11 Best CRMs for Mortgage Brokers and Loan Officers in 2026

Are you a mortgage broker striving to assist your clients in finding their dream homes or making smart financial decisions? You might be handling lots of clients, capturing loan prospects, doing tons of paperwork, and managing your sales team every day.

At times, it can be challenging to track client interactions, schedule meetings, and streamline the lending process.

Moreover, customers' and borrowers' expectations are continually evolving. Gone are the days when they had to stand in the queue and wait for their turn to speak with the bank manager to resolve their queries.

We live in a technology age. There are numerous tools available on the market. If you ask me the one tool that can ease your operations, boost customer relationships, and generate revenue, I would suggest a CRM platform. There are several benefits of using a CRM platform in the banking industry especially for loan officers.

In fact, A study by Nucleus Research found that businesses that use a CRM system can achieve an average ROI of 877%.

With that said, to make it easy for you to manage your borrowers’ details and offer your financial services seamlessly, here are some of the best CRMs for mortgage brokers and loan agencies. So, let’s get into it.

Zixflow

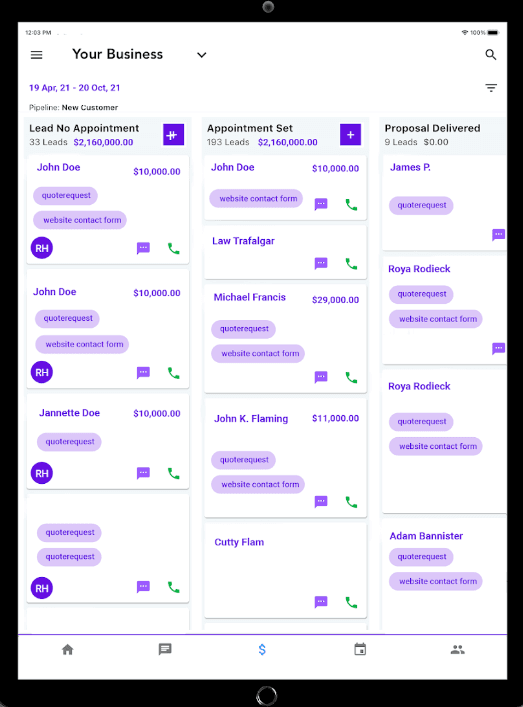

Zixflow is a fully customizable, all-in-one CRM with a wide range of features that can be customized as a robust banking CRM covering everything for loan officers and mortgage firms.

It lets you centralize your data in one place, nurture your leads effectively, automate sales workflow, and streamline the mortgage process. With Zixflow, your mortgage company can drive sales effortlessly and enhance customer relationships.

Manage contact details

Zixflow provides a customized AI-driven CRM platform where you can create and manage your contact details from a central database.

You can even add custom AI-powered fields to your contacts to generate personalized intros or conversation starters. This customized approach helps you and your team to build strong relationships with your customers.

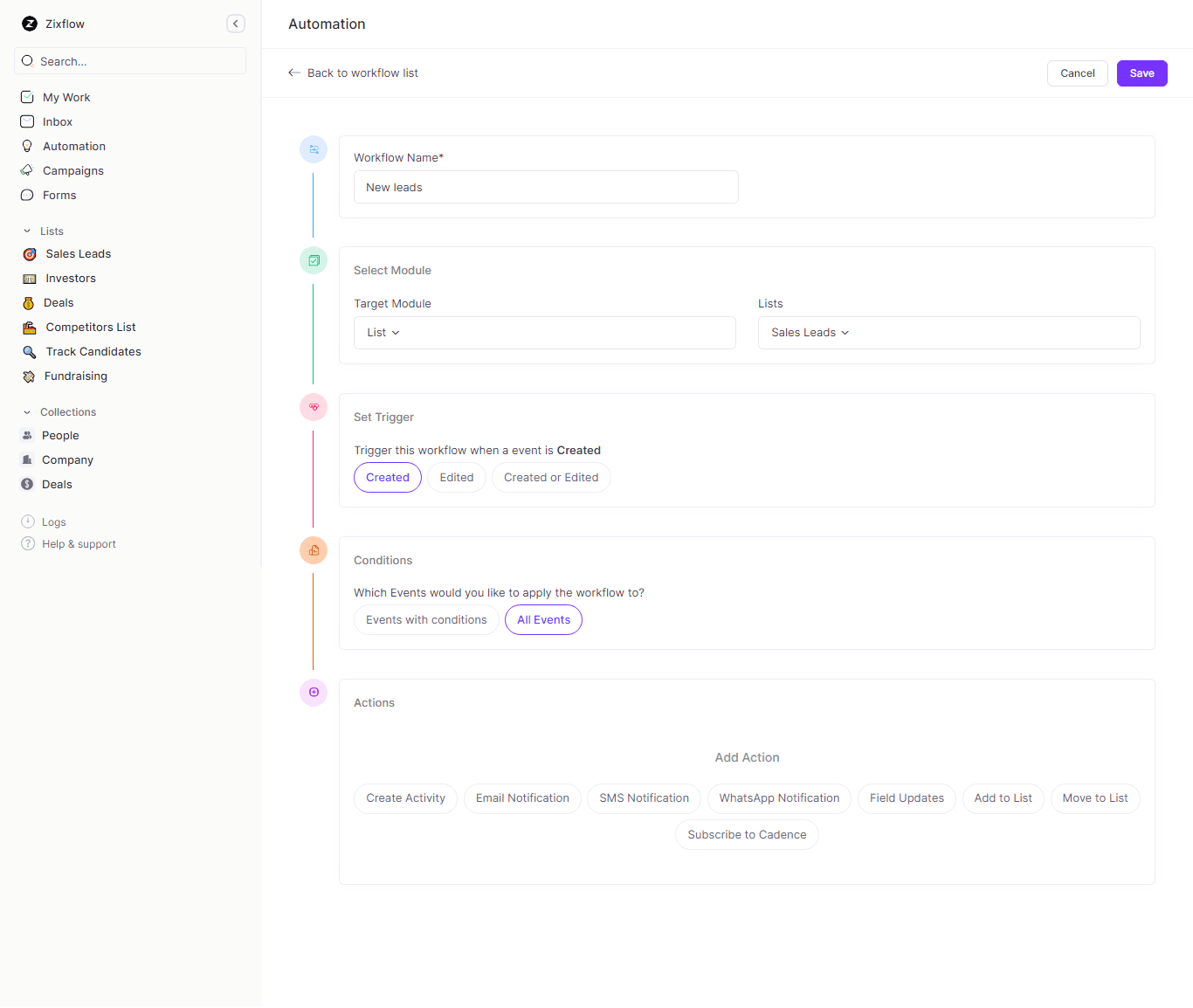

Workflow automation

You can automate your workflow, like client follow-ups, sending email reminders, and scheduling calls with Zixflow workflow automation. This way, you can streamline your lending process and eliminate repetitive tasks from your everyday schedule.

