WhatsApp Banking: What is It and How to Do It the Right Way in 2026

Since the internet became available publicly, the flow of information has changed. These days, data flows at an exponential rate no matter whether it is news, events, or frauds. Everything is happening at lightning speed.

Due to that, people expect everything done promptly. This is especially the case when getting information from a business. Fintech institutes and banks are a prime example of these.

Users expect simplification of complex financial processes, be it opening an account, getting a credit card, or figuring out which insurance type better suits their needs. So, if you are operating in a finance sector, what is the best way to streamline your communication? You guessed it correctly, WhatsApp.

In fact, almost 70% of clients think that reaching out to companies via WhatsApp is one of the easiest methods to gain information. By leveraging the WhatsApp Business Platform, you can converse with prospective clients effectively and share valuable details directly.

On top of that, the end-to-end encryption and messaging compliances of WhatsApp make it a great channel to share sensitive information without having to worry about external interferences from third parties.

Having said that, in this guide, I will cover ways to use WhatsApp for your branding or fintech business along with some of the points you need to consider to make the most of your efforts.

Why should you use WhatsApp for banks?

Banking and financial institutions that provide a wide range of services need a reliable platform for consistent communication. With that said, below are some of the advantages offered by WhatsApp that fintech companies can leverage to drive their customer engagement:

Secured channel

Financial conversations involve sharing personal information, making it a prime target for fraudsters to snoop in and obtain sensitive information. So, the security for your messaging channel needs to be airtight.

With WhatsApp’s security capability, you can rest assured that every message is secured with end-to-end encryption, ensuring no one, not even WhatsApp, can read your messages.

Tailored journeys

Users want personalized customer journeys that either help them find the service they are looking for or provide more information on the thing they are interested in.

Using WhatsApp, you can design custom flows for every user depending on their needs and previous conversations. Linking WhatsApp with your CRM tool gives you a full picture of your users’ profiles. With WhatsApp automation platforms, you can craft customized interactions to streamline conversion.

Build trusted relationships

WhatsApp is more than just a marketing tool. You can have meaningful conversations with your prospects that allow you to establish valuable relations for long-term business success. For example, you can make use of the chatting functionality to send images, videos, files, audio clips, or physical locations to nurture leads or provide relevant information that they might need to come to a decision.

How to set up WhatsApp for your fintech company?

WhatsApp provides multiple offerings to businesses before they can start utilizing it. For example, you can choose between the WhatsApp Business App or the WhatsApp Business API based on your business size and requirements.

If you are a fintech startup or a financial advisor, you can make do with the WhatsApp Business App. Although limited in its capabilities, you can still use it to reach out to your clients effectively and send follow-ups on time.

However, if you have a larger audience or want to implement more complex automation workflows, you have to sign up for the WhatsApp Business API. Using the API, you have full control over your WhatsApp outreach and can make the most of your communication.

To begin with, you have to get a WhatsApp API provider since the API lacks a front-end UI. For simplicity, let’s take the example of Zixflow, a Meta-partnered solution that includes all the required features to help you drive engagement.

