Leverage Sales Engagement for Insurance: 7 Tips & Examples

I still remember how my father gets irritated due to multiple calls from insurance agents explaining their policies.

Many other customers are skeptical of insurance products, and they may be wary of salespeople who are trying to sell them insurance policies.

Research says that 74% of consumers research insurance purchases online, but only 25% end up making a purchase online.

Insurance policy, in contrast to many other products, is an intangible good, so prospects face trust issues in determining the value of the product before buying it.

Under such conditions, sales engagement becomes a challenging task for salespeople working for an insurance company.

This blog highlights 7 tips to effectively use sales engagement techniques in the insurance industry for successful conversion.

“ It’s not about having the right opportunities. It’s about handling the opportunities right.” - Mark Hunter

Know Your Audience

Being aware of your target market is essential when selling insurance plans. My father gets irritated when an insurance call comes in because he doesn't require insurance coverage.

From the standpoint of the salesperson, he has wasted time and effort by phoning random clients rather than conducting adequate research on his target demographic.

Being an insurance salesperson, try to understand what your potential customer base is. Conduct some primary and secondary research to comprehend the demands and expectations of those customers before making a sales call.

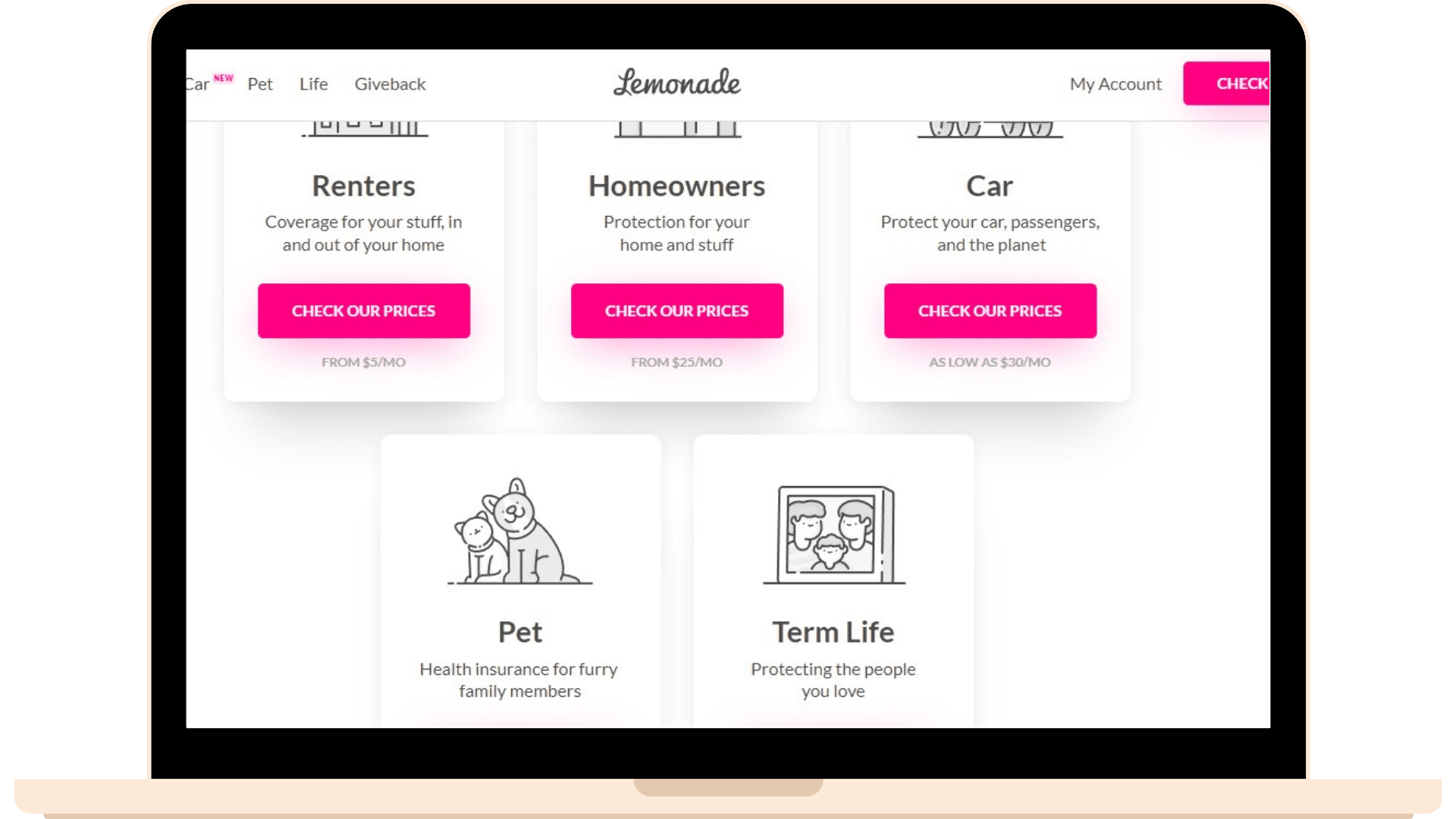

Lemonade, a US-based insurance company, is focusing on millennials for their different insurance needs like homeowners insurance, car insurance, pet insurance, etc. Before launching their products, they conducted extensive research for understanding the needs of millennial customers in the US.

