13 Advantages of CRM in Banking Sector That Explain the Importance of CRM for Bank

When was the last time you went to a bank to check your passbook? I believe it was a long time ago.

In the 21st century, everything is getting digitized; we handle most of our transactions through mobile apps or bank websites. Well, it's not about now and then, rather it's more about your customers' expectations with your financial products or services. Your customers will always be the same whether it's the 21st century or beyond that.

Thus as a banking sector, it's an ongoing requirement to evolve and meet your customers' needs effectively. This is where Customer Relationship Management (CRM) software comes into play, serving as a key tool to help banks provide exceptional service and maintain the best relationships with their clients.

Now, let's talk about your sales executives in banks. How will they successfully maintain a well-managed relationship with your customers?

Again the answer will be the same, it's CRM. Because there are no rooms left where you can overlook the importance of CRM for your sales reps. With the integrated CRM, your sales pro can step forward into nurturing leads and qualify them into your sales quota within their fingertips.

Well, there's more and you need to dive into this article where you will gain a deeper understanding of what is the importance of a CRM in your banking services and how the advantages will altogether turn your business game in the banking sector.

What is CRM software & why is it important for banks?

Are you juggling with your data? If yes, then you need to implement CRM software so that all your data is well organized.

CRM, which stands for Customer Relationship Management, is a digital integration tool for businesses. It's a set of smart computer programs that help you manage, track, and store your company’s information about current and potential customers.

Imagine it as a neat and organized filing system for customer data. When all this data is stored in a centralized system, it helps you and your business team quickly get the information they need whenever they need it through this CRM tool.

Understand why CRM is important in the Banking sector

How long does it take to store data and analyze it manually? Probably more time than you think, it is just a time-consuming process.

But if you are using CRM software, it helps you to save time as it automates each task and also organizes those to provide you with a hassle-free experience. When you don't integrate a CRM tool in your banks, you might miss out on opportunities to grow your bank and also may lower customer satisfaction. This is because you won't be using efficient processes for building strong relationships with your customers.

You'll miss out on getting things done well and on time if you do not implement the CRM tool. Therefore, It is important to use CRM software for your business growth.

Now, I have a question for you: Do you know how effective is CRM in the banking sector?

Well, let me tell you, the effectiveness of integrating a CRM system into your banking business becomes crystal clear when you look at the numbers.

Consider these statistics:

- 47% of professionals using CRMs report higher levels of customer retention.

- 39% have witnessed improvements in upselling and cross-selling.

- 45% of companies saw increased sales revenue thanks to CRM.

What's even more impressive is that 7% of CRM users in the banking sector have seen significant return on investment (ROI) enhancements in just six months or less. These figures highlight the substantial impact that CRM can have on a bank's overall performance and success.

Challenges faced by the banking sector

Before delving into the advantages of CRM, it's essential to understand the challenges faced by the banking sector:

Increased competition

Your banks are dealing with intense competition not only from traditional banks but also from emerging fintech (financial technology) companies Like Paytm, Phonepe, and many more. Fintech firms often leverage advanced technology and innovative approaches to offer financial services that can compete with or even surpass traditional banks.

Regulatory compliance

As you know, the banking industry is highly regulated to ensure financial stability and protect consumers' data, so it needs to maintain various protection laws such as the Anti-Money Laundering (AML) Act, The Payment and Settlement Act, and so on.

Although your bank must comply with every updated law, it becomes very challenging as it is a time-consuming process. Moreover, your bank must regularly report its financial data to regulatory authorities to maintain transparency.

However, your failure to adhere to regulatory compliances and missing out on sending reports in a timely manner can cause you a burden of monetary penalties, which will turn into revenue losses as well as damage to your banking reputation. That’s why conducting CRM audits on a regular basis becomes crucial.

Data security

With the increasing frequency of cyberattacks, it is important to protect sensitive customer data. This must be counted as the top priority for your banks. A data breach can lead to financial losses and severe damage to a bank's reputation.

If a cybercriminal gains access to customer account information due to an issue in the security system, it can lead to unauthorized transactions and a loss of customer trust. Such incidents can be costly to resolve and may result in customers switching to more secure banks.

That’s why security is a major issue to take care of for all businesses dealing in money and finances. For example, companies doing crypto marketing attract people to invest money in cryptocurrencies, making it a sensitive matter of finances and investment. That’s why to retain their customers, all crypto platforms must implement security protocols as well to safeguard against potential breaches so that the customer doesn't switch to other virtual currencies on ground of security concerns. Without security in place it just can’t work. Holds true for banking and all other financial institutions.

Changing customer expectations

Customers today expect personalized and seamless banking experiences across various channels, including mobile apps, online banking, and in-person interactions. Your banks must adapt to meet these evolving customer demands to build a worthy relationship for selling purposes.

A customer who is shopping online now for personalized products and services is also expecting their bank to offer similarly personalized financial advice and tailored banking experiences.

Operational efficiency

The banking sector has to fulfill multiple tasks at a time from administration to marketing to sales, so your banks must enhance operational efficiency to beat the time while reducing the cost. This may involve pipelining your internal processes, optimizing resource allocation, and adopting technologies that drive efficiency.

To overcome all the aforementioned challenges in a single snap, you must require a strategic approach with advanced technology, such as CRM (customer relationship management) software in your whole banking business journey.

13 Advantages of CRM in the banking sector

Here are some of the key benefits of implementing CRM software in the banking sector.

Get a 360-degree view of every customer

Having a complete view of your customers’ journeys can give you a deeper understanding of their buyer persona, which allows you to tailor your banking services to perfection while meeting their specific needs effortlessly.

How do you get this comprehensive overview? Well, that's where a banking CRM system comes into play.

