Sales Engagement for Banking and Financial Services: A Practical Guide with Examples

A busy banking and financial services professional juggling multiple clients, keeping up with the latest market trends, and trying to stay ahead of your competition. The perfect thrilling, caffeinated adventure.

At the heart of all these tasks lies one crucial factor that can make or break your success: sales engagement.

But that isn't that easy to crack, or is it? If you have sales automation tools, then, indeed, you will be on top when it comes to sales engagement. But again, the big question is, how??

With the help of AI-powered sales automation tools, you can now level up your sales game and enhance customer experience like never before. So grab a coffee, sit back, and let us guide you through the world of sales engagement in the banking and financial services industry with practical examples and wisdom you can start implementing today.

What is Sales Engagement and Why Does it Matter?

Sales engagement is like the secret sauce that gives your sales strategies, tactics, and tools the power to captivate potential customers, strengthen relationships, understand their financial desires, and ultimately seal the deal. It's a delightful mix of sales processes, sales psychology, and software designed to generate interest, nurture leads, and drive revenue growth.

Why should you care, especially in the banking and financial services industry? Well, it's simple: customer trust and strong relationships are the lifeblood of your success, especially when it comes to money matters! Sales engagement for financial services is the key to building that.

How can sales engagement for financial services help you?

Customer satisfaction

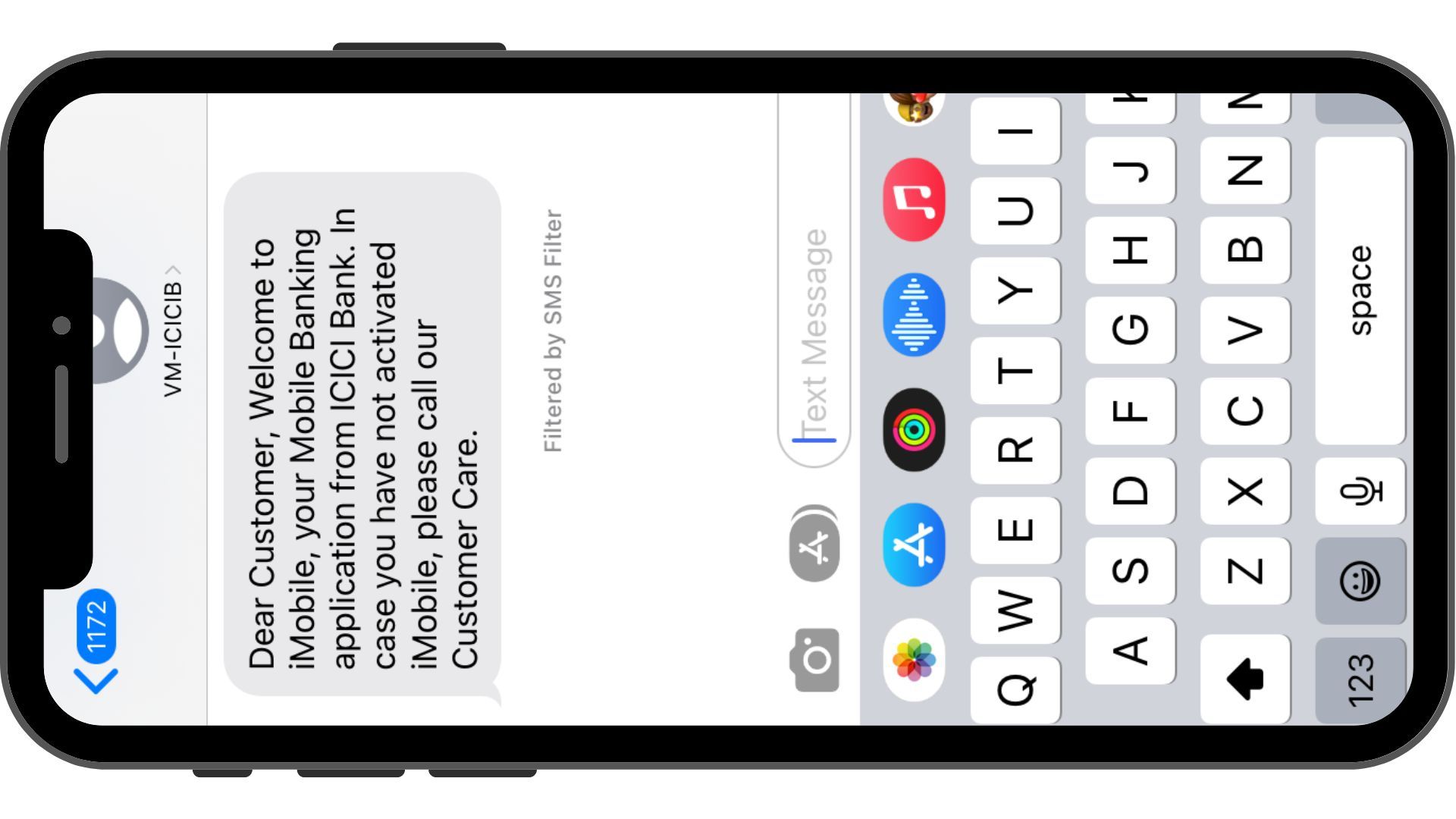

I remember this one time when I had to transfer some money to a relative, a significant sum of it. I did, and I received the SMS regarding the debit. However, the relative did not get the SMS for the amount credited.

They kept wondering what had happened while it was already gone from my account. That put all of us in a fix and, of course, the obvious stress. But when they checked their account, they could see the amount had been credited.

All this stress over one SMS message. One minor glitch in sales engagement efforts in the financial sector has a huge impact! Customer satisfaction is of utmost importance, and it cannot be compromised. My bank ensures that at all times, I am satisfied and aware; no doubt I trust their services. So if you want customer loyalty and trust, you must satisfy them first. It starts with sales engagement efforts, which are small yet significant!

Upholding your reputation

How often does your bank check up on you? Do you get any surveys from them looking out for feedback? Do you get your concerns addressed immediately?

