13 Best CRMs for Insurance Agents & Brokers for Sales & Client Management in 2026

Table of Contents

Think of it this way: You just started an auto insurance firm. For that, you're taking a list of cars that are bought at nearby shops. And trying to collect their details. After a few days, you have a thousand pieces of client data in your hand.

Let's imagine!

What are the things you can do with this data?

You can do things like build engagement with your clients by sending personalized messages about your insurance firm, or else you can ask them for a quick call regarding taking insurance for their newly bought cars.

More advantageously, you can use that information to achieve your sales goals, right? But before that, how are you going to manage all your tasks? Will you send messages one by one? Really? I hope you say no.

Even if you do, it will take you more time because you have a thousand pieces of information. Day by day, it will increase, and now the question is, where will you store information? How will you send bulk messages? How can you track your team’s performance?

There are plenty of unanswered questions.

To all these questions, one of the best answers is a CRM solution. With good CRM software, you can store all your client information in one central location, so you never worry about managing the client database.

Moreover, with CRM software, you can automate tasks like sending personalized messages to all your clients within a few clicks, and you can also regularly follow up with your clients by streamlining notifications about your policy updates or renewals.

These are the things that lead to increased sales engagement activities and help you achieve your sales success.

Now you have a better understanding of how CRM can help you be smart and efficient. Let’s discuss the top CRM options for the insurance industry out there in detail.

What are the challenges that an insurance CRM helps you overcome?

With a wide range of tasks to handle, it is crucial to have a reliable tool that can assist you in overcoming obstacles like high competition rate in insurance industries and difficulty while retaining customers. When CRM enters the chat, let's dive into detail about how CRM software can help you get rid of challenges.

Increased competition rate

Have you ever experienced the frustration of losing a potential client to a competitor within just a day of receiving their inquiry?

It may seem like a short amount of time to you, but the younger generation moves at lightning speed, and a delayed response can mean losing their business with you.

By using effective CRM for your insurance business, you can streamline tasks such as data entry, document processing, policy generation, and follow-up. By doing so, you can reduce the chances of delays and ensure a quick response from your clients and overcome objections from sales.

Moreover, CRM software helps you stay competitive in the insurance industries by providing you with valuable insights and analytics. By analyzing such data and trends, you can identify potential leads, target a specific demographic, and personalize marketing strategies.

More importantly, CRM software allows you to understand your client's needs and preferences better and enables you to offer tailored solutions and stay ahead of the competition.

Difficulty in retaining customers

Are you struggling to retain your customers?