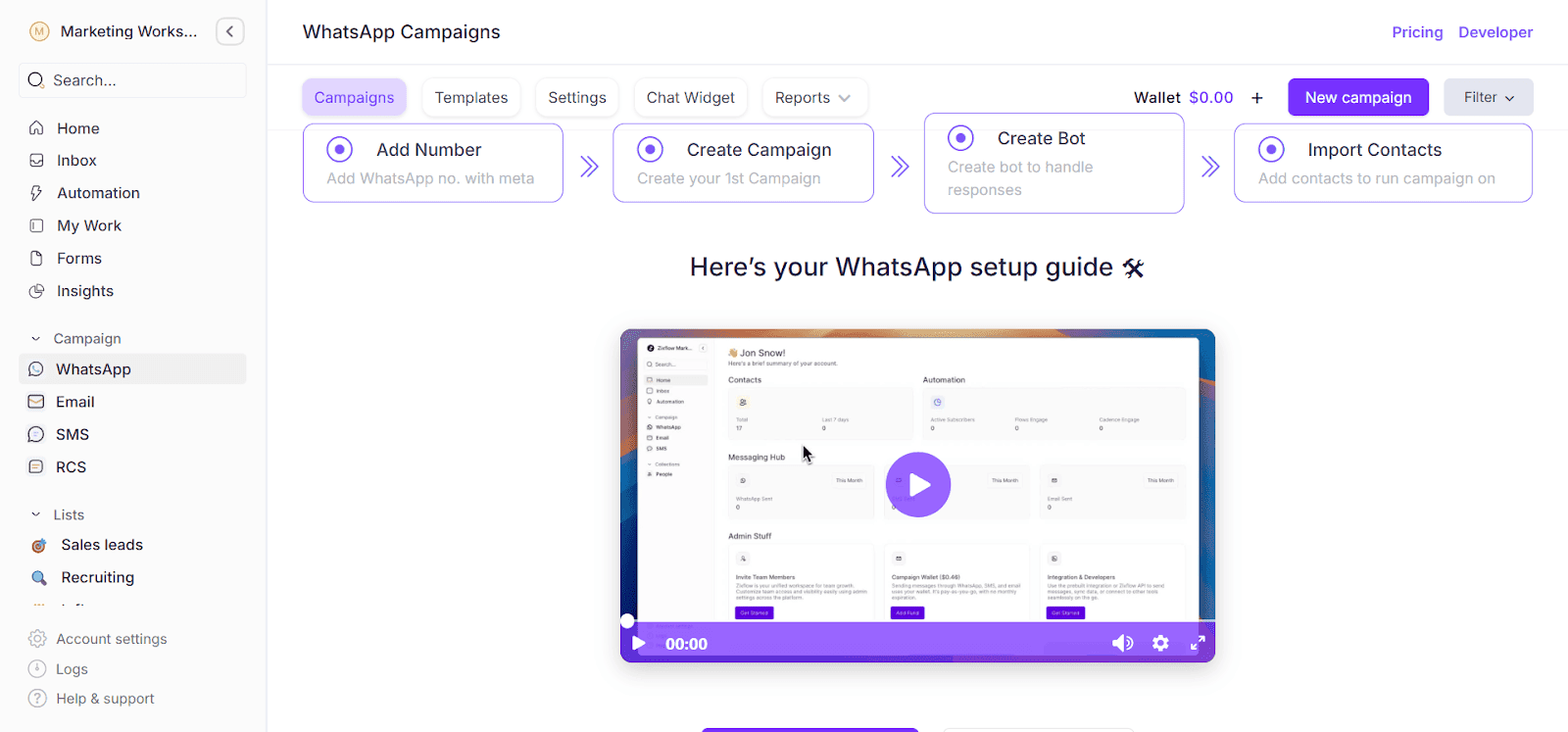

Set up your WhatsApp Business Account

To get started with your WhatsApp Business Account, log in to Zixflow by clicking here and navigating to WhatsApp. Once here, you will see the step-by-step instructions on how to get started with WhatsApp via Zixflow.

Firstly, you have to link the WhatsApp Business API with Zixflow. To do that, click the Add Number button and follow the instructions mentioned in our how to connect WhatsApp Number to Zixflow.