Do you know when your bank is under maintenance and not working, or you stand at a random shop trying to make the payment, trying to add to your Apple Pay wallet but getting an error? Well, this one is too specific, and it is what I once went through. Of course, I did not carry cash (because, hey, my phone is my wallet, and I put modern technology to use to the fullest), and I had to return a bag full of snacks! Not something you would ever want to witness. It is not only embarrassing but also frustrating.

I took the liberty to blame my bank. Knowing very well how dependent we are on technology today, they should have notified us that the bank is under maintenance. Zero marks for sales engagement efforts!

I am confident that it wasn't only me who went through this; there would have been many others who had to endure this.

Clearly, the bank's reputation was under threat, and why not? After all, they could not even bother to notify their very loyal customers of the ongoing issues. These small slips have a prolonged impact. Thus, proving the importance of sales engagement for financial services when it comes to maintaining reputation and customer trust.

Strengthen your relationship

As per the statistics, the customer retention rate in financial services is 78%, while in the banking industry, it is 75%. It is a shocker considering the amount of effort a customer has to put in to move their assets from one place to another or invest in any service. So why do you think it is so? I have an answer, lack of sales engagement in financial services!

Your customers want to feel connected and valued. They want constant reassurance that their assets are in safe hands. Most of all, they want you to engage with them; otherwise, they feel used, taken for granted, and whatnot. You might not be hiding something, but your customers still feel that they are being kept in the dark if you are not engaging with them regularly. This eventually strains your relationship with the customers and forces them to switch.

Why let it get to that when you have a sales CRM tool designed for accountants that helps you drive engagement by running omnichannel sales campaigns? With a sales tool, you can automate sending regular feedback forms to your customers, promotional emails, and important notices. Not only that, but you can also track the analytics to see how well your sales engagement activities are working. The benefits of CRM software in the banking sector cannot be overstated!

The financial sector is the one that has evolved the most with technological advancements. Therefore, it is high time that the sales department of the finance industry also starts putting the tech to use!

How to drive sales engagement for banking and financial services?

It isn't easy, but it isn't impossible either. Hold onto this statement if you want to crack sales engagement for the financial sector. All you need is the right strategy, proper tools, and an understanding of customer requirements, and you are good to know. Lucky for you, as a customer myself, I can tell exactly what all customers are seeing and how you can provide them with it. So let's get right into it!