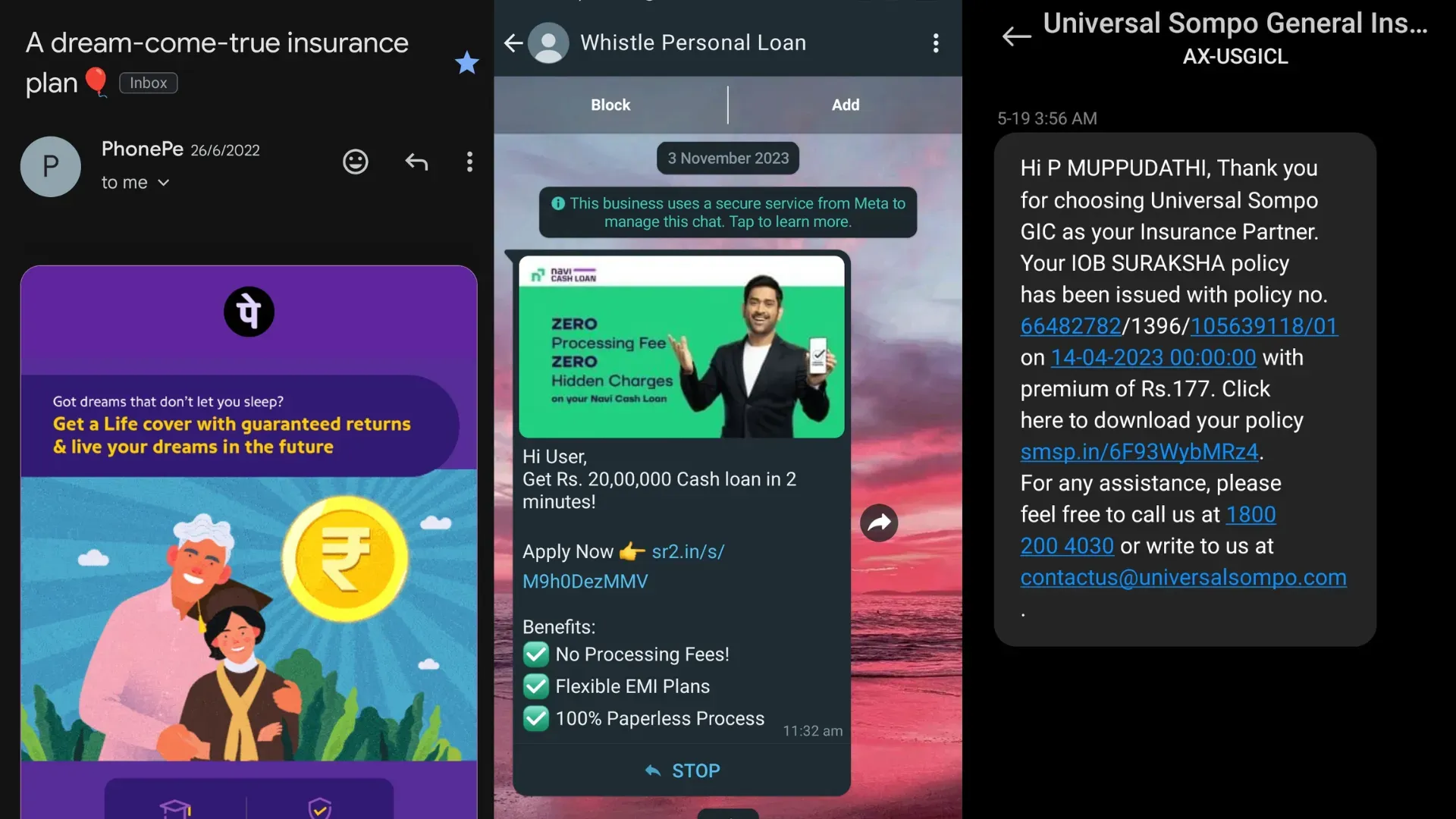

Look no further, because CRM can be the game changer you need! With CRM, you can get to know the preferences and needs of your customers. After that, you can send them regular campaigns or new policies through their preferred channels, through which you can retain your customers. Let's see an example to understand this concept better.

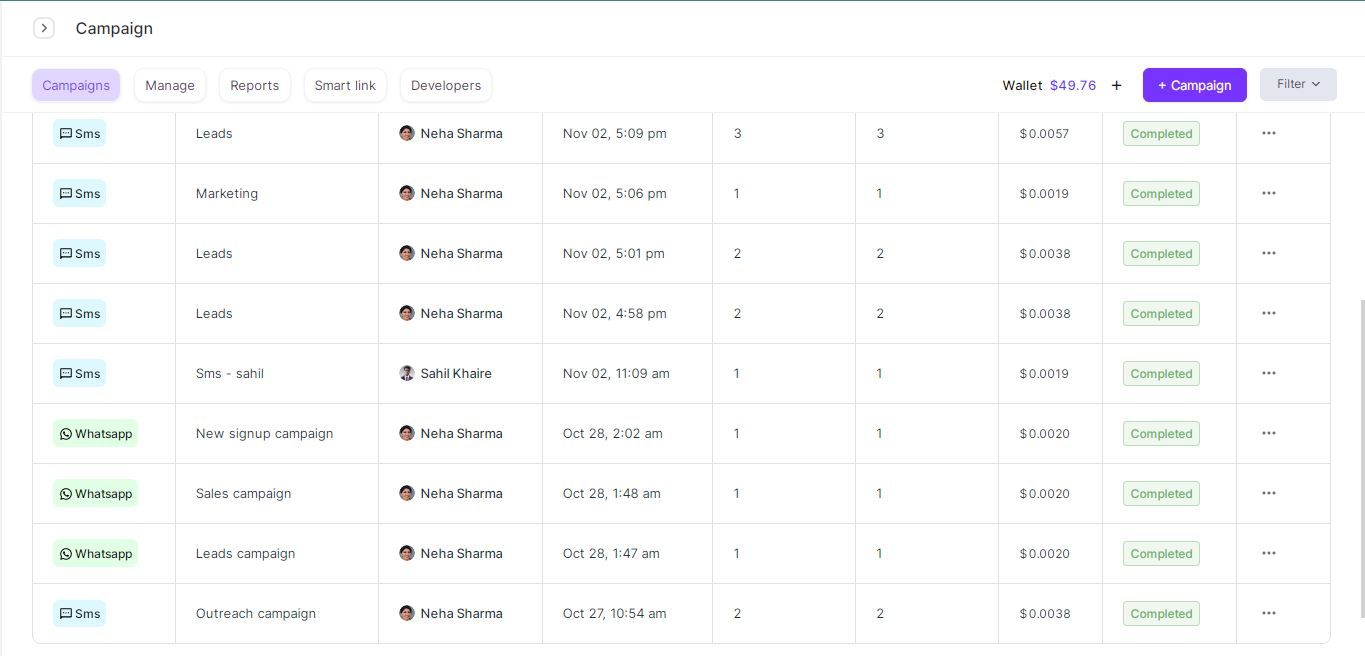

From the above picture you can witness how the brands are sending engaging messages to their customers via email, WhatsApp and SMS. You can use these sales engagement strategies in your business to improve customer experience and retain more customers.

A checklist for selecting the ideal CRM for insurance needs

Before investing in a CRM it's essential to take all the requirements of your team members into account and check whether the CRM you’ve got your eyes on is capable of fulfilling them or not. Let’s see what are the things you must consider when going for a CRM.

Customizable fields

Customizable CRM allows you to adapt the system to match your specific insurance workflows. You may have distinct stages in your sales process, such as lead generation, policy creation, underwriting, and claims management.

By customizing your CRM, you can create custom fields, stages, and workflows that reflect these specific steps, ensuring that the system aligns seamlessly with your existing processes.

Moreover, a customizable CRM enables you to personalize the interface to suit your preferences and working style. You can rearrange the layout, choose which information is displayed prominently, and customize the dashboard to provide quick access to the most relevant data.

This level of customization ensures that you can easily navigate the CRM and allows you to build an efficient sales team and access the information needed without unnecessary clutter or distractions, ultimately saving you time and improving efficiency.

Track activities

You need to keep tracking your activities to provide excellent customer service and manage your clients' insurance needs.