You see, a banking CRM isn't just a stand-alone tool; it's your ultimate connection and collaboration of various banking software applications. When they all come together, they create a unified system that provides a single, clear view of all your customer accounts.

Every action your customers take, whether it's using an online payment, inquiring about a loan, or any other interaction, can be neatly recorded in the CRM.

This important data allows your bank to dive deep into your customers' habits and preferences. Based on these insights, you can modify your personalized pitches to offer your customers financial products such as loans, FDs, credit cards, etc. to match their finance intent. By doing so, the credibility of your customer-centric selling will enhance your banking growth than ever before.

Make a personalized customer journey

How many bank accounts do you have? Umm, it may be only one or more than that.

Well, that’s not the concern, rather this question is a gentle try to place you once in your customers’ shoes.

Why? Your customers may have plenty of private banks to choose from, instead of relying on just one bank, customers often hop between several.

So, how can your bank set itself apart in this crowded field? The answer is simple. By delivering a personalized customer experience that stands out!

Now, to do this, banking CRM software takes center stage. A trusted CRM tool for accountants that ensures there are no gaps in your customer's journey. From the very moment, your prospects open an account, throughout every transaction, and even when they apply for loans, the CRM's got it all covered.

Moreover, this AI-driven CRM software helps you use better customer engagement in increasing sales and also meets your bank's financial needs with speed and precision.

Segment customer demographics

Imagine if your bank could customize its services just for you. Well, that's the goal! You are aiming for a customer-focused business model that's tailored to meet your customers’ needs perfectly. And the tool that makes this possible is a banking CRM.

Banking CRM software sorts customers into categories based on all sorts of factors, like gender, where they live, how old they are, how much they earn, their credit history, and much more. But it doesn't stop there! It even helps classify customers based on their investment preferences, how much they may be willing to invest, and how long they've been part of the bank family.

Now, why is all this sorting and classifying important? Well, once your bank knows all these details, it can tailor its services to suit your customers’ unique needs. For example, as an investment banker, an investment banking CRM will help you analyze your customers' needs and preferences to make informed investment decisions. This way, the bank can reach out to your loyal customers in just the right way and build a strong and lasting business relationship.

Boost in loan sales

Does your customer need a loan? No problem!

The CRM knows just the types of customers you are dealing with and even their needs. And it doesn't stop there; it's simply digging up your customer's previous interactions with the bank to figure out their behavioral patterns.

This helps your expert sales team modify sales conversations and encounter loan selling strategies in a way that your consumers feel valued. All-in-all every bit of data is in the hands of CRM software only to make your sales process successful.

But wait, there's more! It also helps with everything from managing opportunities to generating reports, keeping track of leads, and more. Meanwhile, a CRM designed for loan officers can streamline the loan approval process while reducing paperwork and speeding up procedures. Whether it is banking online, in-branch, or on a mobile app, your integrated CRM ensures that your bank offers the best experience and provide a streamlined loan origination process across all channels.

It's all about making sure your customers experience the seamless journey that they expect throughout the sales process & as a sales pro, you just need efficient CRM software to do so.

Excel in customer retention rate

Let’s suppose that with the increase of higher interest rates in loans or lower interest rates in savings, some of your customers move forward with your competitors. But let me tell you, you can retain those lost customers and start counting on them again with exclusive deals.

Remember, it’s not always necessary to have a great product, it’s also about overcoming objections in sales and maintaining rapport while enhancing customer engagement. By doing so, you can experience an uplifted graph in your sales customer retention rate.

Now, how can a CRM tool make this happen?

With your CRM system, you can pull up your lost clients’ service history, likely what they bought, or when and why they gave up on you, in just no time. This means your bankers can dive right into the problem and fix it quickly.

By providing them with exact solutions, you make your customers happy without putting them on hold. And when you make your customers happy, they're more likely to stick around your banking business.

That's what we call customer loyalty and satisfaction. Happy customer! Happy You!

Enhance customer service with reports and analytics

A real-time banking CRM system is trustworthy for you as a bank representative. It has all the recording of customer information and making follow-ups.

Why? You can analyze data to understand customers' persona, find gaps between your performance and your customer's satisfaction, identify banking trends, measure campaigns' effectiveness, and build crucial analytical reports to improvise strategies.

Plus, it's like a map that shows you which financial products are most capable of attracting your customers and generating more revenues. This way, you can keep an eye on what's working successfully and what needs a little boost, which will help you make informed decisions.

