RCS OTPs & How They Can Boost Your Customer Trust & Security

Did you know? Online spam and phishing activities have gone up by 94% since the year 2020. That is not all. Digital payment gateways and e-commerce transactions are the number one target of fraudsters, with losses as high as USD 48 billion in 2023.

So, it goes without saying that online security should be your top priority if you want to protect your customers from unwanted data leaks and phishing attacks.

One of the most common ways to safeguard your customers is sending OPT messages to verify various actions of your customers. However, traditional SMS OTPs are not that safe, and anyone can easily pretend to be you to solicit information from your customers (more on this below).

The solution to that problem is using RCS.

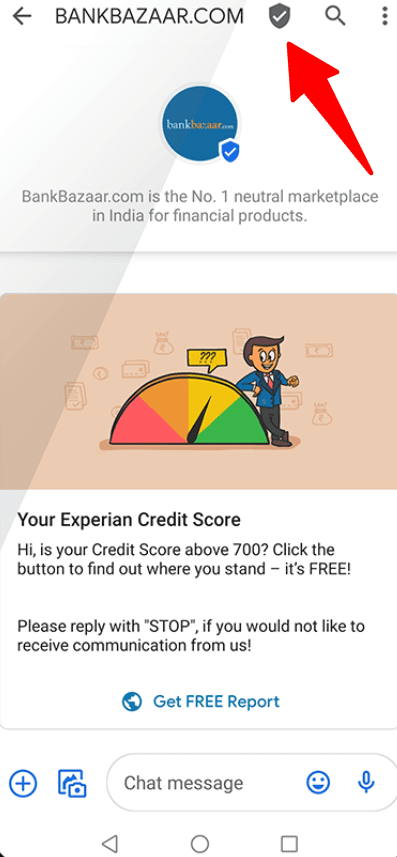

What is RCS? RCS is a secured channel where you have to get your business verified before sending any messages to your customers. This adds a layer of security and ensures that your customers know they are receiving messages from a trusted source.

That being said, in this article, I will tell you all you need to know about RCS OTPs and how you can use them to boost customer safety and build rapport with your customers as a credible brand that values the safety of its users.

What are RCS OTPs?

As the name suggests, RCS OTPs are a type of message that you send to your customers to verify their legitimacy and guarantee credibility. Using these messages, you can boost the protectiveness of your overall customer base and build a solid relationship with your customers.

By sending prompt OTPs and 2FA authentication codes, you can greatly reduce the chances of any fraudulent activity that might happen to your customers' accounts and notify them immediately that their information has been compromised. This way, they can take immediate action to change their credentials to regain access to their profiles.

You can send the RCS OTPs through the RCS Business Messaging, also known as the RBM, which is a similar business communication solution to WhatsApp Business Platform. After you have your business verified on RCS, you can make use of the RBM to send OTPs for any of the following situations:

- New registrations

- Phone number/ account verification

- Logins

- Transactions

- Profile changes

These OTPs make sure that it is your customer who is making these decisions and not someone else who has gained access to their account.

A thing to note here is if you are using RBM to send OTPs to your customers, make sure they do not include any other information, such as marketing content, information about future events, exclusive offers, etc.

OTP messages should only include the verification code and why this message was sent. To send promotional or informational messages, you can use the marketing capability of the RCS to engage your customers and promote your offerings through the correct messaging types.

Elevate your SMS messaging to the next level with RCS.

Leverage media-rich messages, product carousels, and interactive elements of RCS with Zixflow – a Google-partnered service provider.

Book Tailored DemoAdvantages of using RCS OTPs for your brand

Usually, OTPs allow you to strengthen your security against fraud, establish solid relationships, and protect customers’ privacy. But by utilizing RCS OTPs, you can further optimize your protection by leveraging its advanced features.

Enhanced messaging encryption

OTPs have been a go-to verification medium to authenticate customer details and help them make secured transactions. To add to that fact, RCS OTPs offer better security due to approved business profiles along with your brand’s elements to assure customers that these messages are genuine.

Although there is always a potential risk with OTP messages being targeted by external parties, RCS reduces this risk by making it difficult to infiltrate the conversation with end-to-end encryption, while also stopping users from clicking on unknown URLs that can capture their device or personal information.

Credible sender ID for better trust

Unlike SMS, where you cannot tell exactly who sent you the message, RCS messages contain complete information about your business, enabling your customers to identify who you are immediately. These business profiles can clearly indicte to your customers the legitimacy of your business so they can safely use the OTP to complete the due process.

Real-time feedback

RCS allows you to see read receipts to get real-time feedback for your OTP messages. This feature helps you know if the OTP has been successfully delivered and read, allowing you to take prompt action if there are any issues or if they request to resend the OTP.