By monitoring and documenting every interaction, you can ensure accurate and up-to-date information is available when needed, allowing you to provide prompt and efficient service to your clients.

Moreover, keeping track of activities helps you identify patterns or trends, enabling you to make informed decisions and recommendations to your clients related to their policies and increasing the probability of the sales engagement process.

Maintain and update policies

You must regularly manage and update policies to ensure accurate and effective coverage. By reviewing policies, you can identify changes in clients' circumstances or needs and make necessary adjustments to the coverage. This proactive approach helps you provide suitable insurance solutions and ensure adequate protection for your clients.

Furthermore, policy management and updates help you stay informed about changes in regulations or industry standards, enabling you to provide up-to-date advice and guidance. Effective policy management is crucial for you to meet your client’s evolving needs and maintain a high level of service.

Fast and effective support

When selecting a CRM for your insurance business, it is crucial to seek prompt and efficient support. This is because a CRM system is a complex tool that requires proper implementation and maintenance. Just like having a well-thought-out insurance business plan is essential for guiding your overall strategy, choosing the right CRM system can ensure smooth operations and long-term success.

Without proper support, you may face issues such as data loss, system crashes, and poor performance. Quick and effective support can help you resolve these issues punctually, ensuring that your business operations run smoothly this leads to impress sales prospects.

Moreover, speedy support can help you maximize the benefits of your CRM system, such as improved customer engagement, increased sales, and enhanced productivity.

Affordable and scalable

It is highly important to prioritize the affordability and scalability of the CRM system when choosing. By selecting an affordable CRM system, you can effectively manage your budget and ensure that the cost of the system does not outweigh its benefits.

Moreover, opting for a scalable CRM system allows you to accommodate growing business needs and easily adapt to changes in the industry. Ensuring both affordability and scalability in your CRM system enables you to streamline your operations, enhance customer relationships, and ultimately drive your business growth.

Top 13 CRMs to drive sales in your insurance business

Let’s look at the ultimate insurance CRM software solutions that are taking the market by storm!

Zixflow

Zixflow CRM software provides a centralized, all-in-one platform for managing and storing all your policyholder information. With Zixflow, you can easily track customer interactions, follow up on policies, manage your sales pipeline, schedule meetings, and manage marketing campaigns, resulting in improved customer service and increased sales.

Key feature of Zixflow CRM

Let’s dive deep into Zixflow’s features and know the reason to choose Zixflow over any other CRM, and how it will help you manage your business in detail.

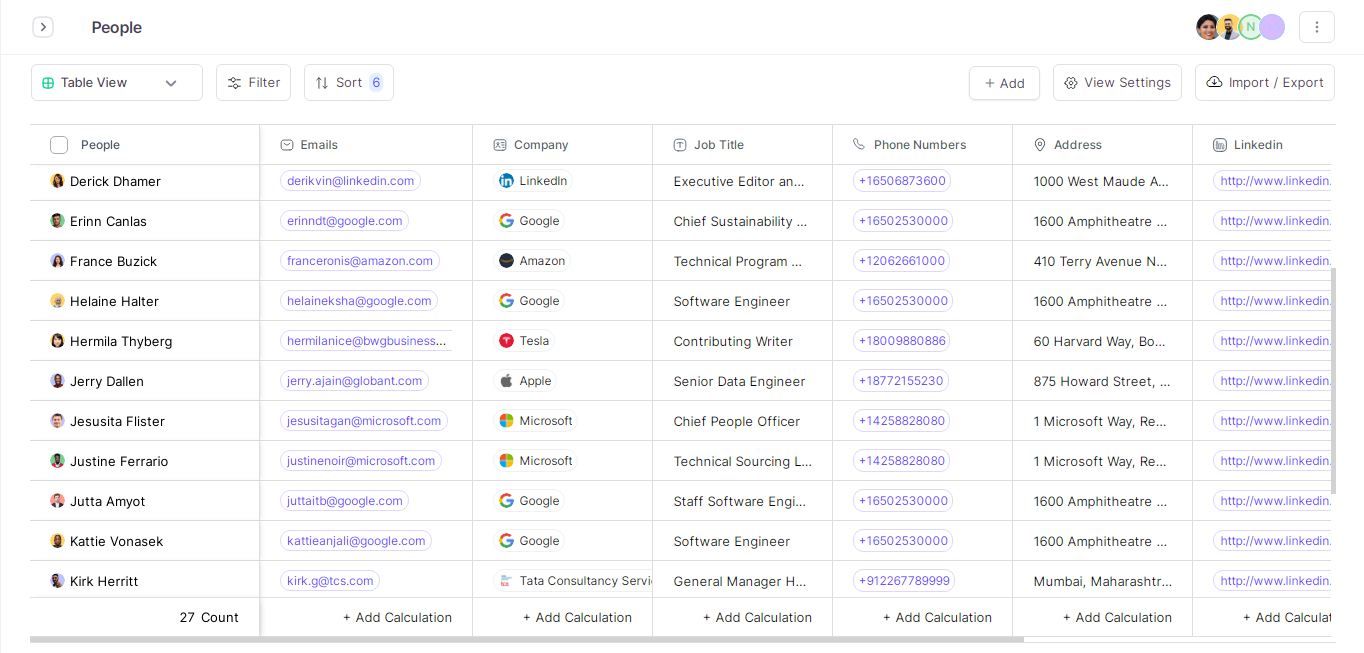

Manage client information

Zixflow provides a comprehensive contact management system that allows you to store and organize client information, including contact details, policy information, and communication history. More importantly, you can customize the fields of your business operations and needs. And also, you import and export the client database.