In the research, they found that millennials prefer digital channels of communication and are looking for transparent, affordable, and easy-to-understand insurance products. So, the company incorporated the following changes:

- Insurance policies include renters insurance, homeowners insurance, pet insurance, and car insurance, which was highly demandable by millennials.

- Policies are made purchasable through the mobile app of the company.

- The claim process is streamlined and made fully digital.

The strategies helped Lemonade to become a leading player in the InsurTech space.

Personalize Your Outreach

“A tailor-made service to a customer is more personal, genuine and natural; fits to size like a bespoke suit.” - Dateme Tamuno

Try to customize your services as well as your approach according to the customer. Below mentioned are a few ways for customizing your approach:

- In the case of mailing prospects, use “Hi John” instead of the generic “Dear Sir”.

- Mold your service according to the requirements of the customer. For example, you can provide a lower premium to the safe driver who doesn’t drive often in comparison to a higher premium to those who drive regularly.

- Provide different payment options to different customers based on their ease. For example, few customers prefer to pay a premium in installments, whereas others prefer to pay upfront.

- Provide an exceptional experience to customers by quickly responding to their queries and providing personalized advice on risk management or coverage options.

Leverage Social Media

Try to use social media platforms like Facebook, Twitter, LinkedIn, etc to increase sales engagement of your product. Post relevant and regular content related to your insurance services to keep customers engaging and reach out to a potential customer base.