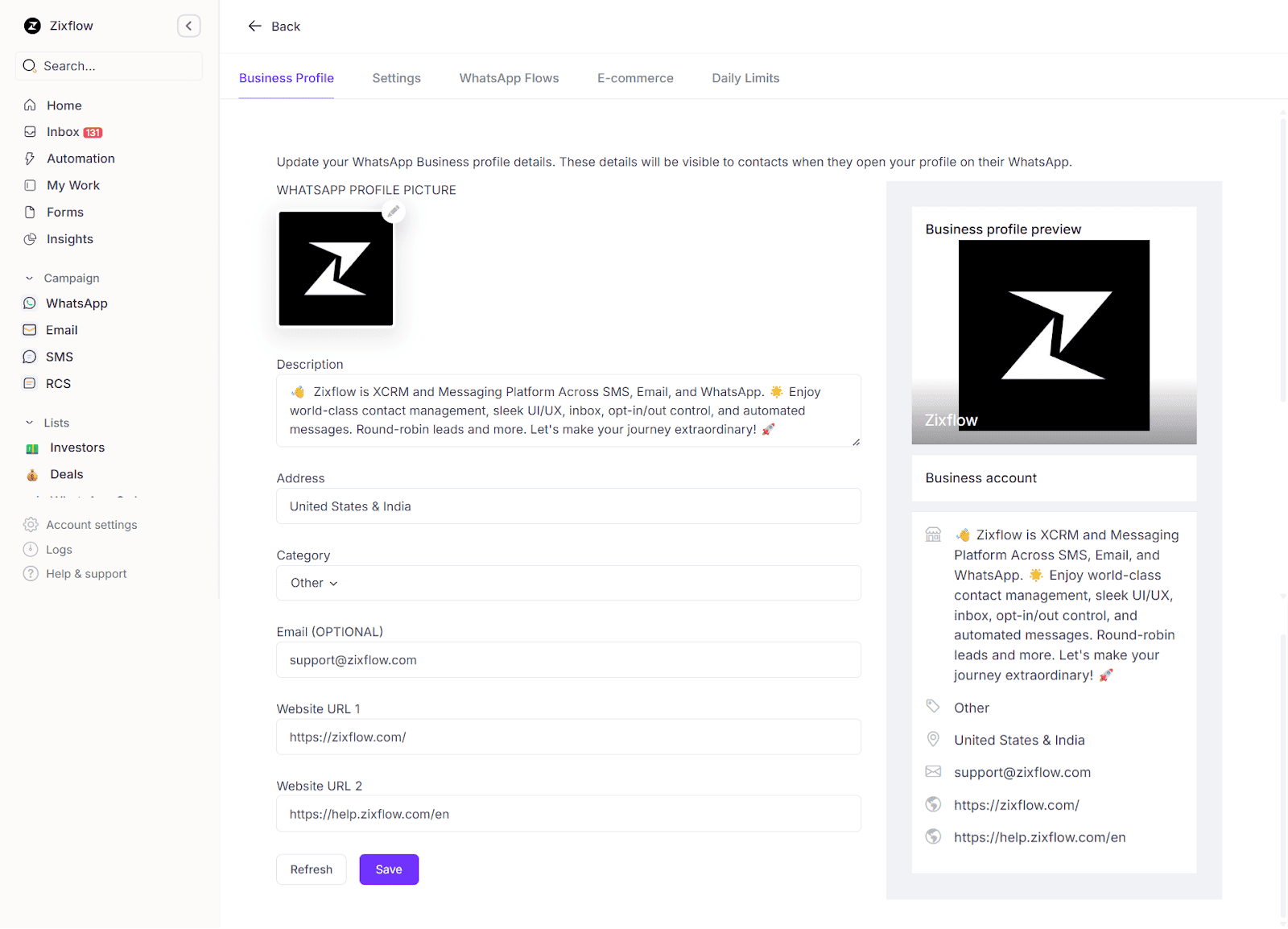

Set up your WhatsApp Business profile

After you have added your WhatsApp Business Account, you have to update your business profile. Fortunately, you can customize your WhatsApp Business Profile from Zixflow itself. You can add a business logo, enter a business description, and include contact information so users can reach out to you straight from WhatsApp.