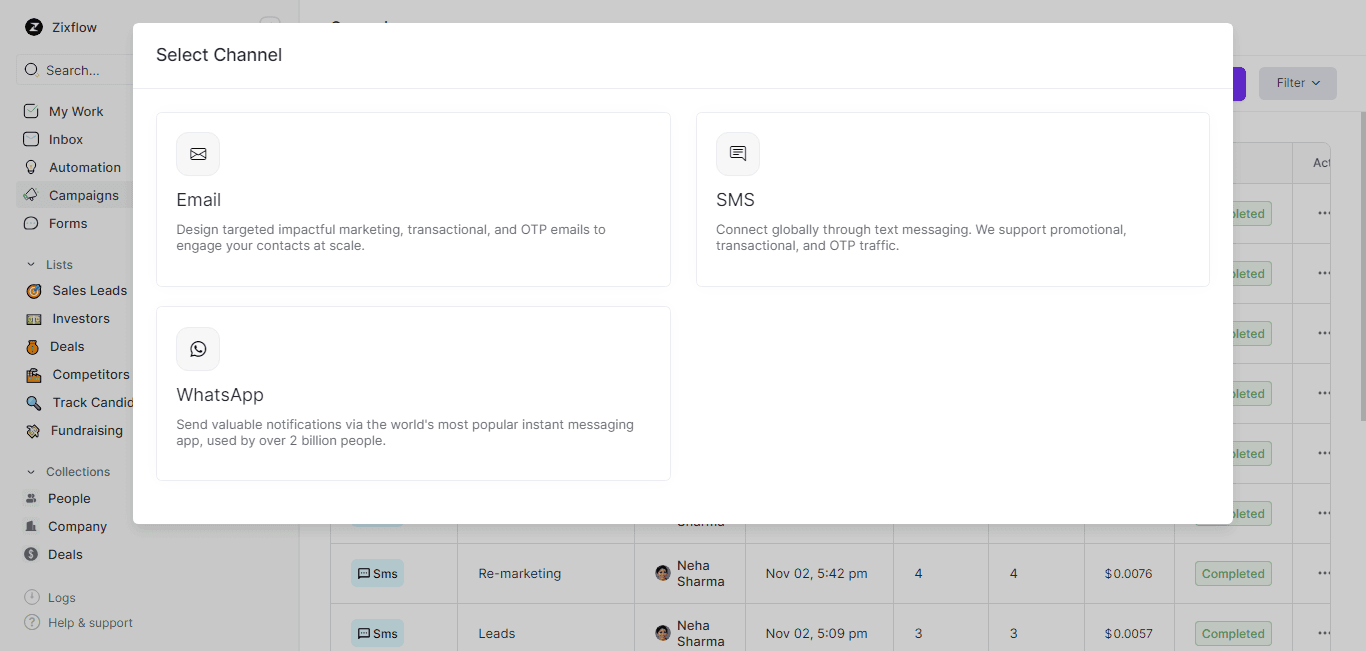

Multi-channel engagement

With Zixflow, you can connect with your prospects via multiple channels, including SMS, email, and WhatsApp. Plus, you can also track analytics, get insights, and analyze your campaign performance to enhance your mortgage process.

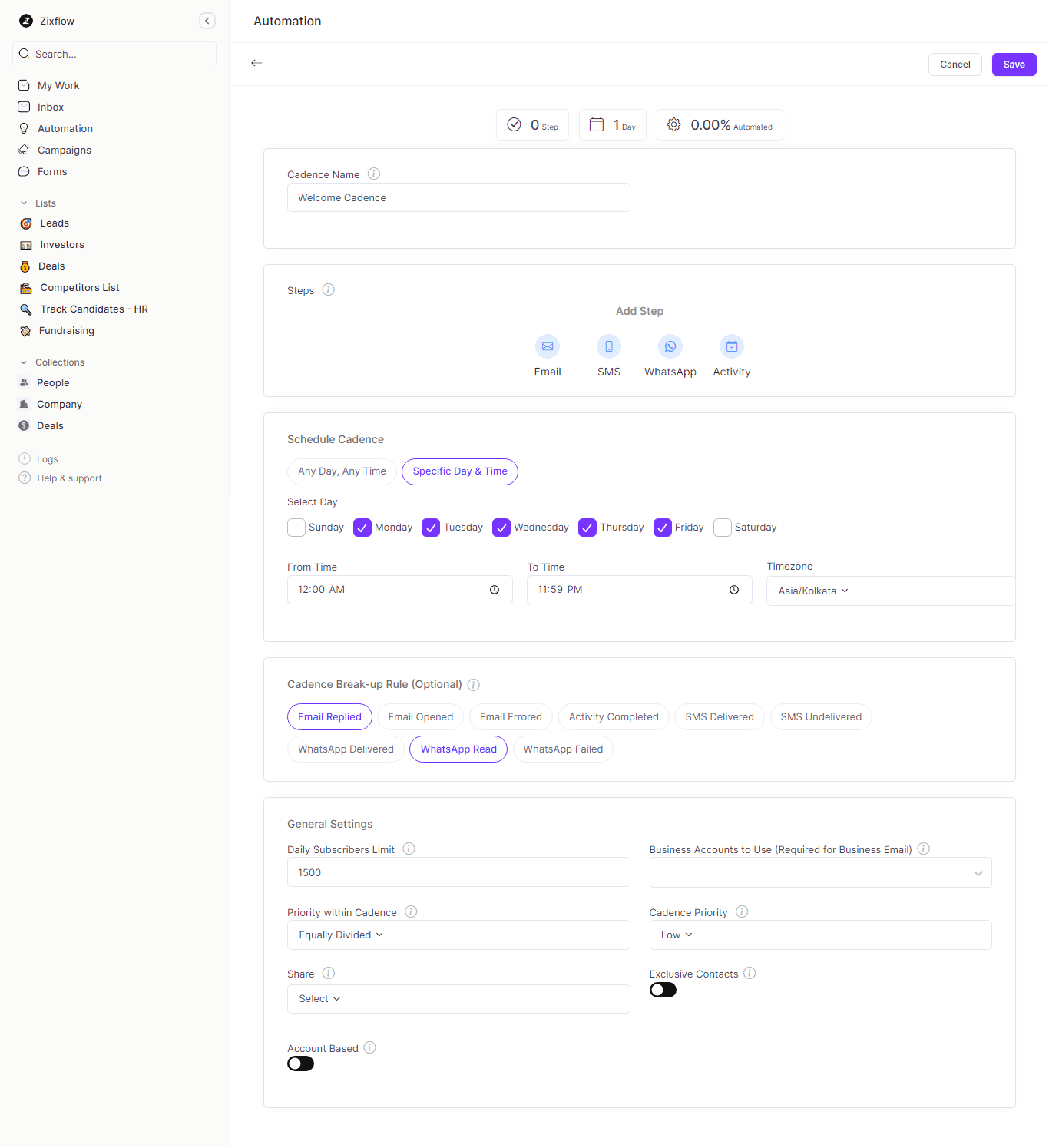

Sales cadence

Zixflow allows you to set up cadences to boost your sales efficiency and automate your outreach. By leveraging the sales cadence templates, you can speed up your sales process.

It offers a wide range of sales cadence templates for all the possible situations a salesperson may encounter. These templates are customizable, allowing you to add steps in the cadence as per your business requirements.