Difference between SMS and RCS OTPs

SMS OTPs are the first choice for many businesses to send passcodes to verify the authenticity of their customers. This is because all the phones come with a default SMS messaging capability without having to install an additional app to send and receive them.

However, these OTPs are extremely vulnerable to different kinds of spoofing attacks like phishing, smishing, and many others, where someone sends messages while pretending to be your business to ask for highly sensitive details from your customers or send them fake links to grab their information without consent.

However, this is not the case with RCS. RCS needs you to get verified first before you can send messages to their customers. This verification includes the name, logo, and a verified shield icon to promptly tell users that they are receiving a message from a legitimate company and not someone impersonating one.

Even though RCS is not supported on all devices and some carriers might not have adopted it into their framework, it is still a better option than SMS, which offers next-to-no safety to the users. Additionally, it is an end-to-end encryption platform where your messages are protected by strict messaging protocols to make sure no information gets leaked during the transmission.

This fact alone makes RCS a much better choice than SMS. You can consider it to be on the same level as WhatsApp, where both sender and receiver messages are encrypted and are not accessible to any third party looking to gain this information.

Having said that, in order to take advantage of RCS’s upgraded communication features, you need an equally powerful solution that supports these functionalities. And Zixflow is one of those platforms, offering robust communication features revolving around both RCS and SMS.

The application is designed to give you the necessary options to manage your promotional outreach no matter how many customers you have. You can send hundreds and thousands of messages with Zixflow without needing any coding expertise.

The campaign builder is straightforward and minimalistic, requiring on the essential details from your end. You don’t have to go through an extensive process to get your campaigns up and running with Zixflow.

Is there any extra step to using RCS OTPs?

After getting a decent knowledge about RCS OTPs, some might think are there any additional steps to using these messages? Although RCS may sound like too much to implement, it doesn’t make any difference from your customers’ end apart from getting OTPs from a verified business.

The process of using RCS is pretty much the same as using SMS. For example, once a customer types in the username and password, you can send the RCS with the OTP. They can then enter the passcode manually or copy & paste the code directly. And that’s it.

Similarly, you can send transactional OTPs when customers place orders to confirm the payment process safely. This way, you can validate customer details and tighten the security across the checkout effectively.

Scenarios where you can use RCS OTPs

RCS OPT use cases are pretty much the same as sending normal OTPs. That being said, let’s take a look at the most common situations and how RCS can help you send secure passcodes.

Payment confirmations

The most common usage of OTPs is at the time when your customers are placing an order or completing an online transaction. As a business, RCS OTPs are great for online payments, especially if you’re a bank needing to verify customer transactions.

On top of that, RCS messages have a character limit of 8,000, which is significantly more than SMS’s 160 characters. This allows you to include additional information revolving around the transaction to give your customers an enhanced shopping experience.

Account verification

No matter if you are an e-commerce store or a local store, it is crucial to safeguard your customers' accounts and keep them protected from cyber attacks. In addition to that, if you ask for too many security checks at the time of registration or ask for multiple passwords at the time of payment, then they might not end up completing the process.

For this reason, RCS OTPs are a great way to add layers of security to the signup process while also streamlining it.

Account modifications

After gaining access to a customer’s account, the first thing a scammer would do is to change account information in order to not lose access (via the forget password option) or inflict financial damage to the account holder.

So, to make sure that doesn’t happen to your customers, send RCS OTPs whenever there is a change in your customers’ profiles. This way, you can ensure it is your customers who are making these changes and not someone who has gained access.

Industry-specific uses

Apart from these use cases, RCS OTPs have different purposes in different industries. For instance, banks and financial service institutions have reported a significant reduction in fraud cases after implementing RCS OTPs. The interactive elements and enhanced security measures ensure that customers can confidently carry out transactions.

For e-commerce and online platforms, the convenience and security of RCS OTPs help assure customers during the checkout process.

Similarly, in the healthcare sector, the use of RCS OTPs has resulted in better patient engagement and trust with secured, interactive business communication where sensitive information remains protected.

Boost customer trust and enhance security with RCS OTP

Well, there you go. I hope now you have gotten a good idea of what RCS OTPs are and how they can help you make your business a secure place for your customers.

By taking advantage of RCS OTPs, you are safeguarding your customers and fostering a secure, trustworthy environment while boosting your company’s image as an entity that takes security very seriously.

That’s why, investing in RCS OTPs is not just a technological upgrade but a strategic move, making use of a customer-centric selling model to attract customers who prioritize safety and build stronger relationships with customers through enhanced security.