Use Conversational AI and automate customer communication

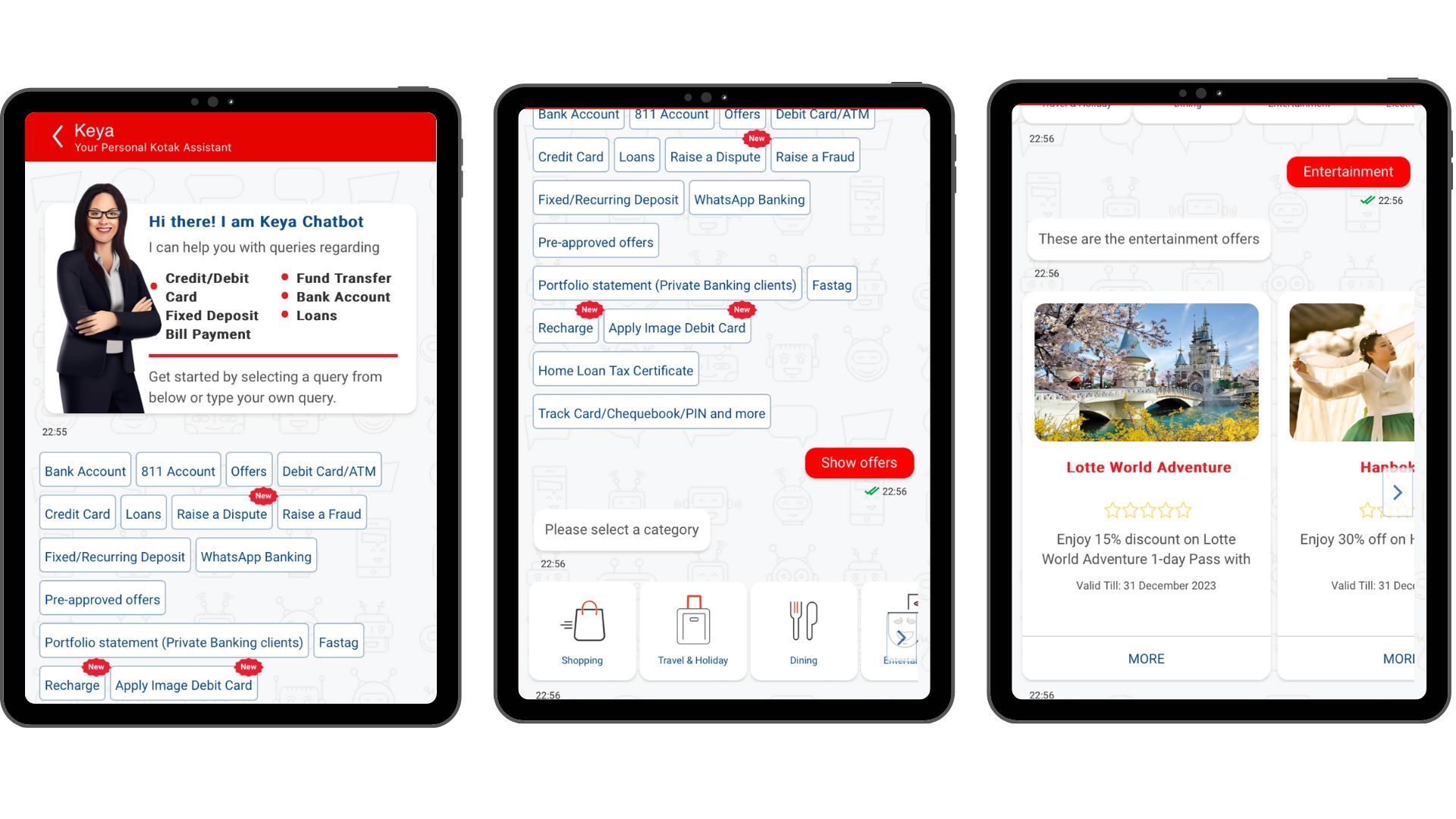

Keya is my best friend. She answers my questions instantly. She does not hold any small talk, and most importantly, she intends to help me without an ulterior motive. Wondering who Keya is? Keya is Kotak Mahindra Bank's virtual assistant that is there to help me out 24x7 without complaints. Now who wouldn't like her?

Our conversations are to the point, and I get resolutions to all my queries. In case she is incapable of helping me, she still provides me with the direction I can go in to seek help. No one can compete with the kind of sales engagement Keya drives for Kotak Mahindra Bank.

You can get automated yet seamless sales engagement and lead generation with the help of a Leadbot like Keya. That answers all your customer queries, assists them in filling out necessary forms, helps them find out details about their account, and also adds user information to the sales pipeline as needed. A virtual assistant sets the tone right, it is always on its best behavior, and most of all, it is available around the clock.