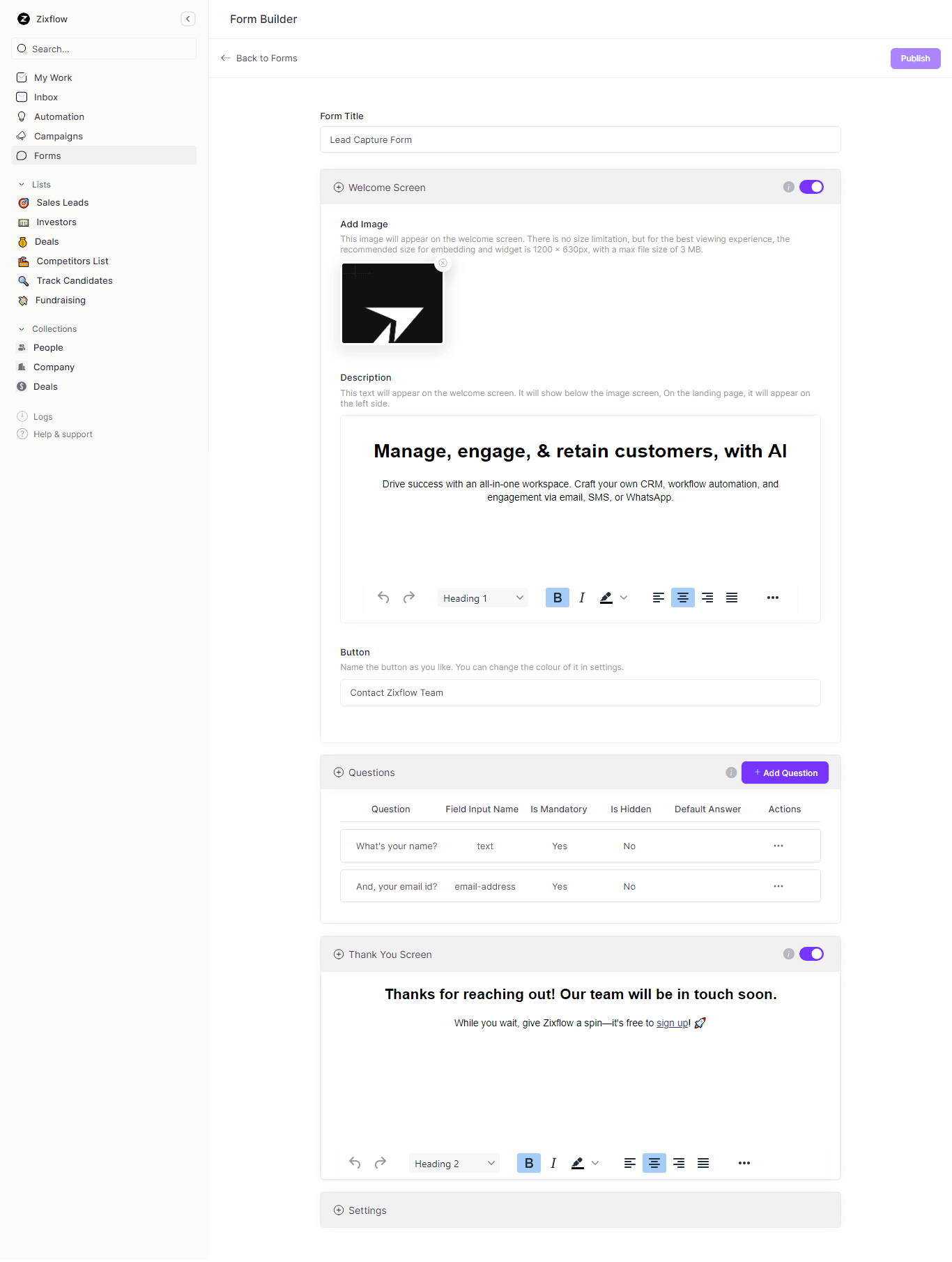

Custom forms

Zixflow provides modern, customizable forms to capture the attention of your customers and prospects while collecting their details.

For example, you can design a customized welcome screen, incorporate personalized questions, and use numerous colors to make a form that aligns with your brand’s identity.

You can use these forms for multiple use cases and send them to your customers via email, SMS, or WhatsApp.

Robust data security

Zixflow offers advanced security features to its users. If you’re looking for a CRM system that not only provides excellent features but also robust data security, Zixflow is the perfect solution for you.

So, if you want to smoothen the mortgage process and enhance the relationships with your clients, Zixflow is one of the best CRM solutions for you to choose.

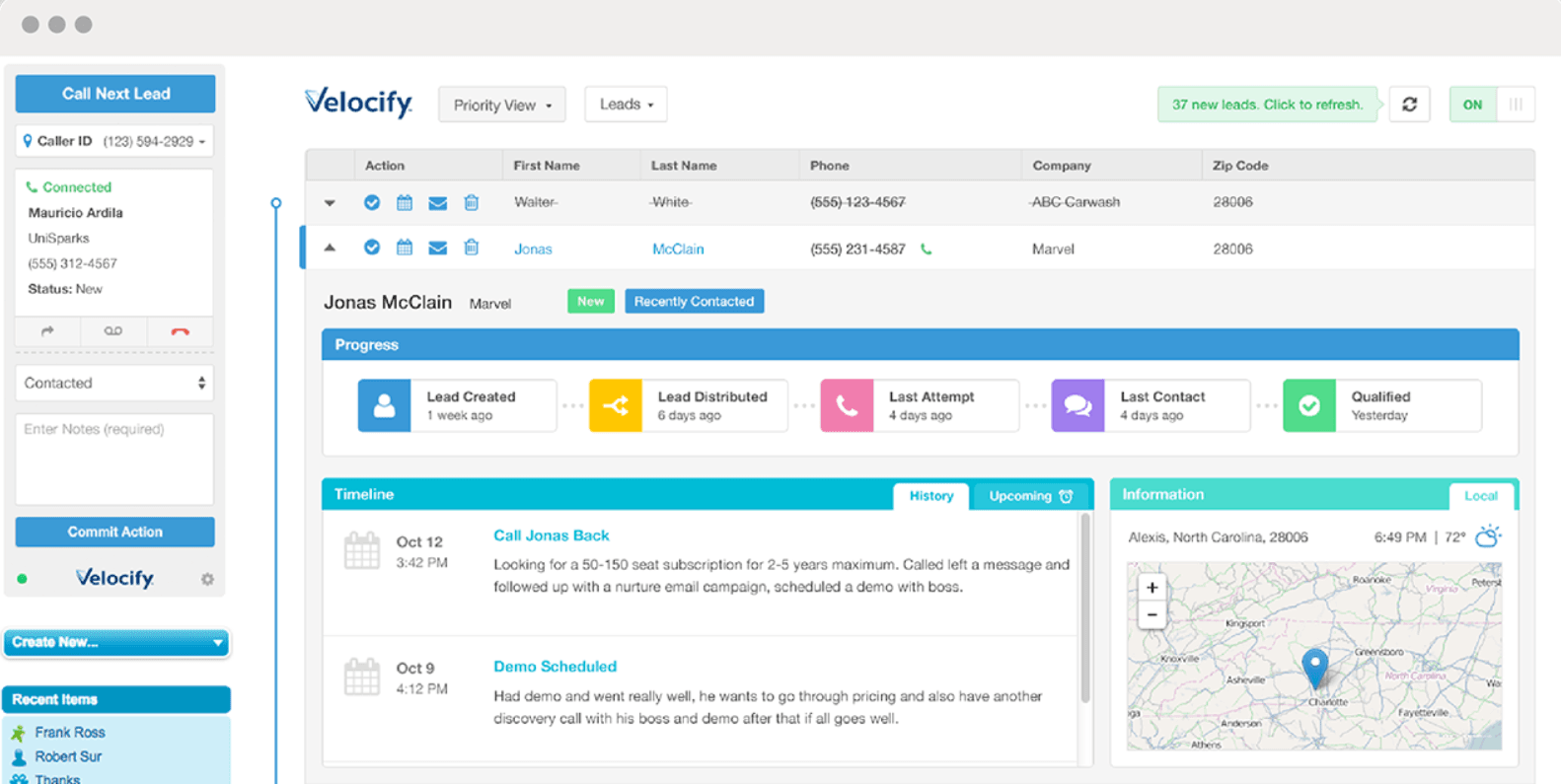

Velocify

Velocify is a sales and marketing automation platform that enables loan officers and mortgage brokers to work efficiently and effectively.