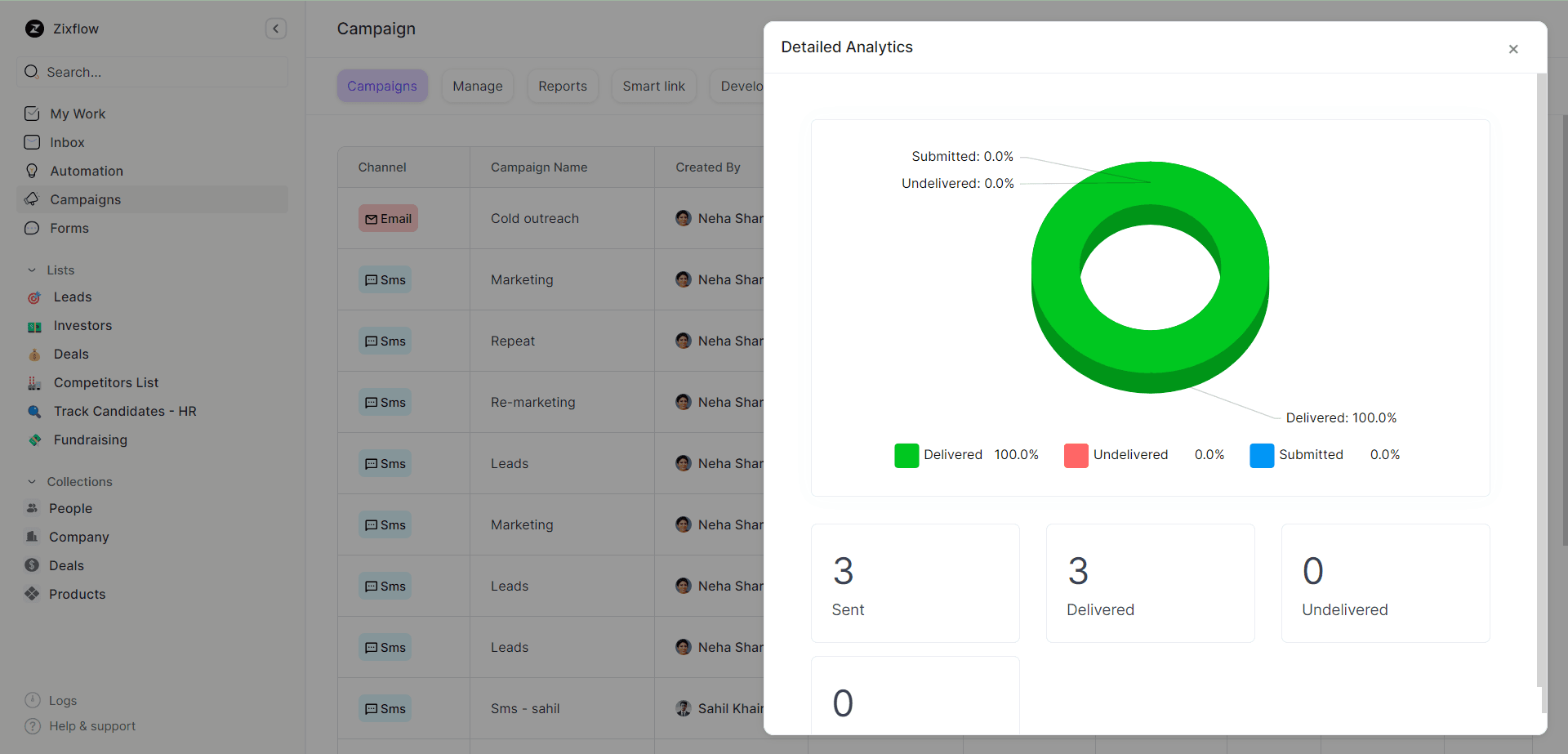

For example, you want to know what your customers' current intent is. Whether they want to go with your banking products and services or they simply want to opt out because of financial intricacies, you can get a detailed view with Zixflow’s advanced analytics to find any reasons. Also, Zixflow enables you to leverage benefits from analytical details of your marketing and sales campaigns and your teams’ efficiency behind them.

With online banking right at your prospective clients’ fingertips, you can give them a personalized experience. Moreover, with the help of the CRM solution, it is possible to manage customer interactions through WhatsApp, calls, email, social media, and mobile apps.

All these make sure that your customers have a delightful experience whenever they choose to connect with your bank. It's all about offering top-notch service!

Get real-time Updates

The CRM tool offers real-time data, which helps bank employees stay informed. By empowering your bank to make well-informed decisions for their next moves. This is how your bank can create smart strategies that lead to increased customer satisfaction!

And why is this so important? Because it's what sets you apart from all those other banks out there. This is how you swooped in to save the day for your customers. And when you do that, you're not just winning customers; you're winning their loyalty!

Let's suppose, your banking system is working slowly because of internal technical glitches and your customers are in a hurry to make a quick online transaction. How do you inform them about real-time intricacies, particularly at that moment?

In another case, suppose your customers want to proceed with a payment transaction and they need an OTP to verify their authenticity. How do you provide them with an OTP within a few seconds to make it successful?

In both cases, the answer is CRM. Reaching out to your audience at the right moment with real-time updates can save your consumers from frustration, annoyance, fraudulent activities, and so on. And when you do that, you're not just winning customers; you're winning their loyalty!

Improve cross-department collaborations

A CRM is a centralized panel where you can find all the data in one place making your life simpler. With this tool, all bank departments are in sync, so customers don't have to bounce from one department to another as it's all in one place.

CRM can create a digital experience that feels just like a face-to-face meeting. It's all about meeting those customer expectations.