This single stack management system of Zixflow, not only frees you up from hovering around multiple tools in your crucial moment, but also you can concentrate on your insurance clients whom you need.

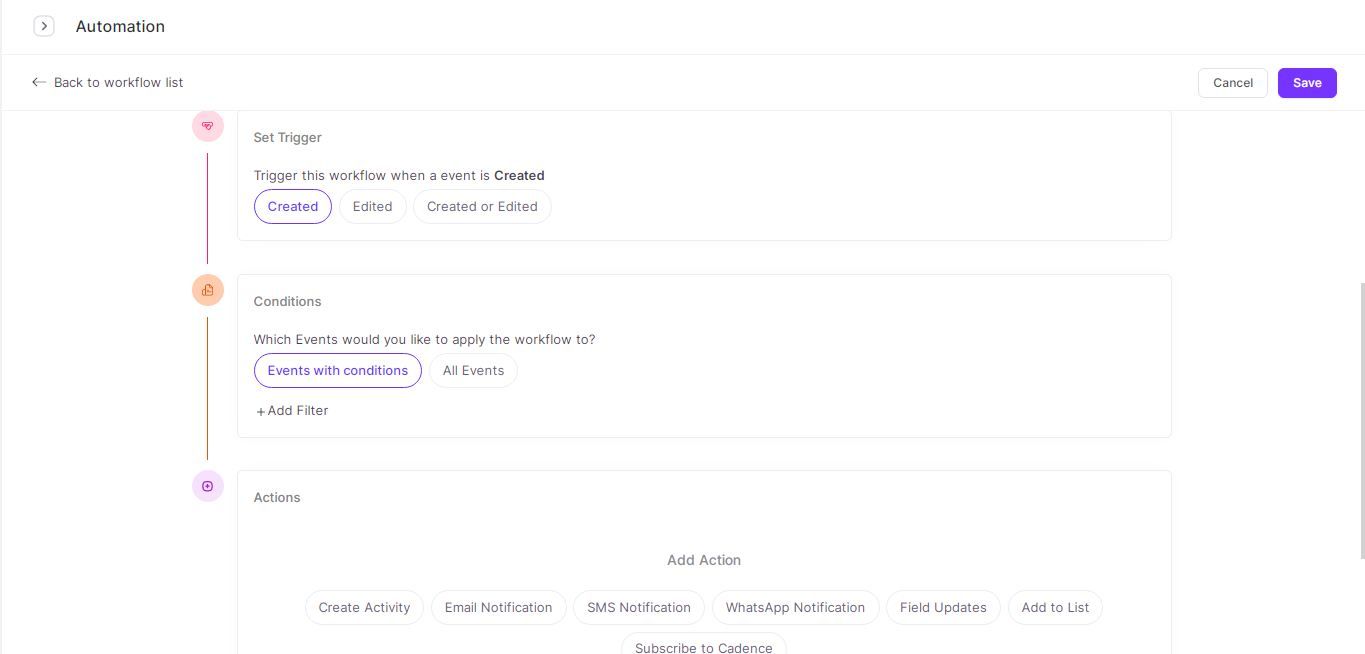

Automate tasks effortlessly

Zixflow CRM automates repetitive sales tasks, such as sending follow-up emails, creating activities, sending updates through SMS and uses. This helps you save time and focus on building relationships with your clients and improve your sales process. Moreover, you can easily follow up on renewals and close more deals effectively.

Provide standardized omnichannel support

Zixflow CRM offers various communication channels, such as email, SMS, and WhatsApp. This ensures that you can easily connect with or communicate with your clients through whichever channel they prefer. It increases the chances of buying a policy.