With a virtual assistant driving mobile sales engagement for financial banking and other financial services is a cakewalk. All you have to do is invest in the right tool such as a custom CRM for banking services!

Send personalize SMS notifications

I receive a ton of SMS daily, but the ones I never miss are those I receive from my bank. Wondering why? Because I believe in staying vigilant when it comes to money matters, many would agree. Better be safe than sorry.

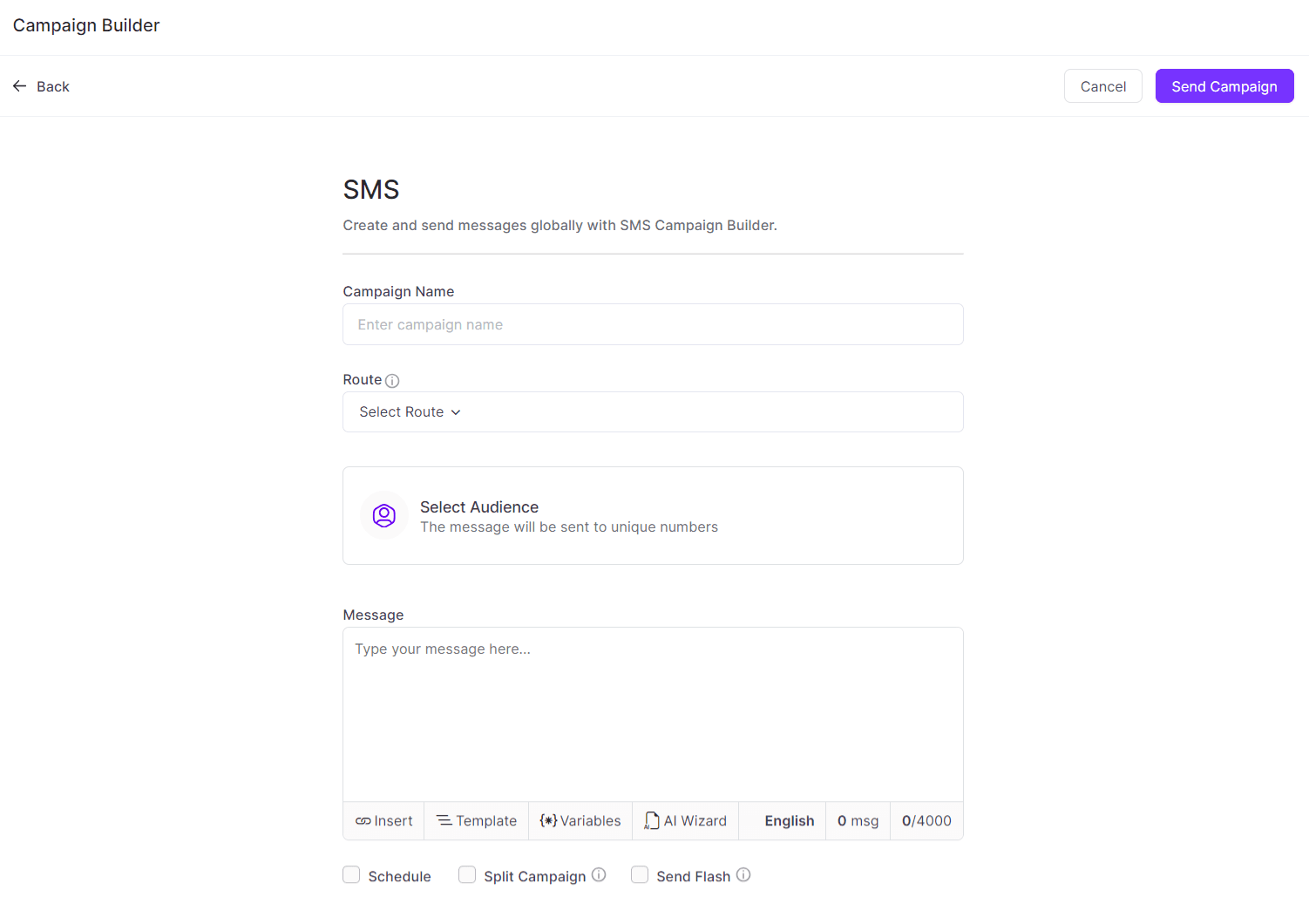

So keep your customers informed, engaged, and want to upsell or cross-sell with SMS campaigns. SMS plays a crucial role when it comes to sales engagement for banking and financial services by keeping your customers in the loop and fostering a sense of trust and loyalty.