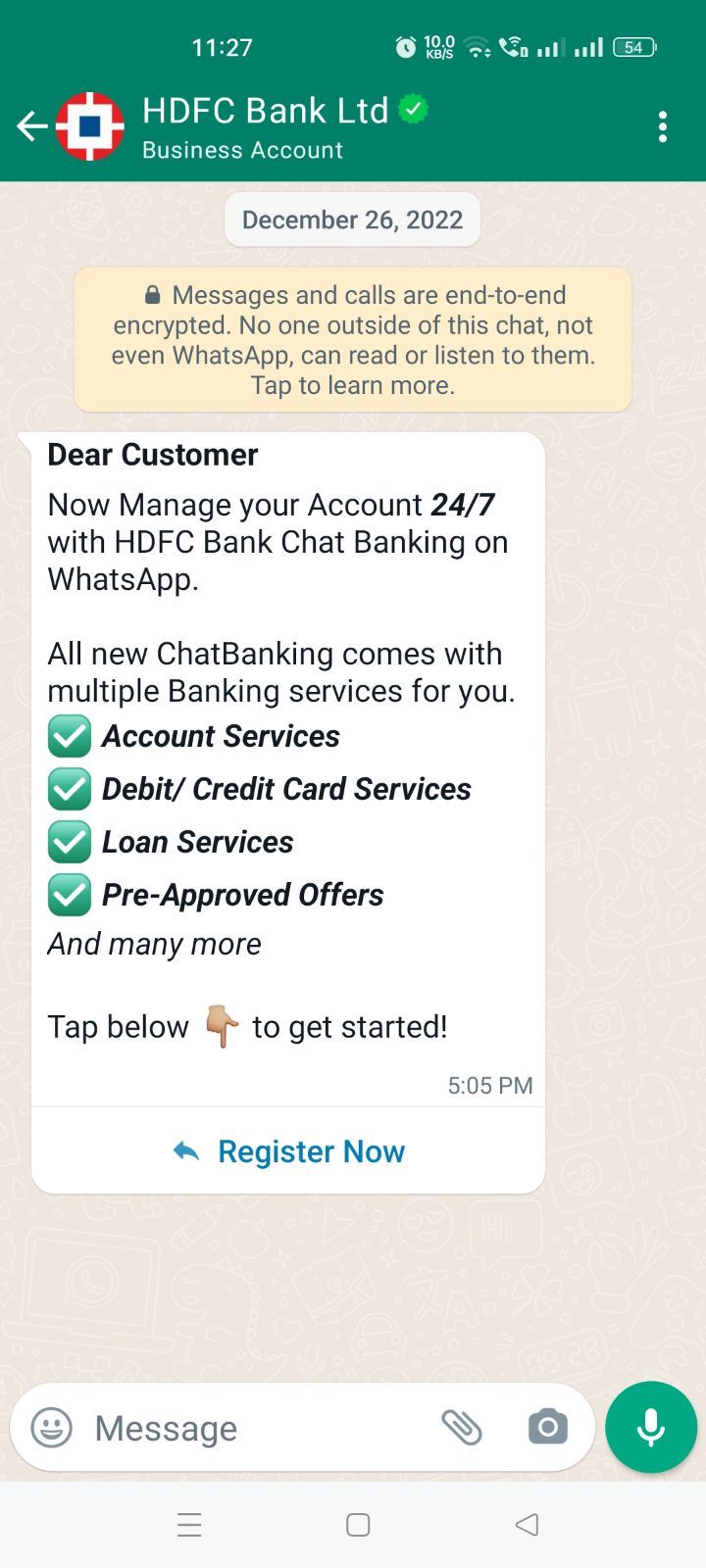

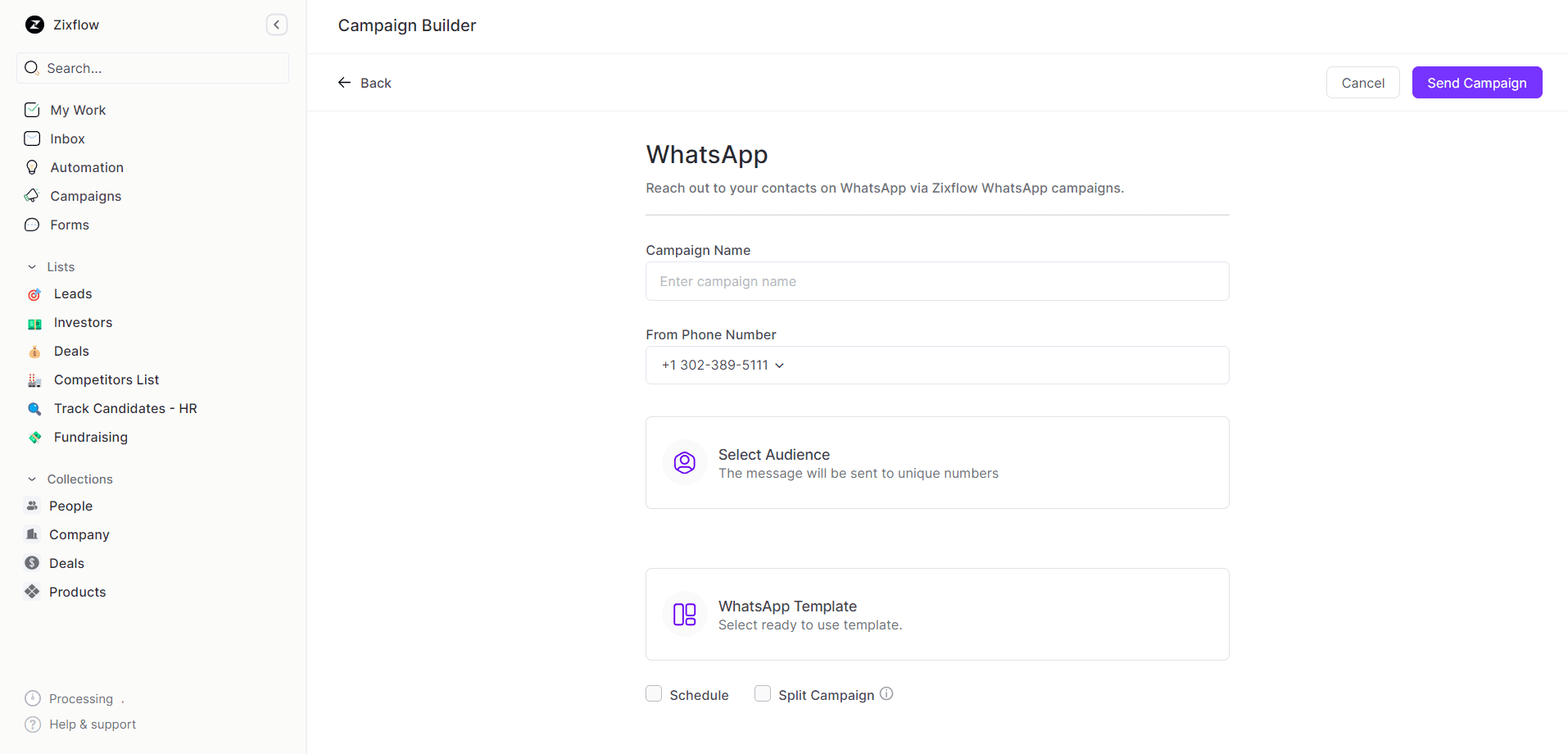

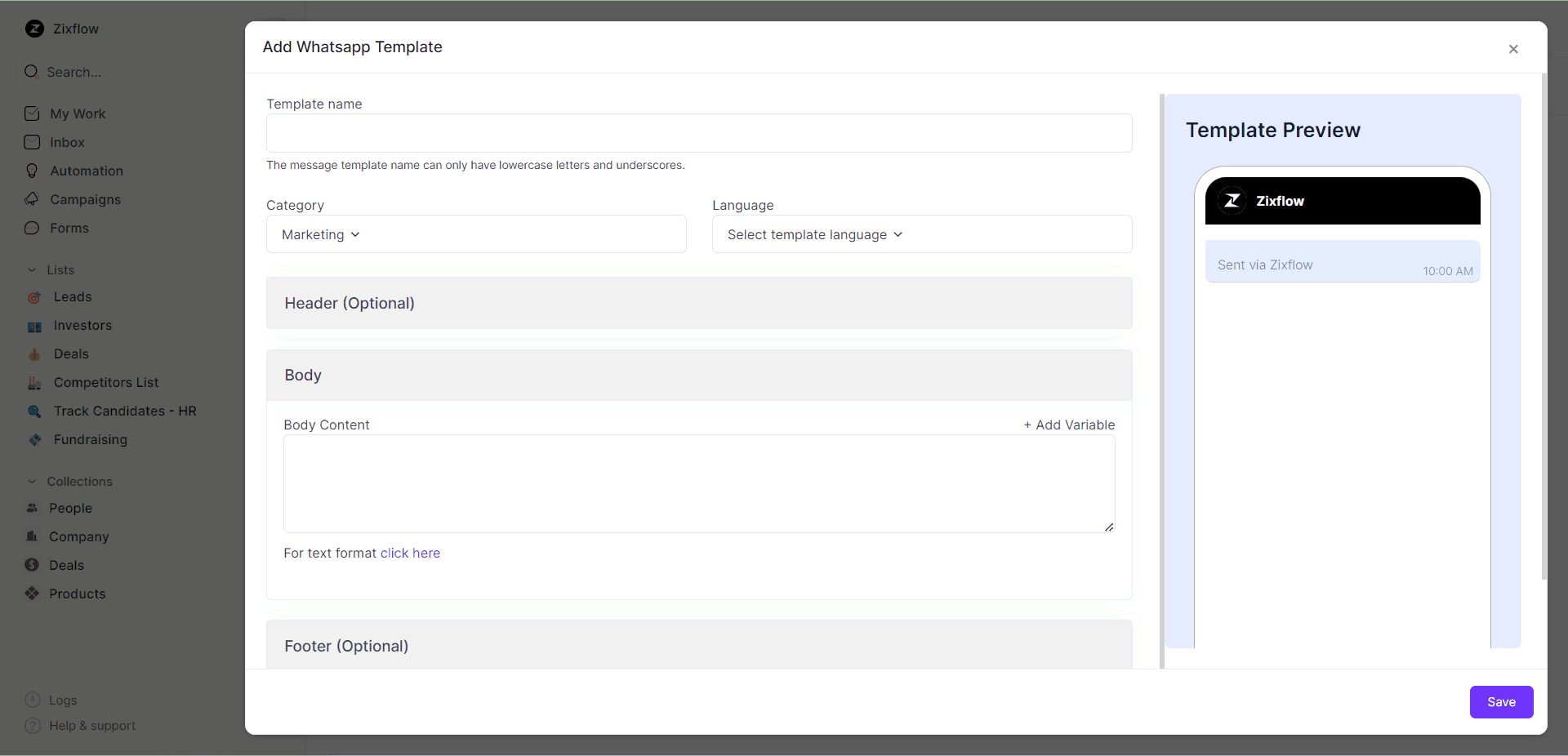

For example, consider two different departments, like sales and marketing, that work closely together. When the marketing team conducts a WhatsApp marketing campaign with a need-to-action button ‘interested’ as soon as customers click, the sales team is instantly aware of the next sales strategies they need to take so that they can process customers' sales pipelines. This is how CRM facilitates seamless collaboration between departments.

Revamp sales and marketing performances

With the CRM tool, you, as a banker, can effortlessly identify patterns, promotional campaigns, and areas for improvement to develop new sales strategies and customize future marketing initiatives.