Velocify CRM, which is a part of the ICE Mortgage Technology Platform, is suited for all mortgage firms of all sizes. This is because it is relatively affordable, easy to use, and scalable.

It comes with a sales management CRM that helps you automate telecommunications and marketing campaigns. It offers you many features that can help you enhance your overall business operations.

Streamline your sales process

With Velocify’s automation features, you do not need to worry about daily tasks. This CRM ensures your mortgage team stays on track, manages your customer relationships, streamlines communications, and focuses on the activities that help drive your business forward.

Lead management

With Velocify, you can track your leads from initial contact to closing. It provides a variety of features for you that help in distributing new leads, responding to high-priority leads, and creating custom sales workflows. This ensures you work smarter and close more loans.

Accelerate the mortgage process

You know that the manual process for loan approval might take up to eight days or more.

But with Velocify's automated multi-channel marketing and communication tool, you can attract your new leads, follow up with them on incomplete applications and missing documents, and engage with them seamlessly. This CRM simplifies your mortgage process and helps you get the loan faster.

Click-to-call sales dialer

Velocify dial-IQ is a reliable inbound and outbound sales dialer that helps you make calls and have smarter conversations with your clients. This enables you to quickly schedule calls and get borrowers’ information for easier loan approvals.

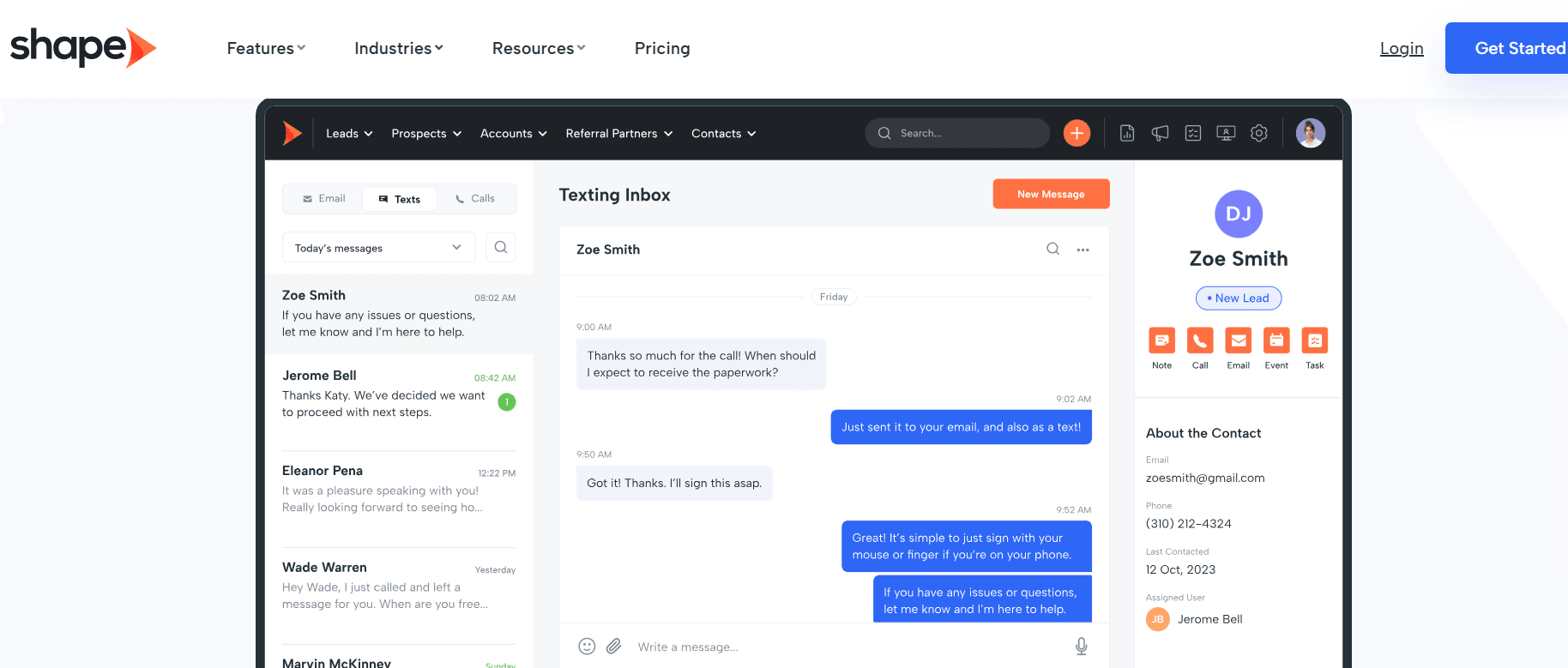

Shape

Shape CRM is a cloud-based mortgage CRM that ensures your team has an end-to-end workflow in place, preventing any qualified leads from slipping through the sales pipeline. This is a sales CRM best suited for small businesses.

You can centralize your business operations with Shape’s enterprise-level customer relationship management. Plus, it can let you automate your sales automation process to maximize your small business's efficiency and productivity.

Lead engine

Shape’s lead engine is specially designed to increase your lead conversion. It enables you to create landing pages, build marketing strategies by utilizing predictions and data-driven heatmaps, and personalize your user experience through inbound call routes, scheduling appointments, and more.

Email automation

Using Shape’s integrated email automation feature, you can send individual or bulk emails to your potential customers. It also provides you with email marketing templates for various scenarios. You can also integrate and use your Outlook or Gmail account with Shape’s email automation software.

CRM dialer

With Shape’s dialer system, you can impress your prospects and make your calling process more efficient. You will have the option to pre-record voicemail drops, conduct conference calls, and transfer calls.

All in all, you can increase your call performance through its dialer system.

Built-in customer portal

Through its survey-style lead funnels, you can collect your customers’ details and documents securely without manual data entry.

It also provides additional features like e-signature solutions, cloud-based storage, and templated document sets that can increase your conversion rates.