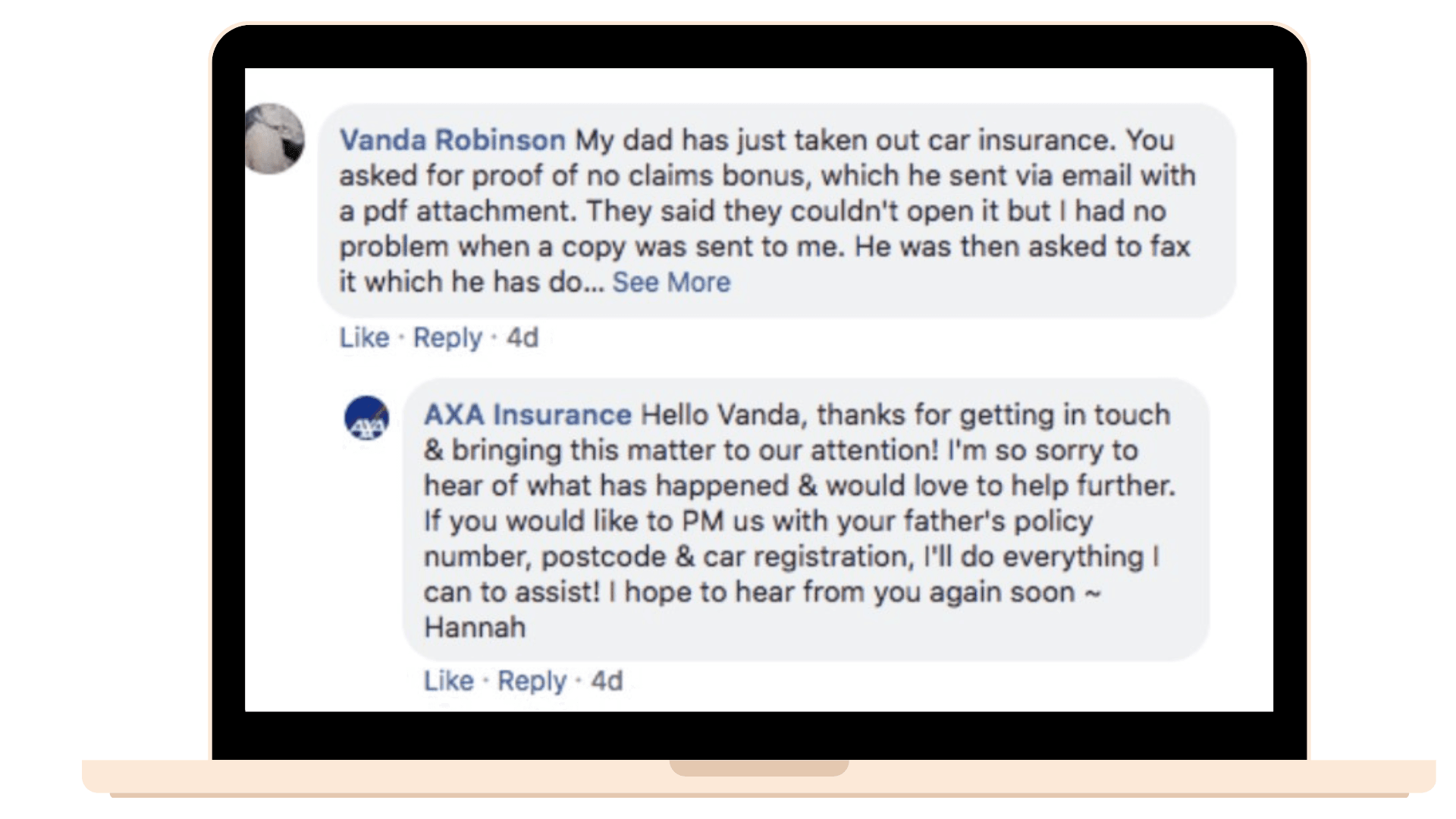

You can also use social media platforms to answer queries, concerns, or pain points of your customers. Axa, a Paris-based insurance company, uses Facebook too answer queries from their customers, even in the Comment section, within an hour. As the CEO of the company says, ‘The key is to be where customers are’, the company was successful in reducing negative comments on the AXA France Facebook page by 53%.

Moreover, you can partner with social media influencers to create sponsored content promoting your insurance products.

See how Sonnet Insurance promoted their insurance products on the Instagram page of Renee, a lifestyle blogger and a social media influencer with 52.2K followers on Instagram.

Build Trust

As I mentioned earlier, insurance products are intangible, making it difficult for customers to trust the product before buying it as they can’t see or touch it. Here, the role of the salesperson is significant in building trust and credibility of the product in the eyes of customers.

Always try to provide clear and transparent information about insurance policies simply and concisely. Even the policy document should be written in very simple language.

Try to show your expertise to customers. In today’s era, clients are already well-versed with many of the insurance prices and policies, but they may lack some technical knowledge. Inform them about every single bit of information to make yourself reliable.

Watch this video to get the art of building trust.

Provide Value

Try to provide value to the client out of your insurance policy. You will get clients when you will be able to create the need of your policy in the eyes of customers.

“Service is taking action to create value for someone else.” - Ron Kaufman

Offer additional benefits, discounts for additional clients or access to exclusive services to differentiate your product from others.

For instance, if you are selling an insurance policy to families. The main concern of a family is financial constraint after the death of the breadwinner. Explain how your policy will cover that risk and make them feel confident that they have made the right choice by purchasing your policy.

Listen More Than You Speak

Try to listen to your customer’s words before explaining anything to them. In the insurance industry, everyone is providing similar insurance policies, so you need to create a differentiating factor in your guideline to attract more customers. To create a difference, first of all, you need to understand what the expectations of customers are.