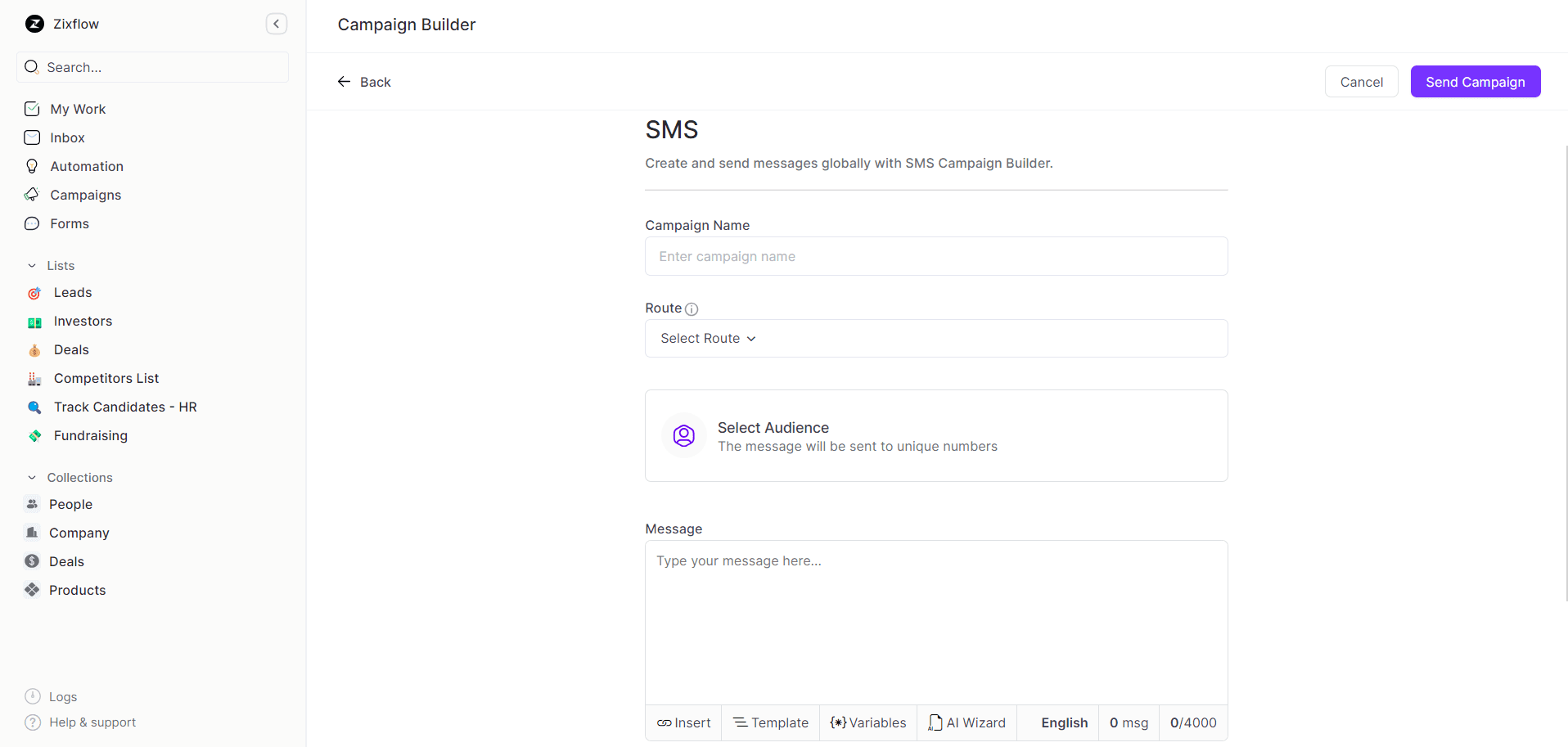

CRM software can significantly enhance sales and marketing performance by streamlining communication and automating tasks. CRM platforms practice SMS automation, WhatsApp automation, email automation, and more.

For instance, with the Zixflow SMS automation campaign, you can set up personalized text messages to be sent to your leads or customers at specific stages of the sales funnel. These automated messages can include appointment reminders, special offers, follow-ups, or OTP, ensuring timely and targeted communication that increases engagement and conversions. As a result, Zixflow CRM software helps you simplify the sales and marketing processes, saving time and improving overall efficiency.

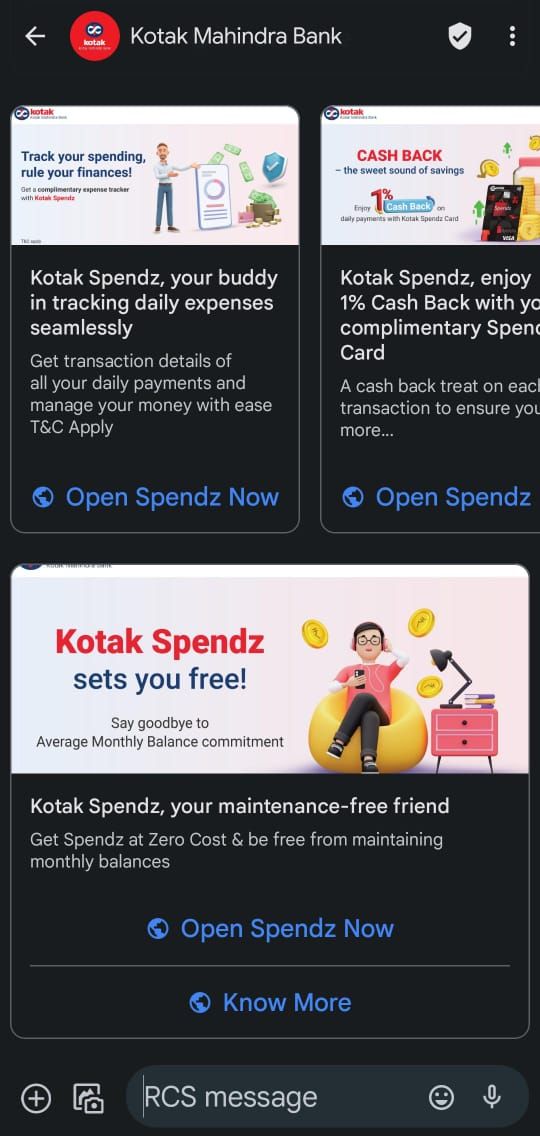

Well, for your deeper understanding, you can see the below-mentioned SMS, sent by Kotak Mahindra Bank to update its customers so that they can now track their daily expenses. Here, the intention is to show care towards customers with its user-friendly updated tracking feature so that they do not run out of the budget. And with Zixflow, you can undoubtedly do the same.

Simplify the underwriting process

Let's take a closer look at how the traditional way of granting loans worked. Bankers make endless phone calls to verify a customer's background. It's not only time-consuming but also prone to mistakes.