Get analytics of your campaigns performance

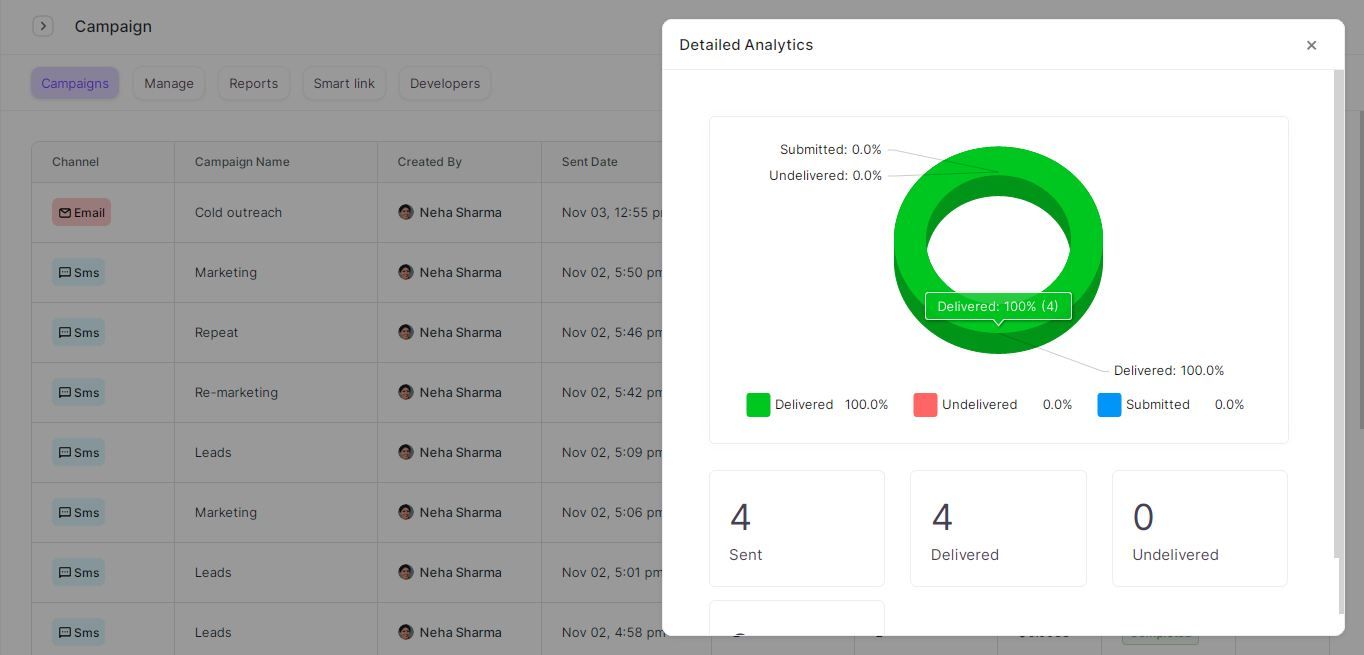

With Zixflow, you gain access to a wide range of comprehensive analytics presented through visually appealing charts, as shown in the picture above. These analytics provide you with valuable insights into the performance of your campaigns, enabling you to easily understand how well they are performing and identify areas that require improvement.

By leveraging the power of effective reporting and analytics offered by Zixflow, you can significantly enhance communication and productivity within your organization.

The detailed data and visual representations allow you to track key metrics, such as click-through rates, conversion rates, and engagement levels, providing you with a clear understanding of the effectiveness of your marketing efforts and helps in simplifying your sales process.

Customization and Scalability

The highly beneficial feature of Zixflow CRM is customization; it will meet your specific needs. It is also scalable, allowing you to add more clients and features as your business grows.

Moreover, you can edit your client's insurance policy and renewal details as per your business needs. Zixflow is an ideal CRM software for you to streamline your daily tasks, improve efficiency, and enhance customer relationships, ultimately helping you grow your business and achieve success.

Zixflow CRM pricing

Zixflow software offers pricing plans that are not only budget-friendly but also incredibly convenient for you. The XCRM module has three paid options:

- Starter - $59/month with 3 users included, billed annually.

- Growth - $129/month with 3 users included, billed annually.

- Enterprise - $249/month with 3 users included, billed annually.

Also, if you want to make use of the marketing capabilities of Zixflow along with the XCRM, you can go for the One, which is a combined package of XCRM and marketing. The starting plan for One costs $79/month and comes with 3 users by default.

Ratings and reviews

⭐⭐⭐⭐.8

4.8 out of 5 (11 reviews) by G2.

⭐⭐⭐⭐.7

4.7 out of 5 (80 reviews) by Capterra.

Zoho CRM

Zoho CRM is a cloud-based solution, which means you can access your data from anywhere, at any time, using any device with an internet connection.

With Zoho CRM you can organize prospects, track opportunities, and automate activities, allowing you to focus more on addressing your customers' needs.

It helps you to manage your clients' information, policies, claims, and other related data in one place. With Zoho CRM, you can easily track your sales, monitor your team's performance, and automate your workflows. Zoho is also renowned for being a good Freshsales alternative. If you’re looking to choose between the two, then you can check out our blog on detailed comparison between Zoho CRM vs Freshsales CRM for making the informed decision. Don’t forget to check some best Zoho alternatives for making a comparison between the features and choosing the best software.

Key features of Zoho CRM

User-friendly interface

Zoho CRM has an easy-to-use dashboard and gives your clients policy and information all in one place.

Automation

It has an AI-based sales assistant that helps you stay on top of your tasks by automating your leads and sales process.

Omnichannel support

It helps you engage with your customers across multiple channels, including social media, live chat, email, and phone.

Seamless integration

It helps you build your integrations with the Zoho Suite and REST APIs.

Mobile app

It grants access to manage your policy information remotely or from anywhere by using the mobile app for enhancing sales engagement.

Zoho pricing

- Standard - Rs.800/user/month billed annually.

- Professional - Rs1.400 /user/month billed annually.

- Enterprise - Rs.2400 /user/month billed annually.

- Ultimate - Rs.2600 /user/month billed annually.

Ratings & reviews

⭐⭐⭐⭐

4 out of 5 (2501 reviews) by G2.

⭐⭐⭐⭐.3

4.3 out of 5 (6578 reviews) by Capterra.

Radiusbob

Radiusbob is a platform that provides sales and marketing automation, allowing you to prioritize important tasks. Radiusbob has a user-friendly interface, making it easy to navigate.

It enables you to efficiently handle your prospects and lead conversion strategies, streamline your sales and marketing procedures, and even make calls directly from the CRM using integrated VoIP.

Key features of Radiusbob

Sales and marketing automation

It helps you automate your sales and marketing process effectively.

Integrated VoIP

It is integrated with VoIP and provides click-to-call, auto preview dialer, call recording, call queue lists, IVR & group calls.

Customization

It grants you to customize fields of your needs or requirements.