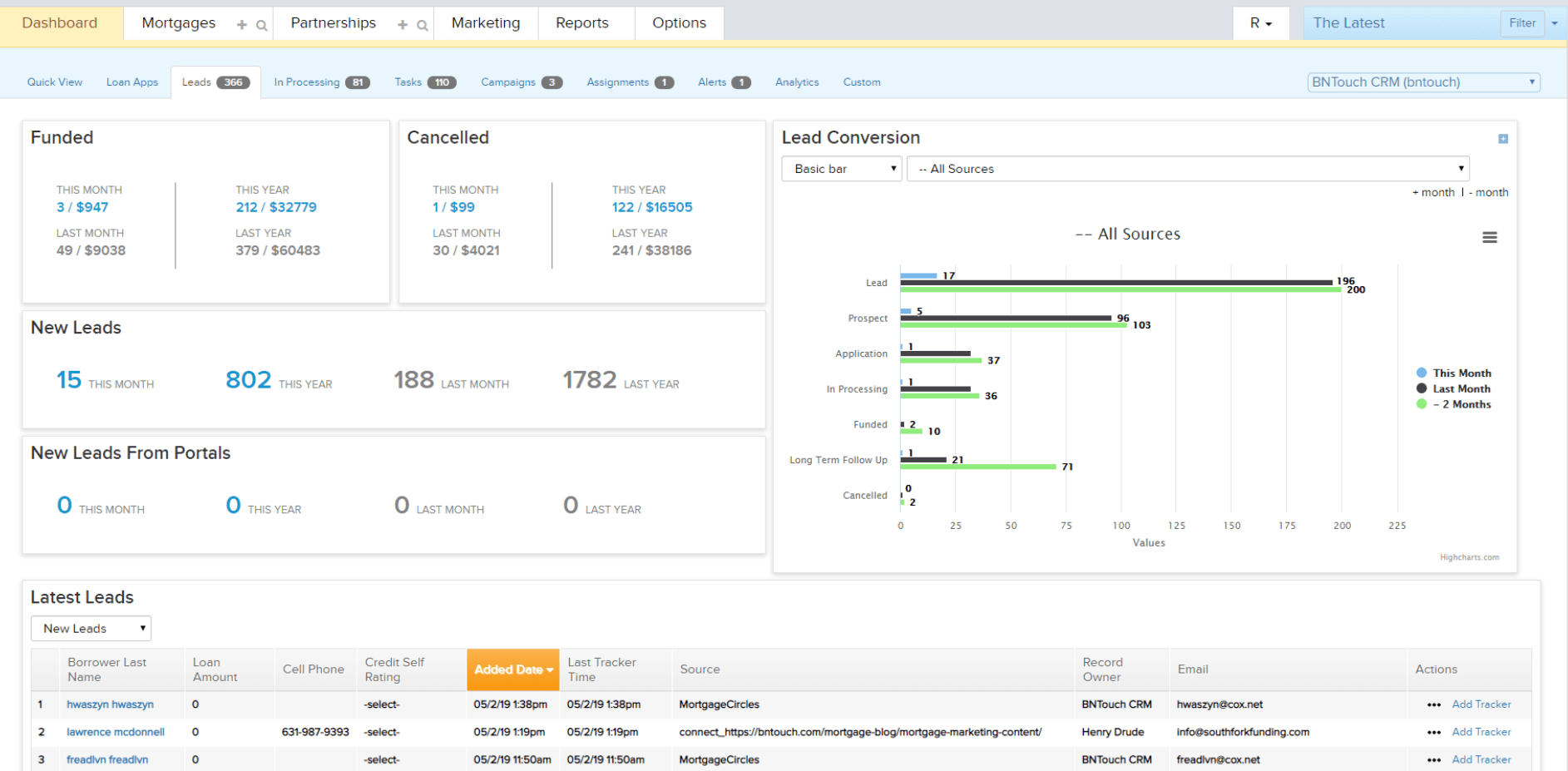

BNTouch

BNTouch is a fully integrated feature-rich CRM specially designed for the mortgage industry. It was trusted by high-profile customers like Empire Mortgage, Alterra Homes, and Summit Funding.

Whether you run a small business or a large enterprise, BNTouch offers flexible pricing plans. Its customized features help you to manage potential customers and referral partners.

You can automate your mortgage process, convert more leads, maintain strong customer relationships, and expand your network of partners with this CRM.

Email marketing and text automation

With BNTouch's centralized email marketing and text automation feature, you can create personalized emails for all your marketing activities from a single account.

Once you save them, it will automatically send emails and texts to your customers, borrowers, and partners. Besides, you can get email marketing performance reports to help you perform better.

Borrower and partner management

You can quickly manage your mortgage business using BNTouch's borrower and partners management feature.

It helps you keep all communications organized, stay updated on your sales pipeline, assign leads to your sales reps, and receive notifications about transaction status changes and updates from loan officers.

Collaboration tools

BNTouch provides collaboration tools for mortgage offices. With these tools, you can create marketing materials that are accessible to your entire team. You can also effectively manage and share marketing campaigns within your team, allowing you to foster a sales enablement ecosystem.

Live Chat

With the BNTouch live chat feature, you can automatically collect the details of your customers, like name, phone number, and email address, and add them to your lead pipeline.

It also enables you to connect and chat with any of your team members. Plus, this CRM also provides you with analytics to help you optimize your chat interactions.

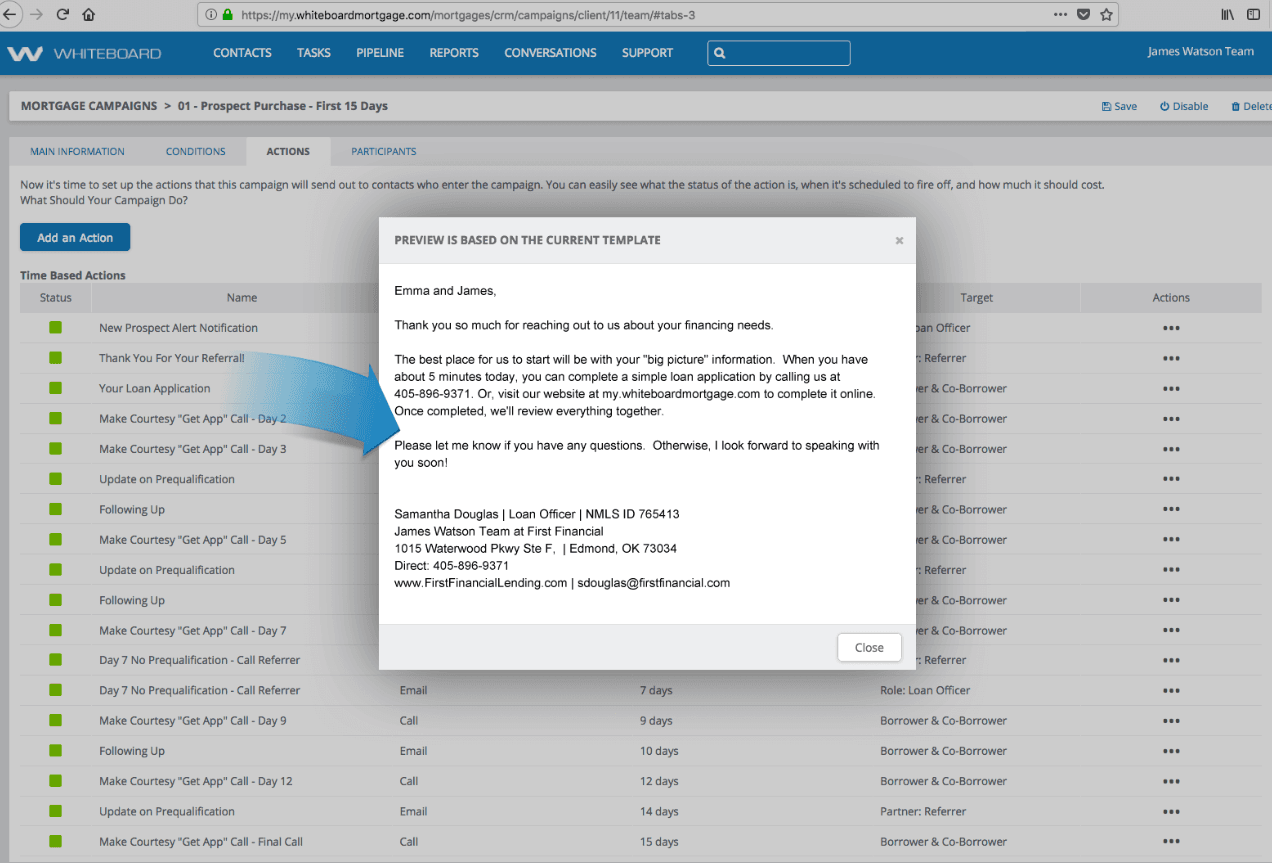

Whiteboard CRM

Whiteboard CRM is one of the best CRMs designed for mortgage professionals by mortgage industry leaders. It offers one of the best pricing plans for growing businesses. Whiteboard’s approach is all about results, as it leverages proven methods to help you grow your business.

This CRM helps save your time and increase your efficiency and productivity while simplifying your workflow.