Once CRM software is in the picture, it simplifies the sales process. Now, you and your expert teams have all the information they need about a customer's past interactions and their financial situation.

With this, you will have your checklist for loan eligibility, including checking credit scores, income, and employment. With a CRM, this eligibility check becomes easy. It uses smart rules to automate the process. Plus, it ensures that leads are given to relationship managers efficiently.

Improve up-selling and cross-selling

CRM helps you make your sales engagement more effective. It carefully looks at your customer's history and behavior and spots the perfect opportunities for suggesting to your customer more advanced services or upgrades; this is what we call cross-selling and upselling.

Imagine, you have successfully closed a deal with a prospect for one of your banking products. You've got that sense that they might need an upgrade or a little something extra to cover their other financial needs. But before you make the call, you notice in the CRM software that another colleague from your bank has already offered them that extra service.

The chances of upselling or cross-selling to an existing customer are way higher. Studies even back this up, showing that the probability of selling something to a customer who's already happy with your service in your bank ranges from a 60% to 70% success rate while trying to convince new customers typically falls between a 5% and 20% success rate.

Well, now you may understand that it's simply in your hands to grab the opportunity & turn your table, when it comes to your existing customers, as they trust you. It's the perfect time to show them what else your bank can do for them.

Maintain extra caution in data security

As data security plays a major role in gaining loyalty & showcasing authenticity, you need to safeguard sensitive customer data from hackers or computer viruses. Before applying CRM software, you need to choose the best CRM for your business. A CRM tool that looks out for encryption, access controls, and regular security audits to protect against data

For example, the Zixflow CRM system will help you encrypt customer financial information, ensuring that even if the data is compromised, it remains inaccessible to unauthorized parties. In this way, Zixflow CRM systems prioritize maintaining customer trust and compliance with data protection regulations, and it is one of the safest platforms.

Capture leads smoothly & follow them up

Lead capturing and lead management is a critical aspect for you as a sales executive in the banking sector. Using CRM and sales automation, you can ensure potential customers are effectively nurtured throughout their journey. CRM systems allow businesses to organize and track leads systematically, preventing valuable prospects from falling through the cracks.

To maintain the nurturing process, you need help. Zixflow, an AI-wizard modern all-in-one single stack, will lend a hand with that process by having potential lead capturing and sales automation. It provides you with emails, WhatsApp messages, and SMS for consistent follow-ups to your customers.

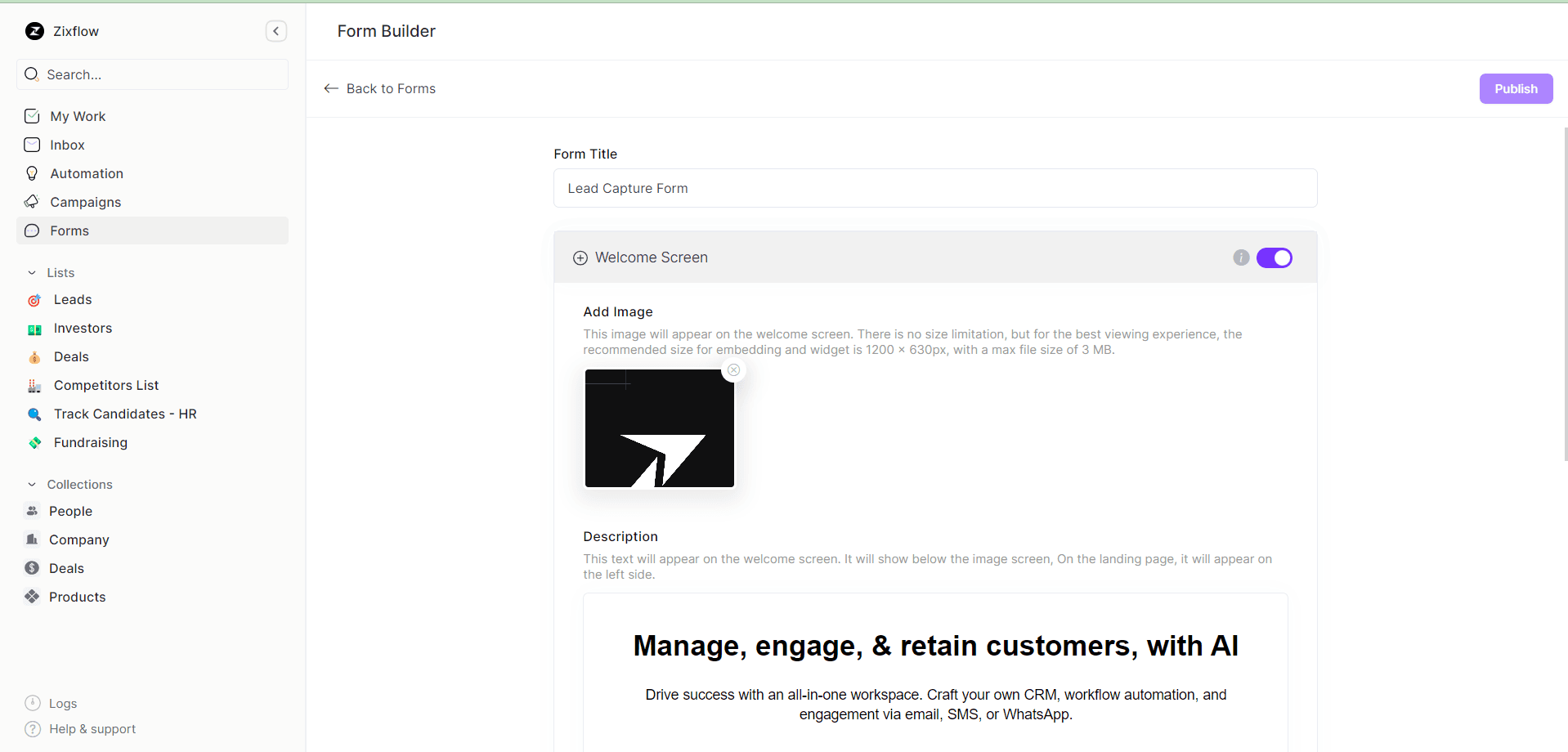

Furthermore, Zixflow provides you with a captivating form-building feature that you can use as your landing page, embed forms in your website, or simply you can showcase your interest in your leads with these forms. There you can ask interesting questions to engage your leads and evoke their buying intentions.