Radiusbob Pricing

- Agent (Basic) - $43 per month.

- CSR (Basic) - $86 per month.

- Broker (Basic) - $190per month.

- Agency (Basic) - $380per month.

Ratings & reviews

⭐⭐⭐⭐⭐

5 out of 5 (1 review) by G2.

⭐⭐⭐.7

3.7 out of 5 (1 reviews) by Trustpilot.

Freshworks

Freshworks CRM can enhance your productivity and assist in creating a relationship-oriented business. By automating and simplifying tasks like paperwork and scheduling meetings.

Freshworks allows you to allocate more time towards meaningful interactions with your clients. It integrates with Slack, Gong, G Suite, Xero, Outlook, and other apps to provide excellent customer support.

With Freshworks you can easily send personalized SMS in bulk or to individuals and receive responses via Twilio, Zipwhip, and ClickSend. Additionally, Freshworks provides a "Free Forever" plan with unlimited user capacity.

Key features of Freshworks

Track progress

It allows you to track your leads and sales process.

Customization

Freshworks grants you to modify CRM fields of your needs or requirements.

Mobile

You can easily run your sales from mobile and Freshwork mobile apps given access to manage call logs, voice notes, SMS, and Zoom meetings.

Channel

You can connect with your clients through multiple channels via emails, chat campaigns, phone, messenger, SMS integration, and Zoom.

Freshworks pricing

- Free - 0 for up to 3 users.

- Growth - $9/user/month, billed annually.

- Pro - $39/user/month, billed annually.

- Enterprise - $59/user/month, billed annually.

Ratings & reviews

⭐⭐⭐⭐.5

4.5 out of 5 (7546 reviews) by G2.

⭐⭐⭐⭐.5

4.5 out of 5 (601 reviews) by Capterra.

Insureio

Insureio empowers you to efficiently manage your leads, nurture relationships, and close deals effectively.

One of the key benefits of Insureio is its ability to provide access to quotes from over 40 leading carriers for various insurance products, including life, disability, and annuities.

This feature enables you to quickly and easily compare rates and coverage options, ensuring that you can offer your clients the best possible solutions tailored to their specific needs.

Key feature of Insureio

Lead management

It manages your leads and helps you close more deals effectively.

Contact management

It will organize and maintain all your client’s information in one place.

Email marketing and personalization

You can easily generate email templates of your needs or preferences, so that you can easily access different types of emails to build sales engagement.

Quote generator

It grants or generates 40 quotes in various departments.

Insureio pricing

- Basic - $25 billed monthly.

- Marketing - $50 billed monthly.

- Agency management - $50 billed monthly.

- Marketing and agency management - $75 billed monthly.

Rating & reviews

⭐⭐⭐⭐.3

4.3 out of 5 (89 reviews) by Findmycrm.

Applied Epic

Applied Epic provides a comprehensive view of client information, policy details, and claims history, allowing you to easily access and manage all relevant data.

This holistic approach enables you to provide personalized and tailored services to your clients, ultimately improving customer satisfaction and retention.

In addition to managing property and casualty benefits, Applied Epic software also offers a range of other functionalities. These include customer relationship management (CRM) tools, document management, accounting and financial reporting, and marketing automation.

By integrating these features into one platform, you can streamline your workflows and eliminate the need for multiple software solutions.

Key features of Applied Epic

Policy management

It makes back-office administration easy with real-time access to policy information at each stage of the policy lifecycle, so you can provide fast and personalized service.

Process management

Applied Epic grants you to track and manage your policy stages and allows you to automate lead and sales processes.

Report and analytics

It gives graphical insights and reports of your work progress.

Applied Epic pricing

You need to connect their vendor or sales team to discuss the pricing structure.

Rating & reviews

⭐⭐⭐⭐.4

4.4 out of 5 (746 reviews) by G2.

⭐⭐⭐⭐.2

4.2 out of 5 (134 reviews) by Capterra.

Pipedrive

With Pipedrive, a tool specially designed for managing sales pipeline, you can easily track and manage your leads, contacts, and deals in a centralized platform, allowing you to stay organized and focused on your sales activities.

It provides a clear overview of the sales pipeline stages, enabling you to prioritize your tasks and allocate your resources effectively. Pipedrive also supplies comprehensive reporting and analytics tools, allowing you to gain valuable insights of your sales performance.

You can track key metrics, such as conversion rates and deal values, to identify areas for improvement and make data-driven decisions. This data-driven approach enables you to optimize your sales engagement strategies and maximize your revenue potential.

Key features of Pipedrive

Easy-to-dashboard

Pipedrive has an initiative and smooth-to-use interface that allows you to quickly learn and access its features.

Customizable pipeline

It allows you to customize or redesign the pipeline of your requirements.

Workflow automation

It has a workflow automation feature that allows you to streamline your tasks.

Integration

It integrates or syncs with other apps to provide excellent customer satisfaction via Gmail, Zapier, Slack, Trello, Intercom and Microsoft Teams.

Pipedrive pricing

- Essential - $9.90/user/month, billed annually.

- Advance - 19.90/user/month, billed annually.

- Professional - $39.90/user/month, billed annually.

- Power - $49.90/user/month, billed annually.

- Enterprise - $59.90/user/month, billed annually.

Rating & reviews

⭐⭐⭐⭐.2

4.2 out of 5 (1696 reviews) by G2.

⭐⭐⭐⭐.6

4.6 out of 5 (2917 reviews) by Capterra.