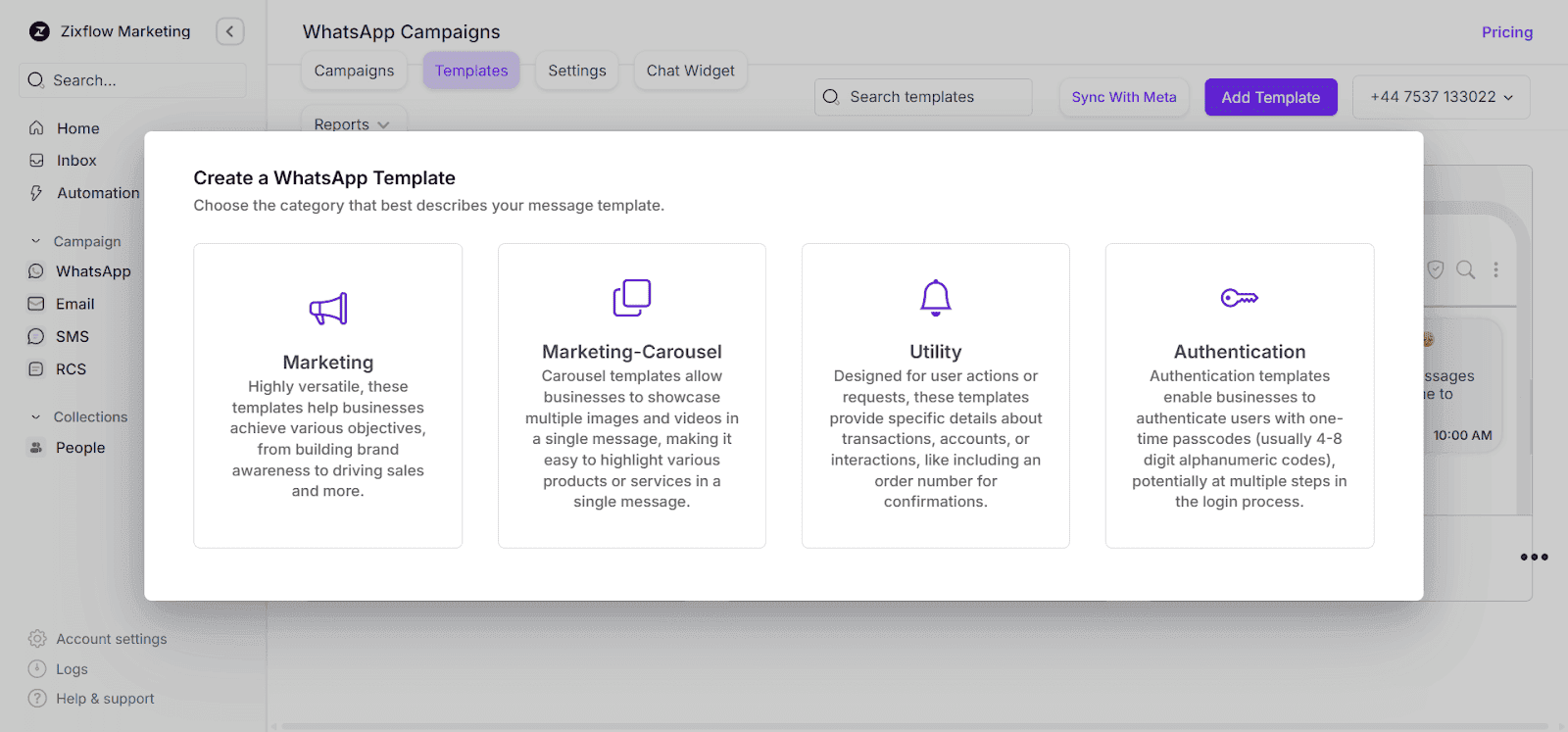

Craft the right messaging templates

After you have successfully set up the WhatsApp Business Account and updated your WhatsApp Business profile, now you can get started with the messaging templates that best suit your finance/ banking needs.

Financial institutes majorly rely on utility, transactional, and OTP WhatsApp messages to stay connected with their clients. Once again, you can leverage an intuitive template editor to design WhatsApp messages. The platform lets you create messages for various use cases be it marketing, authentication, carousel, or utility.

Run outreach campaigns

Now you are ready to run personalized WhatsApp campaigns. Using the templates you built and the number you integrated with Zixflow, you can effectively initiate large-scale campaigns to get in touch with prospective and existing clients.

Check out the following video to see how easy it is to run WhatsApp initiatives via Zixflow:

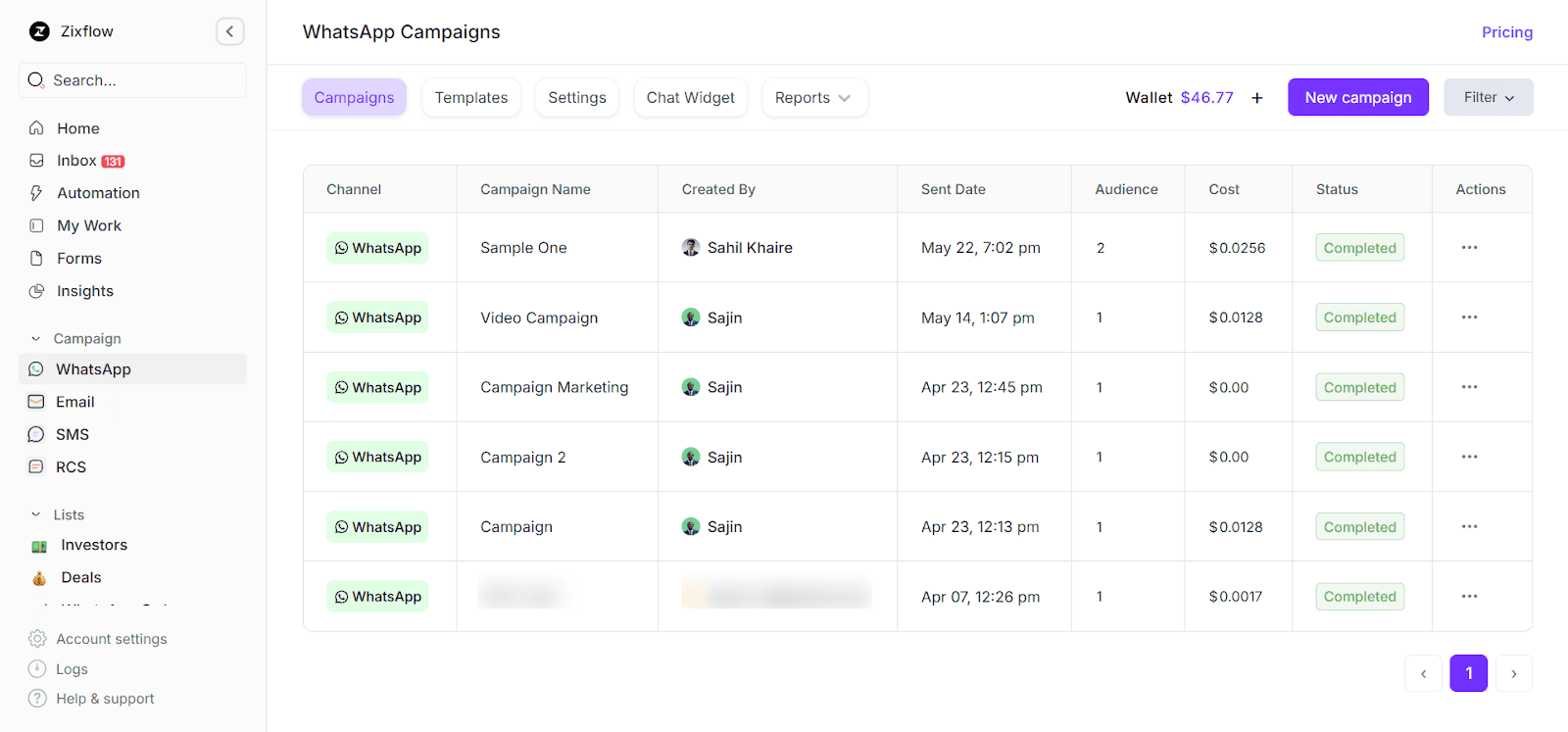

Furthermore, you can view the statistics of your campaigns in the Campaign section. Here, you will be able to see the campaign name, who created it, when was it sent, the number of audiences, and the total cost incurred. You can also click on an individual campaign to open its report to see the engagement rates.

Some of the best practices for using WhatsApp for financial institutions

Banks and financial institutions that offer a wide range of services can utilize WhatsApp’s amazing functionalities to ensure you can effortlessly onboard clients. That being said, here are the best practices for using WhatsApp for your fintech company:

Stay compliant with privacy regulations

When you are dealing with sensitive financial information, guaranteeing data safety is a must. Financial brands using WhatsApp Business API need to stay fully compliant with data privacy laws like GDPR to protect client information.

Not only is this a legal necessity, but it’s also vital for trust. Ensuring your WhatsApp communication channels are secure and your data handling practices are transparent can go a long way in making clients feel safe and valued.

Personalize by segmenting your clients

Let’s face it, no one likes getting a generic message. Clients expect communication that speaks to them, not to a crowd. By segmenting your clients into WhatsApp lists based on demographics, investment goals, financial behavior, or even how long they have been with you, you can craft messages that actually matter to them.

For instance, a young professional starting their career may appreciate content on budgeting and early investments, while a retiree may be more interested in portfolio diversification or wealth preservation.