Lead management

Managing different types of leads can be challenging, but Whiteboard gets you. It is designed for you to make lead management simple and automatic. That way, you won’t miss any new leads and referrals.

Pipeline management

With Whiteboard CRM, you can manage your sales pipeline with ease. It provides you with pre-built mortgage-specific pipeline sequences, eliminating the need for extensive setup.

You can also automate sending the loan status, updates, or any milestone notifications to your clients so that they will be informed about their loan process.

Partner management

You can optimize your partner relationships within the Whiteboard CRM, by utilizing features such as sending updates via email, SMS, and WhatsApp, and by automating the meeting schedules to keep your partners on track.

Mobile app

You can use Whiteboard’s mobile app to manage your leads, and pipeline, receive status updates, and deliver personalized customer service while you’re on the go.

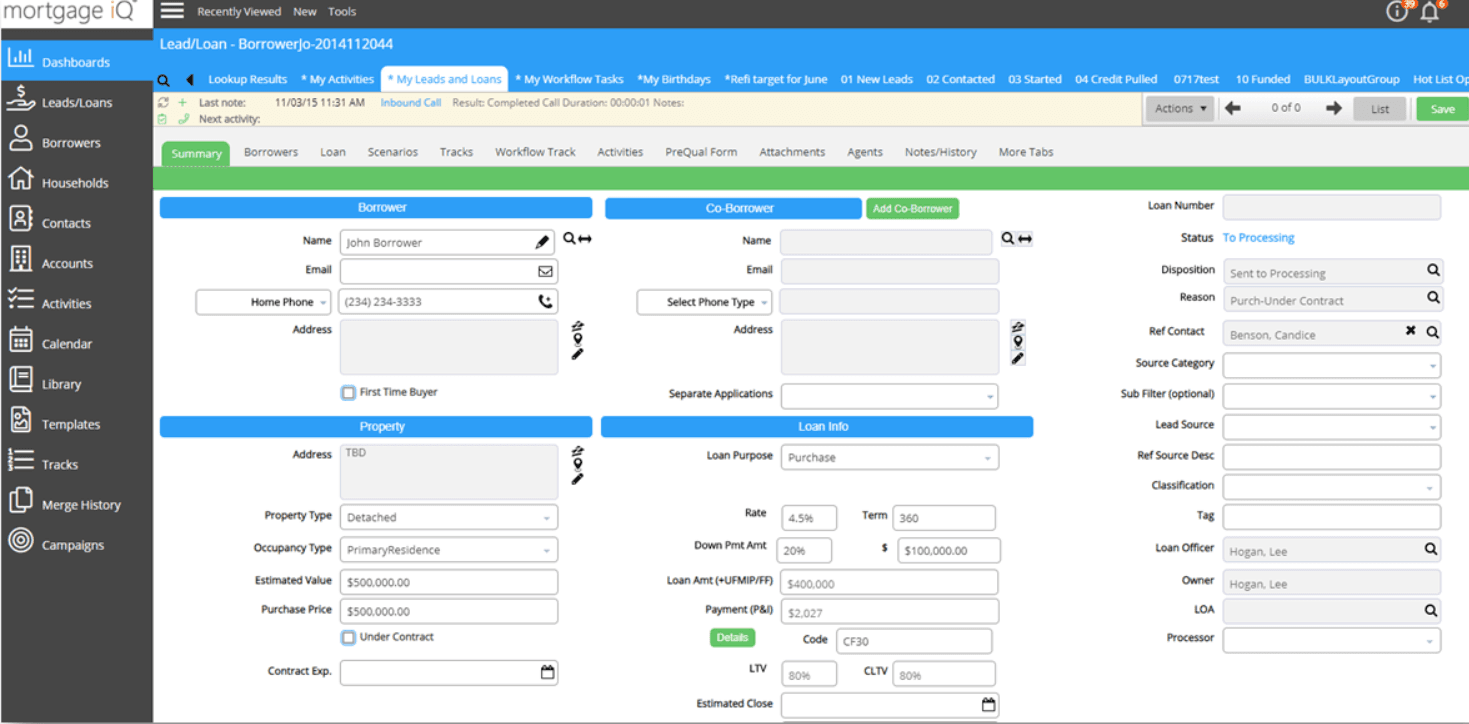

Mortgage IQ

Mortgage IQ is one of the leading enterprise CRM software specially designed for the mortgage industry.

It covers all aspects like workflows, marketing, relationship management, lead management, and much more by keeping mortgage companies in mind. Mortgage IQ provides many helpful features that encourage long-term success for your business.

Marketing automation

With Mortgage IQ, you can automate your marketing efforts. You can easily automate your emails, tasks, activities, reports, and text messages on your preferred timeline. Moreover, Mortgage IQ provides you with user-friendly templates to simplify your sales process.

Borrower relationship management

Being in the mortgage industry, it is always challenging to manage relationships with borrowers and partners. Mortgage IQ offers a robust borrower relationship management tool essential for your mortgage company. With this tool, you and your team can manage relationships and databases seamlessly.

Lead management and tracking

By using Mortgage IQ, you can make your lead management and tracking very efficient. You can benefit from simplified lead assignment and distribution, while your marketing team can automate touch marketing, save time, and streamline the process.

Dashboards and reporting

Mortgage IQ provides insights into your sales performance and activities, which helps you stay informed and make data-driven decisions.