Insly

With Insly, you can easily view active offers, claims, and installment schedules, and manage insurance policies. It provides a centralized location for all client information, making it easy to access and manage.

This allows you to quickly respond to your client's inquiries and provide them with the information they need. Insly also offers a range of features that help you manage your business more efficiently.

For example, the platform provides automated workflows that help you manage tasks and ensure that nothing falls through the cracks.

It also offers reporting and analytics tools that provide insights into business performance, allowing brokers to make data-driven decisions.

Key features of Insly

Contact management

It helps you stay organized by maintaining your client information.

Document storage

Insly allows you to store all your policy related documents in one place.

Track claims

You can easily track or follow up with your clients about the claim progress.

Insly pricing

To know the Insly’s pricing details, you need to contact their sales team or vendor.

Rating & reviews

⭐⭐⭐⭐.5

4.5 out of 5 (1 review) by G2.

⭐⭐⭐⭐.9

4.9 out of 5 (6578 reviews) by Capterra.

Salesmate

Salesmate is a powerful CRM that offers a wide range of features to help you streamline your sales process and improve customer experience.

With Salesmate, you can easily manage all your client information in one place, including contact details, policy information, and communication history. This makes it easy to stay organized and keep track of all your clients, no matter how many you have.

In addition to client management, Salesmate also offers strong deal management features. It shows everything about your deals, including the stage they're in, the amount, and the probability of closing. This helps you prioritize your sales efforts while engaging customers to increase sales and focus on the deals that are most likely to close. Salesmate is also a great alternative to the Pipedrive platform. For exploring the key differences between these platforms in detail, we suggest you check out our blog on Salesmate vs Pipedrive.

Key features of Salesmate

Marketing automation

It also offers marketing automation features, such as email campaigns and leads scoring.

Customization

Salesmate offers a high level of customization. You can customize the CRM to fit your specific needs, whether that’s adding custom fields or creating custom reports.

Text messaging

It allows you to connect with your clients through text messages.

Workflow automation

You can create custom workflows to automate repetitive tasks, send follow-up emails or schedule appointments.

Salesmate pricing

- Starter - $23 /user/month, billed annually.

- Pro - $39 /user/month, billed annually.

- Business - $63 /user/month, billed annually.

- Enterprise - Connect with Salesmate’s sales team for enterprise pricing.

Rating & reviews

⭐⭐⭐⭐.6

4.6 out of 5 (73 reviews) by G2.

⭐⭐⭐⭐.7

4.7 out of 5 (88 reviews) by Capterra.

Oracle

With Oracle's customer experience solutions, you can easily design and implement tailored experiences for your policyholders. This includes personalized communication, targeted marketing campaigns, and self-service options, all aimed at improving customer satisfaction and loyalty. This experience has the potential to turn your prospects into leads, so you can boost revenue with different types of sales leads.

Furthermore, Oracle's platform enables you to efficiently handle billing and policy management. The system automates the entire billing process, from generating invoices to processing payments, reducing manual errors and improving efficiency.

You can also easily manage policies, including policy issuance, endorsements, renewals, and cancellations, all within the same platform. This centralized approach simplifies policy administration and ensures accurate and timely updates.

Key features of Oracle

Reporting and analytics

It provides stats and reports of your entire work progress and helps you stay up-to-date.

Pipeline management

It manages pipeline leads effectively and helps close more deals quickly.

Automation

It automates tasks and reduces operational costs.

Oracle pricing

You need to contact their sales team or vendor for a pricing module.

Rating & reviews

⭐⭐⭐

3 out of 5 (1 reviews) by Capterra.

AgencyBloc

AgencyBloc is a user-friendly CRM that allows you to manage your clients and prospects from one platform. It manages insurance policies by supporting the creation of quotes, issuing policies, and handling renewals.

It simplifies your sales process with its powerful features, provides email marketing campaigns to integrate with your clients and helps you increase sales engagement activities.

Key features of AgencyBloc

Activity tracking

It helps you increase the chances of closing client deals by regularly tracking your activities and giving suggestions to improve.

Contact management

It manages the contact information of your clients or policyholders.

Actionable reports

AgencyBloc provides you with statistical reports and analysis of your entire sales to take further actions to improve the sales process.

AgencyBloc pricing

AgencyBloc plans are customized to your agency's unique needs and basic plans start at $75/month.

Rating & reviews

⭐⭐⭐⭐.7

4.7 out of 5 (38 reviews) by G2.

⭐⭐⭐⭐.8

4.8 out of 5 (121 reviews) by Capterra.