Leverage the benefits of banking CRM software with Zixflow & experience your desired ROI

From enhancing your customers' satisfaction to skyrocketing upsell and cross sales, accessing in-depth data analysis to retaining your lost clients, with CRM you can leverage a wide number of benefits in the banking sector.

However, before diving into the beneficial procedures, you just need one of the best CRM software. Although plenty of CRMs are already available in the market, you can make a strategic move by choosing Zixflow.

Well, before relying on my suggestion have a look at your benefits:

-

Zixflow enables you to track your activities, using filters and sort them out according to your needs with different modern table styles, so you can headstart on the right track.

-

Zixflow’s lead-capturing forms and smarter lead management process to satiate the thirst for high-quality leads irrespective of your industry benefit you in the long term.

-

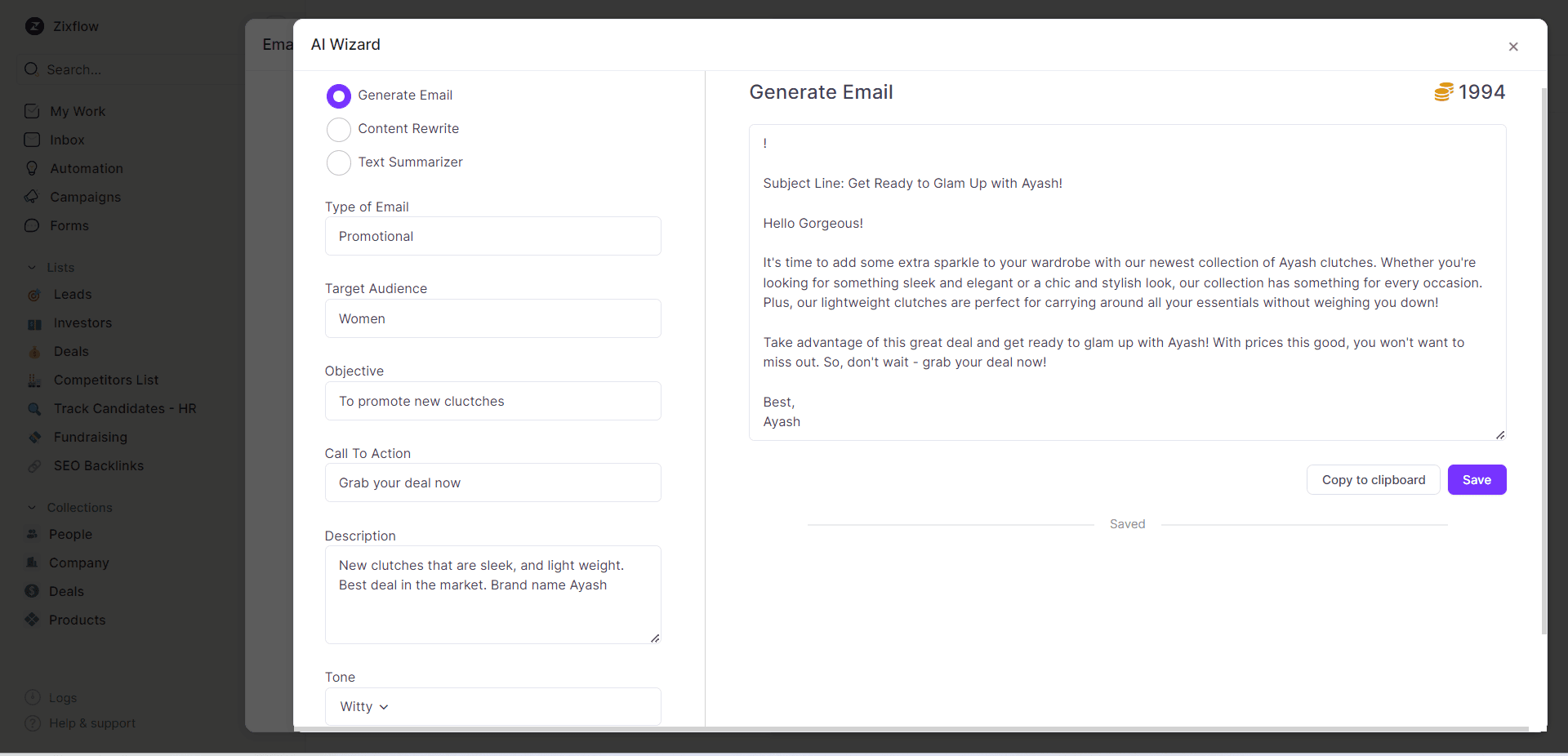

With its unlimited pre-made captivating email templates, you can follow up with your clients without being shuffled in their inboxes. Also, with its AI writer, you can generate engaging personalized content for your customers.

-

Zixflow's WhatsApp automation gives you an extra edge on alluring WhatsApp broadcasting messages so that you can smoothly promote your financial products and services.

-

Moreover, with its extra care for data security protect your banking service from any kind of privacy breaches.

_Do you wanna experience it all? Then stop reading and start exploring._ Book your demo with Zixflow now!