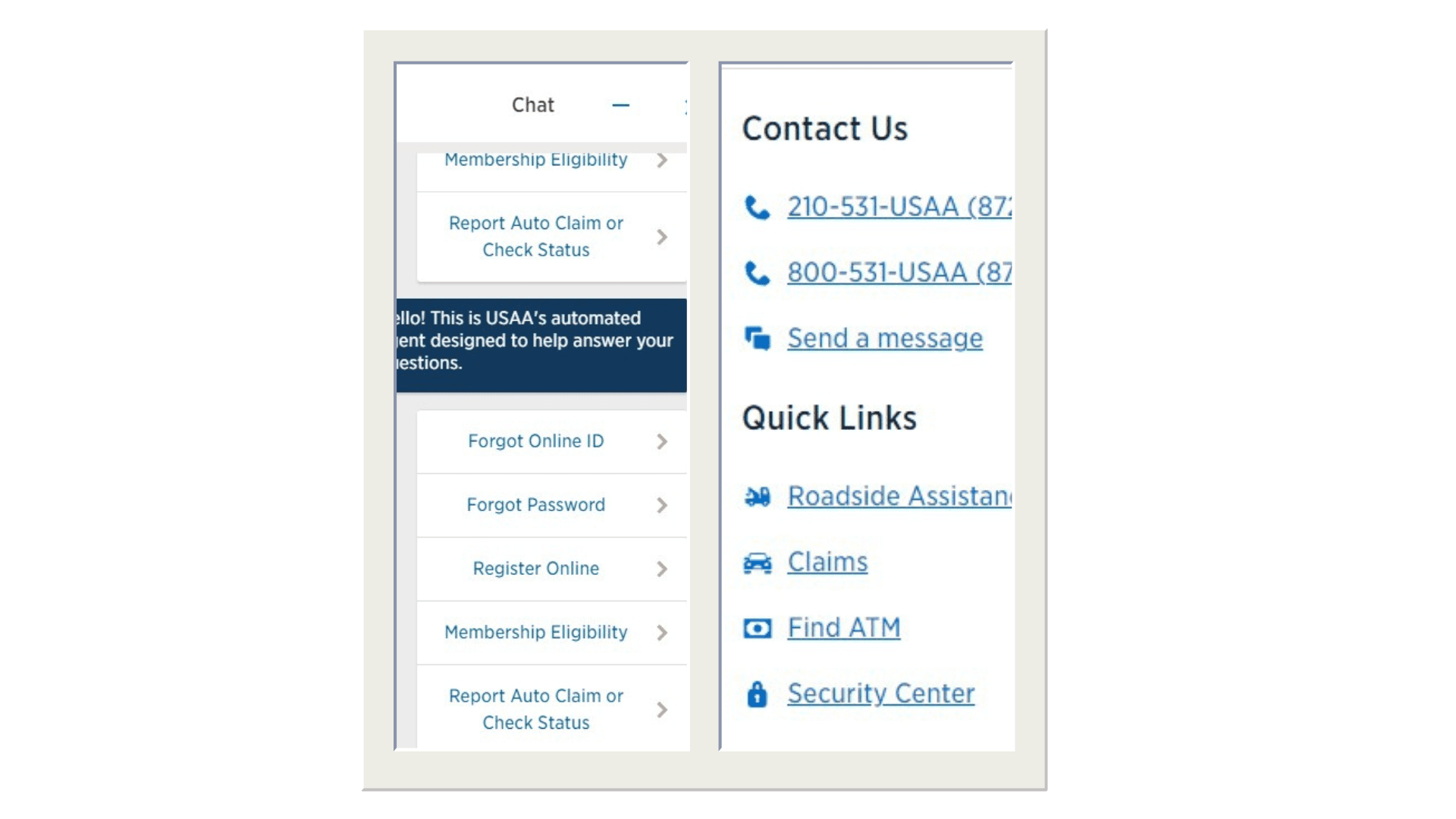

USSA, one of the top insurance companies, is the best example for practically implementing the ‘listen before you speak’ policy. From online to offline, USSA provides multiple channels for clients to connect with them, including phone, email, and live chat.

It also has a comprehensive feedback mechanism to get suggestions from its clients. USSA prioritizes listening to its clients, and this helped them to make a loyal customer base.

Follow Up Consistently

Follow up with your clients to keep your business at the top of their minds. You can follow up via phone calls, emails, social media, text messages, or automated follow-up systems.