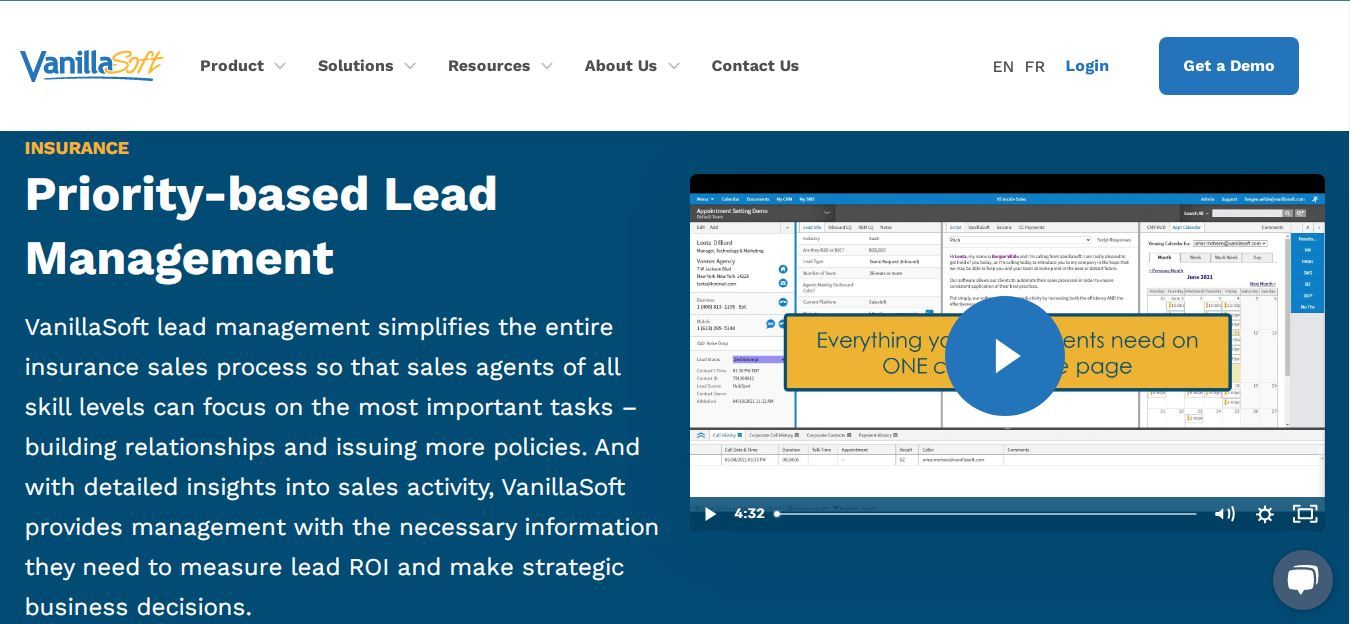

VanillaSoft

VanillaSoft CRM is a useful tool for you to manage your customer relationships more efficiently by providing a centralized platform to store and access customer information.

With VanillaSoft CRM, you can easily track customer interactions, follow up on leads, and manage your sales pipeline. This ultimately leads to better customer service and increased sales.

It allows you to create and manage customer profiles, including important details such as contact information, policy history, and preferences. This enables you to have a comprehensive view of each client, allowing you to provide personalized and targeted customer service.

Key features of VanillaSoft

Manage leads

It sets reminders and automates follow-up tasks, ensuring you nurture leads and convert them into sales.

Custom reporting dashboard

It allows you to customize reporting dashboards of your preferences or requirements.

Lead prioritization

You easily set up and follow up any leads of your needs.

Contact management

It manages and organizes all your client information in one place.

VanillaSoft pricing

VanillaSoft user price starts as low as $99 per month. Contact the sales team for more pricing information.

Rating & reviews

⭐⭐⭐⭐.6

4.6 out of 5 (476 reviews) by G2.

⭐⭐⭐⭐.6

4.6 out of 5 (153 reviews) by Capterra.

Salesforce

Salesforce allows you to store customer and prospect contact details, identify sales opportunities, track service problems, and handle marketing campaigns such as WhatsApp marketing, SMS marketing, and email marketing, all in a single place.

Moreover, it enables easy access to information about every customer interaction for anyone in your company who requires it. You can utilize Salesforce to automate and simplify your payment procedures, including enhancing payment security and making payments.

Its payment automation feature enables the processing of all claims accurately and efficiently, resulting in a quicker and more straightforward process.

Key features of Salesforce

Contact management

You can manage all your contacts and client databases effortlessly.

Analytics and insights

It gives you excellent analysis and stats of your sales process.

Automation

It has workflow automation capabilities that allow you to streamline your tasks effectively.

User interface

Salesforce is known for its easy-to-use interface. It is extremely easy to access.

Salesforce pricing

Salesforce has four different sales cloud pricing plan sections that are listed below:

- Starter - $25/user/month, billed annually.

- Professional - $80/user/month, billed annually.

- Enterprise - $165/user/month, billed annually.

- Unlimited - $330/user/month, billed annually.

Rating & reviews

⭐⭐⭐⭐.3

4.3 out of 5 (18,388 reviews) by G2.

⭐⭐⭐⭐.4

4.4 out of 5 (296 reviews) by Capterra.

Use a top-notch CRM solution to stay ahead in insurance industry

There you have the treasure trove of 13 best CRMs for your insurance business that can effortlessly manage your clients’ database, enhance multi-channel presence, assess your productivity, and provide you with a detailed outlook.

If you sum up the benefits of it then you find that your clients’ become more happy as you engage them well and respond promptly whenever they need. Also, in your insurance business whatever amount you invested matches your expected ROI.

However, the more you want to leverage benefits with CRM, the more you should become vigilant especially when it comes to choosing one of the best CRM amongst them. Well, needless to say, Zixflow could be your top choice.

Zixflow’s AI wizard CRM solution is unbeatable. It enables you to run marketing and sales campaigns with its campaign builder while utilizing captivating templates, capture leads, and immediately engage them while grabbing attention through forms, automate and list daily activities to eliminate your headache, and so on.

If you want to get more and see how it drives results for you, feel free to book a free demo with Zixflow and further try its offers while paying as you use it.

Bulbul Gupta