘yes’.

Staffing and resource allocation

Understand the flow of your deal cycle or your progress in the pipeline with Navatar CRM to manage the workload and make it efficient through effective reallocation of resources when necessary.

Performance overview

Understand your progress with your clients in terms of deals, sector success, returns on investment, and funds with Navatar’s detailed reporting. Use the data to easily compare internal performance with industry benchmarks to track growth and optimize workflow accordingly.

Customer rating on G2

⭐⭐⭐⭐

4.0 out of 5 (1 review).

Pricing

Navatar offers a custom pricing solution based on your requirements.

CRMs the perfect investment for investment banking

I understand that in the sphere of investment banking time is of great importance. Now I know these tools I have told you about might lead you to ask which one to choose.

Well, what’s there to think about? The amazing features that Zixflow has make it a no-brainer like Justin Beiber sang. With Zixflow you save time, boost productivity, increase profit, and just elevate to the next level in your investment banking business.

If you want to have these all in your single platter, just book a free demo with Zixflow and access it all in a single snap!