You can run SMS campaigns to give information regarding new offers, new opportunities for investment, feedback surveys, and to keep them informed about fraudulent activities.

SMS campaigns are the easiest way to reach your customers across the globe. You pay as per the SMS rates of the targeted nations, and it is also worth it because SMS open rates are as high as 98%. So, if not done already, then start leveraging SMS for mobile sales engagement for the banking sector.

Help your customers fight fraud with consistent and instant communication on safety

Earlier fraudulent activities were mainly carried out through calls and asking for One Time Passwords for verification, which were still easy to figure out that they were not authentic. But today, with technological advancements, it has become hard to keep track of who and what is genuine and what is not. A new technique being opted by frauds is to send a link; if clicked, then one will give access to all the crucial information in their phone, making their bank details and other financial information accessible to them. Scary but not surprising- frauds can go to any lengths, and thus, the banking and financial sector has to take the responsibility of making sure that their customers do not become the victims.

You can introduce two-way SMS communication or directly reach out to your customers if you see any suspicious activities. This one, I was trying to place an order from Russia; it was my first time ordering something from out of state. This got flagged to my bank as suspicious activity, and I instantly received a call regarding the same and guided me about the frauds going on. If someone else had tried to use my credit card maliciously, I would have still received this call and would have been saved from a huge loss.

Ever since, I have made sure that I never take any SMS casually which is related to my assets in any way. So, engage your customers by conveying that you care about them and that their resources are always secure with you.

Add ease to your customers' life and watch your sales engagement peak

Gone are the days of standing in bank lines to deposit or withdraw money. So if you are still making your customers leave their comfort to meet you for financial advice, then you are undoubtedly doing something wrong. Make things easier for your customers. Instead of calling them over for a meeting, hop on a virtual call and discuss the details of the matter. Instead of calling them for every single query or update, opt for async communication and drop a quick text. You cannot meet your customer 3 times a day, but you can drop an SMS multiple times.

So opt for ways that make your customers' life easy yet give you effective results for your efforts toward sales engagement.