According to a study, personalized marketing can reduce acquisition costs by up to 50% and increase ROI by 5 to 8 times. So yes, segmentation is not just good practice, it drives results.

Make your content visually appealing

Talking finance can sometimes feel like reading through a wall of text and that is where most messages lose people. WhatsApp gives you tools to fix that. Using visuals like charts, infographics, short videos, PDFs, or even voice notes can help simplify complex topics like mutual funds or retirement planning.

Think of sending a quick video breakdown of a quarterly portfolio review instead of a long paragraph. Clients are more likely to engage with content that’s easy to digest and visually interesting.

Track and improve

It is important to monitor key metrics like open rates, response times, click-throughs on shared resources, and overall engagement.

Are clients replying? Are they clicking your links? Are certain types of content getting more traction than others? Regularly analyzing these WhatsApp trends helps you tweak your messaging and segmentation strategies to better suit your audience.

WhatsApp use cases for finance brands

Using WhatsApp, you can get so much done compared to traditional communication channels. Below are some use cases in WhatsApp that can be used to drive results:

Transform WhatsApp into a lead-generation machine

People spend an average of half an hour daily on WhatsApp, which makes it a goldmine for financial advisors looking to connect with potential clients. With features like click-to-chat links or QR codes, you can turn passive website visitors or social media followers into active conversations. These entry points make it incredibly easy for prospects to reach out; no long forms or emails are required.

Once they are in, you can gather their contact info automatically to follow up with tailored insights like market trends or investment tips, and even run remarketing campaigns to re-target cold leads.

Enhance your customer support

Customer service in finance isn’t just about being polite, it’s about being available when it matters. With automated replies, FAQs, and instant alerts, you can handle most support queries without keeping clients waiting.

For instance, if a client wants to know their portfolio update or the latest market impact on their investments, instead of waiting for a callback, they can simply message your WhatsApp support and get a PDF summary or infographic that explains it all. This not only saves your team time but also creates a more satisfying experience for clients.

Run tailored promotions that work

Forget generic emails that get ignored most of the time. WhatsApp gives you a direct line to your client’s pocket and that is so much more powerful. With WhatsApp Business API, you can run hyper-personalized marketing campaigns.

Whether you are notifying high-net-worth clients about exclusive investment opportunities or sending limited-time offers for financial planning services, these messages feel more personal and less like spam.

Financial firms can also push updates and promote new services by highlighting features using video, banners, or voice messages. For example, a short video that explains the benefits of a new mutual fund can help drive interest better than a static flyer ever could.

Simplify document uploads

Paperwork can be a hassle but WhatsApp makes it easy. Clients can snap a picture of their ID or upload bank statements directly in the chat. If something goes wrong or the conversation is interrupted, no worries because WhatsApp saves the thread so they can pick up where they left off.

This seamless experience removes the friction typically associated with document verification. And since WhatsApp is already a platform most users are familiar with, it reduces confusion and delays.

Account management at the fingertips

Gone are the days when clients had to log into a portal or call customer service for basic account info. With WhatsApp, users can check their balance, view transaction history, or confirm payment due dates with a quick message.

By using WhatsApp automation, banks and financial services can significantly reduce operational costs while boosting efficiency. A chatbot can easily answer: “What’s my current balance?” or “Did my payment go through?” all within seconds. This kind of instant gratification keeps clients happy and engaged.

Take your banking to the next level with WhatsApp

Users expect quick onboarding and prompt responses from banks, as is the case with other industries.

As we head deeper into 2025 and digital conversations are at an all-time high, customers no longer want to wait on hold, switch between apps, or fill out endless forms just to manage their finances. They want speed and simplicity right where they already spend their time.

When done right, WhatsApp banking can improve customer experience and strengthen brand trust while giving your clients a secure way to interact with your services. From onboarding and document uploads to support and self-service options, the possibilities are vast when using WhatsApp Business Platform.

But to unlock real value, banks and financial service providers need to go beyond just being available on WhatsApp. They have to leverage WhatsApp Business Service Providers like Zixflow to handle your WhatsApp efforts from a unified platform.

Try out the platform by signing up for a 7-day free trial right now or get in touch with our sales team to figure out how we can help you according to your unique use case.