Well, an automated system is more efficient than any other means as there are no chances of missing out. Check Zixflow CRM to automate your follow-up with customized messages.

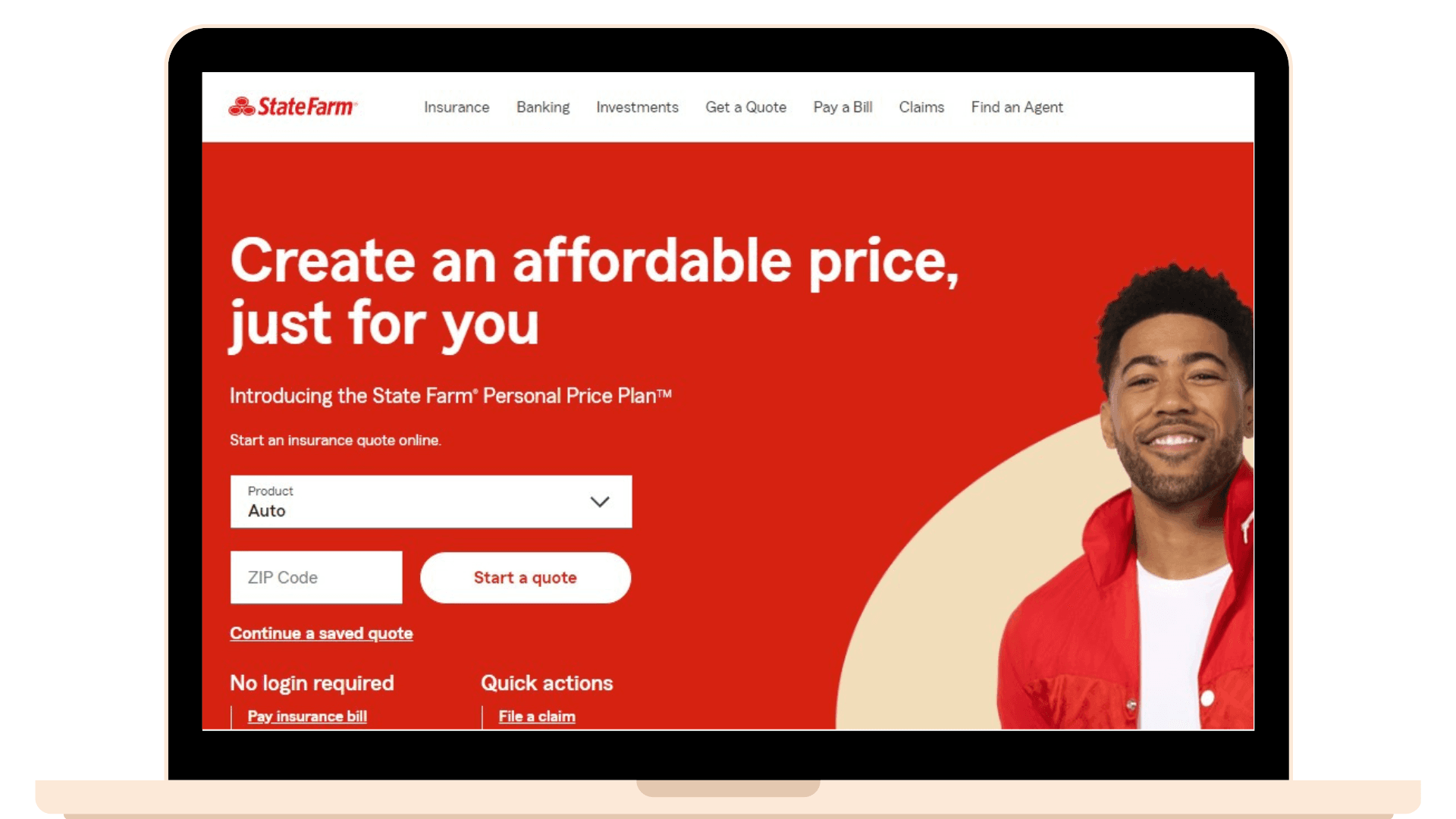

State Farm agents are well known for their follow-ups with clients regularly. Say, suppose a client of State Farm submits a claim. Then the insurance agent will call the client to ensure that their needs are met or not. They will also after the claim has been resolved to ask if customers are satisfied with the outcome.