Utilize sales cadences

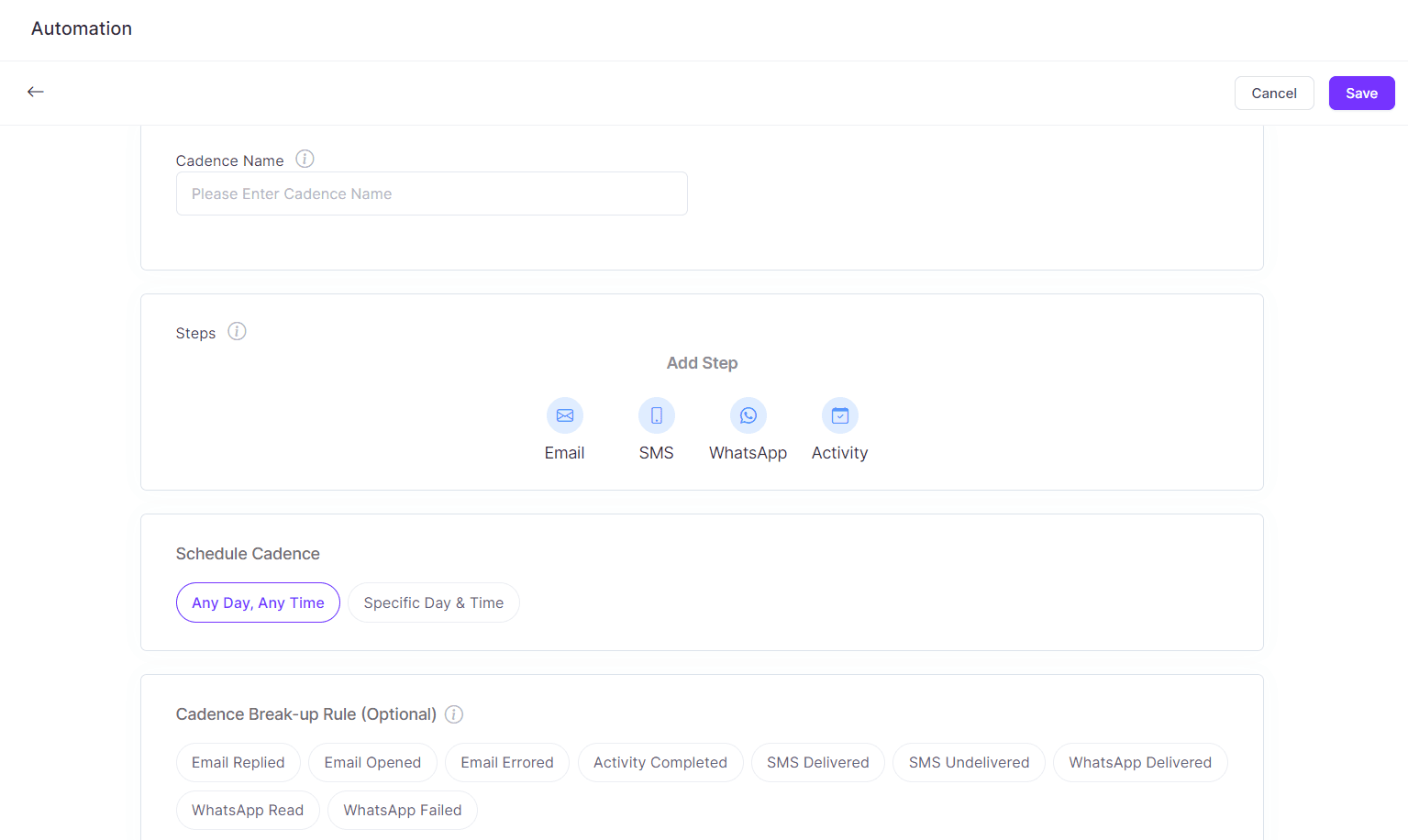

It is not a cakewalk to get a prospect and convert them into your customer, mainly regarding financial matters. Everyone is careful about where they are putting their assets, where they want to invest, and most importantly, where they feel valued and secure. To fulfill all these requirements and make sure that the prospect trusts you and your services, you need a sales cadence for outbound sales and inbound sales.

Sales cadence is a series of actions that your sales team takes systematically over a fixed period of time. For example, today, you contacted a prospect and understood their concerns. Two days later, you called again to provide a solution to the customer's problems. Then five days later, if you get no response from your customer, you drop them an SMS for an upcoming offer they can take advantage of. You carry on with the proactive communication until you convert the lead into your customer.

Having a sales cadence software ensures that your sales team puts its efforts in the right direction, and it also helps in eventually gaining the client's trust with proactive communication. Your willingness to help the client more than selling leaves an impact that ultimately makes the customer opt for your services, and the sales cadence tool makes that happen.

It is a win-win for you as well as your customers.

Ace the space of sales engagement for financial services

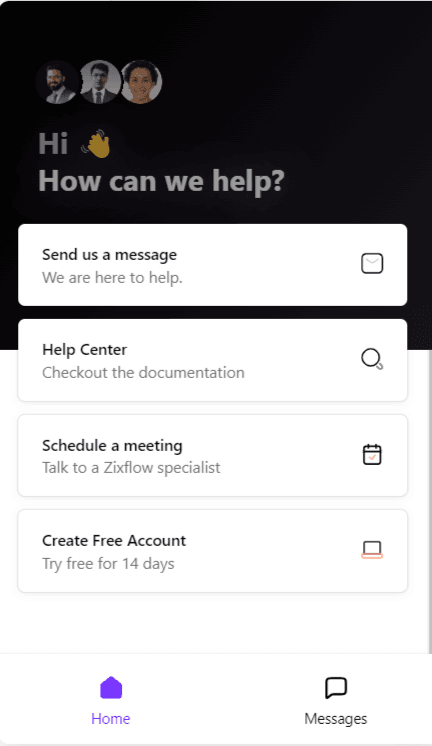

Sales engagement is the topmost priority in any industry, and the competition is cutthroat. So how do you give a tough competition? The best way to do so is to opt for sales automation- through sales automation, you can automate and track tasks like SMS or email campaigns.

When your everyday sales engagement is being taken care of, all you have to do is direct your energy in the direction of converting the customers. This direction as well you can automate with the help of sales cadence.

So if you want to dominate and be on top when it comes to engaging your customers, opt for sales automation with Zixflow! Thank me later!