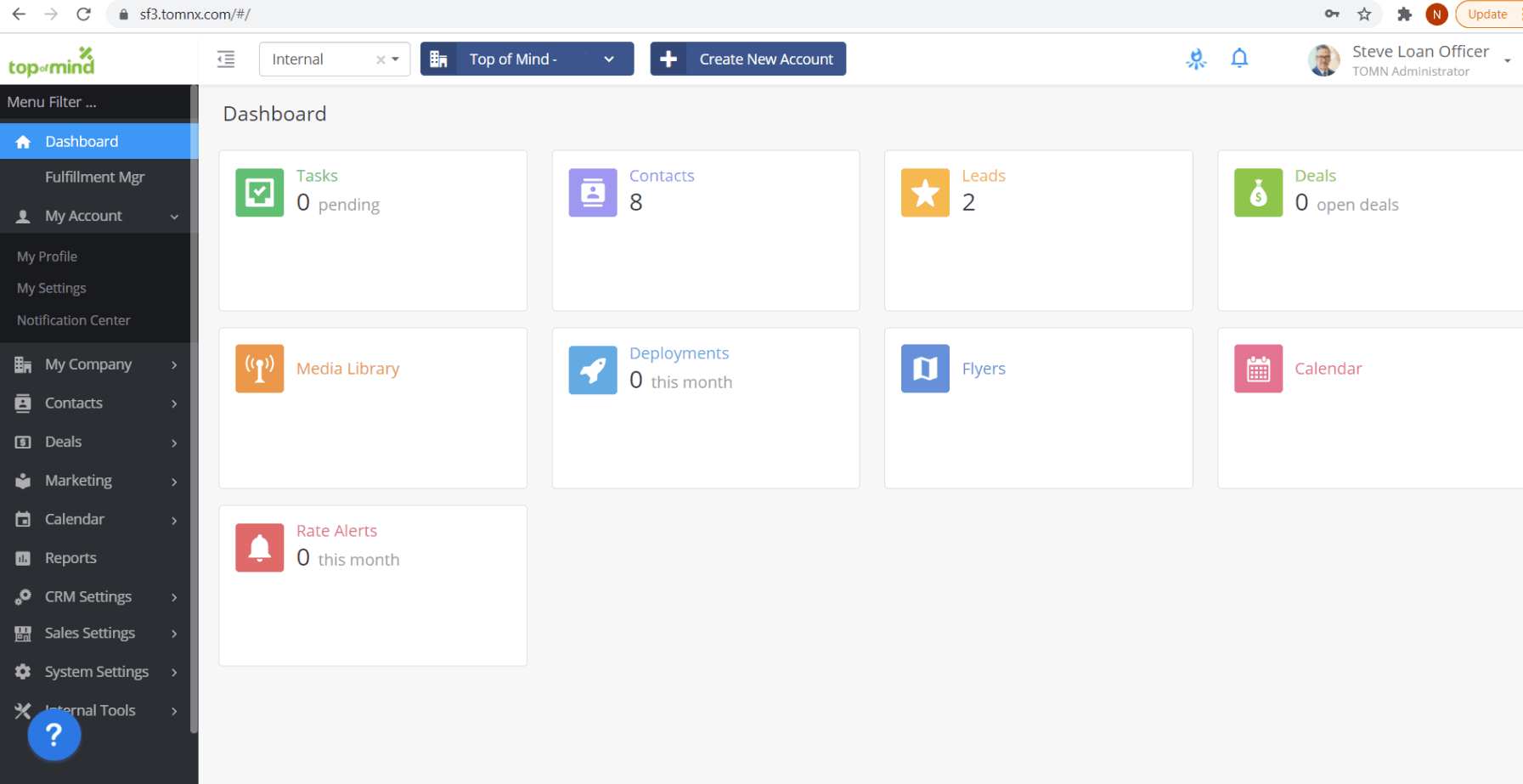

Surefire

Surefire is yet another CRM specially designed for loan officers and mortgage professionals. This CRM has become a popular choice in the industry because of its ability to enhance marketing strategies and enable mortgage marketers to connect borrowers with loan officers repeatedly.

It offers efficient workflows and the best content for you so that you can maintain your strong connections with borrowers, recruits, members, brokers, and real estate agents.

Lead management

You can track different types of leads from initial contact to closing through Surefire’s CRM. Moreover, this CRM’s features help you in lead qualification, prioritization, and nurturing for more efficient and productive interactions.

Marketing automation platform

With Surefire’s CRM, you can automate your tasks like sending email follow-ups, generating reports, and creating tasks. This helps you in making your marketing efforts more streamlined and productive.

Content management system

Surefire enables you to manage your contacts effectively. You can conveniently store and access your contact information, track contact interactions, and categorize them based on specific criteria for improved organization.

Opportunity Management

With this CRM, you can manage your pipeline seamlessly. You can track your opportunities, make accurate sales forecasts, and ultimately close more deals with ease.

Total Expert

Total Expert is a purpose-built CRM designed for mortgage and financial industries. This versatile platform can help you grow your business regardless of its size.

With its robust features, you can effectively manage your leads, contacts, opportunities, and pipeline more effectively. It offers a variety of compliance features for you to keep your business in line with industry regulations.

Lead generation and routing

Through Total Expert’s lead generation and routing feature, you can engage with your clients and generate more qualified leads.

You can achieve this through automating your marketing communications, coordinating with other lead generation channels, and guiding your team on how to enhance their customer engagements.

Increase conversion rates

With the help of Total Expert’s real-time data signals, you can turn the applications into closed deals.

It provides the tools to create hyper-personalized customer journeys, through which you can build stronger relationships with your customers, increase conversion rates, and drive growth.

Automate customer engagement

Implement a customer-centric selling methodology and engage with your customers in a personalized way through Total Expert’s automation tool. This helps you connect with borrowers, increase referrals, and secure future revenue.

It also allows you to run marketing campaigns to provide helpful loan-related information to new homeowners.

Retention

You can stay connected with your customers or prospects via Total Expert’s marketing automation and customer intelligence tools to capture repeat business.

Total Expert provides you with a 360-degree view of your customers by integrating data from third-party platforms, which can help you better understand their financial needs.

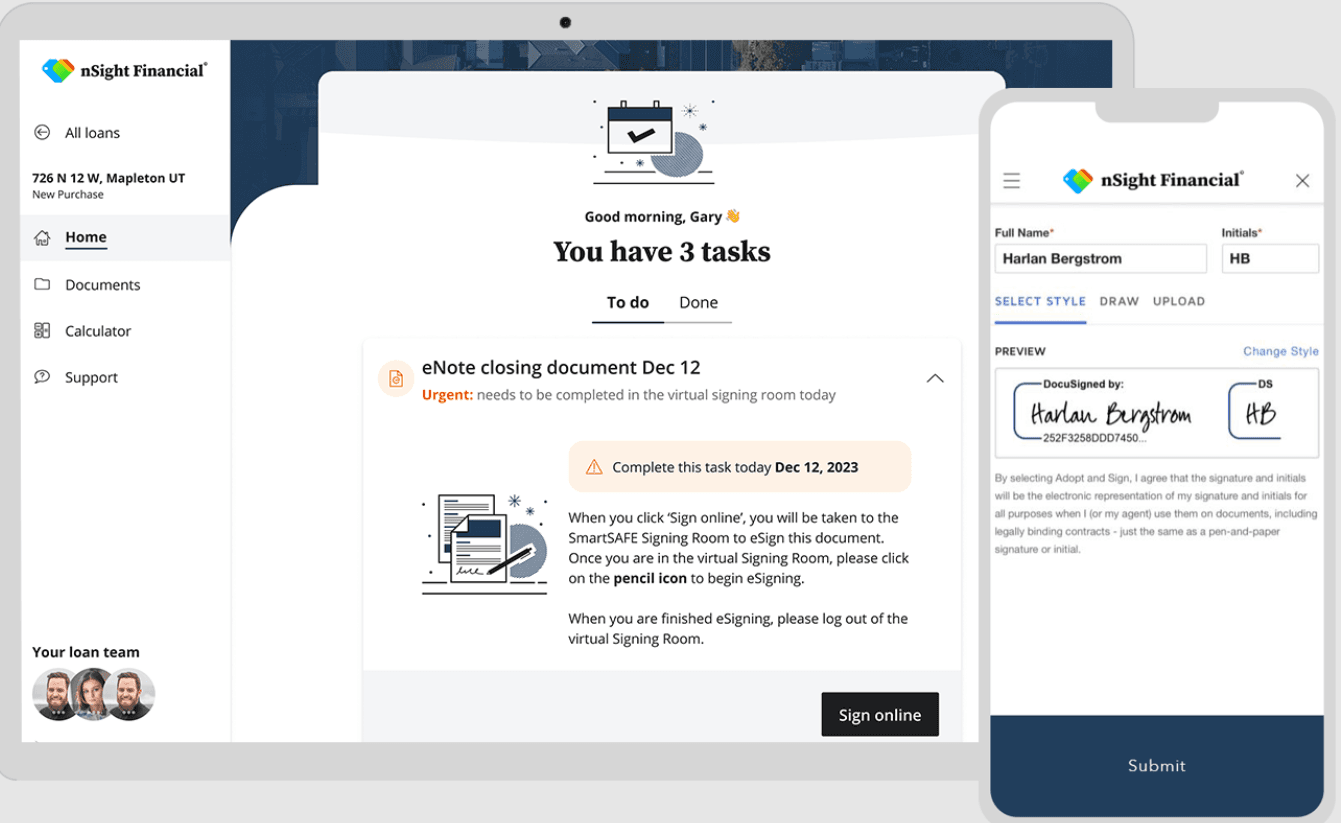

SimpleNexus

SimpleNexus is an enterprise-grade business intelligence CRM designed for Mortgage professionals. This CRM offers a wide range of tools that take digital lending to the next level.

The SimpleNexus optimizes your FI’s mortgage profitability by streamlining loan processing and closing, providing a personalized experience to your customers, and revealing valuable data insights.

Lead management

This easy-to-use CRM provides various ways to capture leads, such as online lead forms, webhooks, and integrations with popular lead-generation platforms. SimpleNexus also offers tools to capture qualified leads, including credit score estimation, income verification, and debit-to-income ratio calculations.

Streamline partner collaboration

SimpleNexus offers integrated tools to keep you and your team members informed throughout mortgage transactions. Additionally, you can use these tools to update your customers about their loan process.

Mortgage analytics

With SimpleNexus, you can enable an analysis of lead quality and loan pipeline, helping you identify the stages in your sales pipeline that may need improvement. Plus, you can get customized data views of your team members, ensuring everyone has the information they need to excel.

Streamline loan compensation management

By leveraging SimpleNexus’s incentive compensation feature, you can get access to a unified platform where you can efficiently manage your loan compensation data, transactions, and communications.

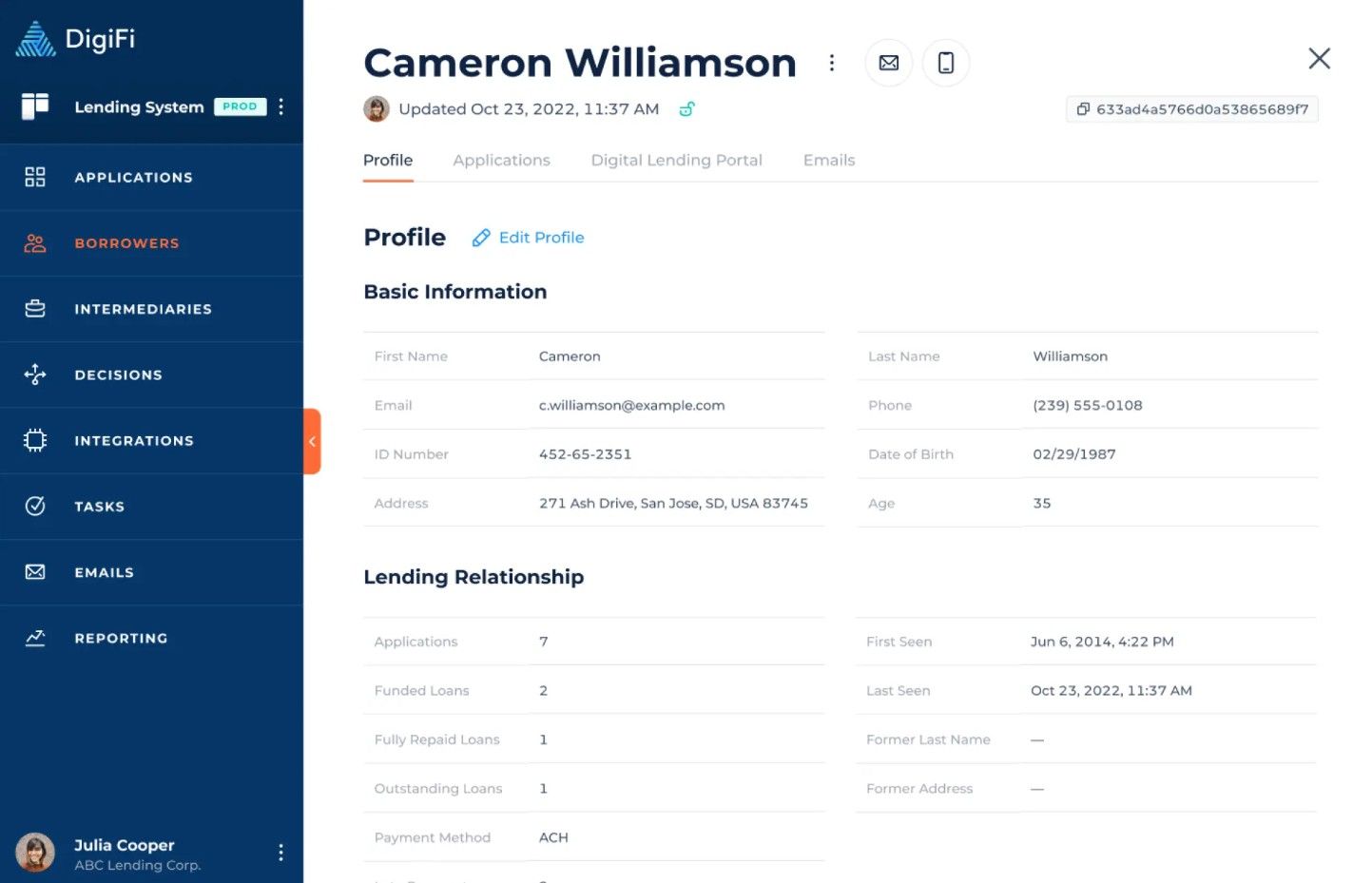

DigiFi

DigiFi is a lending CRM that helps streamline the lending process. This robust CRM empowers you to gain a comprehensive understanding of your borrowers and intermediaries, which includes information, applications, loans, communications, documents, and tasks.

DigiFi is trusted by global lenders such as Mullbry, Greenwave, Zippy, and Mariner Finance. This CRM provides affordable pricing and is suitable for businesses of all sizes.

Easy-to-use

DigiFi interface is extremely flexible and can be customized as per your business requirements. This CRM system allows you to operate loan information management, automation, credit management, and loan reports with ease.

Track activity

With DigiFi, you can have a complete overview of your borrower relationships by monitoring applications, emails, and tasks.

Manage borrower and intermediary profiles

Rather than just adding the basic information of your borrower, you can add any type of information to their profiles. Moreover, your team can also access the information and understand your customers.

Performance reports

DigiFi offers you charts, insights, and efficiency measures. These tools help you to analyze your business performance and forecast growth.

LoanMore CRM

LoanMore CRM is another results-driven mortgage CRM specially designed for loan officers, branch managers, and mortgage brokers.

This sales automation software helps you get sales-qualified leads, stop relying on realtors for business, eliminate time-consuming follow-ups, and increase client referrals.

This CRM offers a variety of pricing plans to accommodate businesses of all sizes and budgets. It also offers many add-on features that allow companies to drive revenue.

Lead management

By leveraging LoanMore CRM, you can get exclusive, pre-qualified mortgage leads straight to your pipeline, which ensures a consistent flow of potential clients.

Automated engagement

This CRM simplifies your lead-to-client journey by automated follow-ups for various occasions. These follow-ups save you time, help you secure client referrals, and enhance your business reputation.

Realtor partner management tool

This LoanMore tool provides a range of features, including automated follow-ups via SMS, emails, and voicemail, for both new realtor leads and your existing realtor partners. It's designed to help you grow your network seamlessly.

Power dialer with call recording

You can call your leads from your mobile phone, desktop, or laptop device through the LoanMore power dialer. Moreover, you can enhance your skills by taking advantage of its automated call recording feature.

Unlock success by choosing the right mortgage CRM

Having the right mortgage CRM can be a game-changer for your business. A properly implemented CRM can deliver an ROI of over 245%.

A mortgage CRM is not just about managing leads, but it provides various features that will not only ease your work but also boost revenue. So, choose the right CRM that aligns with your goals and budget.

Zixflow is more than just a CRM; it’s a comprehensive solution that’s specially designed for your unique business. This all-in-one platform can make your workflow seamless, boost efficiency, and drive success.

But don’t just take my word for it. Try out the free plan and take advantage of its features; indeed, you will see the desired results.